Investor FAQs

- About Intertek

- Divisions & Growth Opportunities

- Cash Compounder Earnings Model

- Margin Progression

- Capital Allocation

- Innovations & Digitisation Opportunities

- AAA Strategy

- Sustainability

For more information, please contact us.

About Intertek

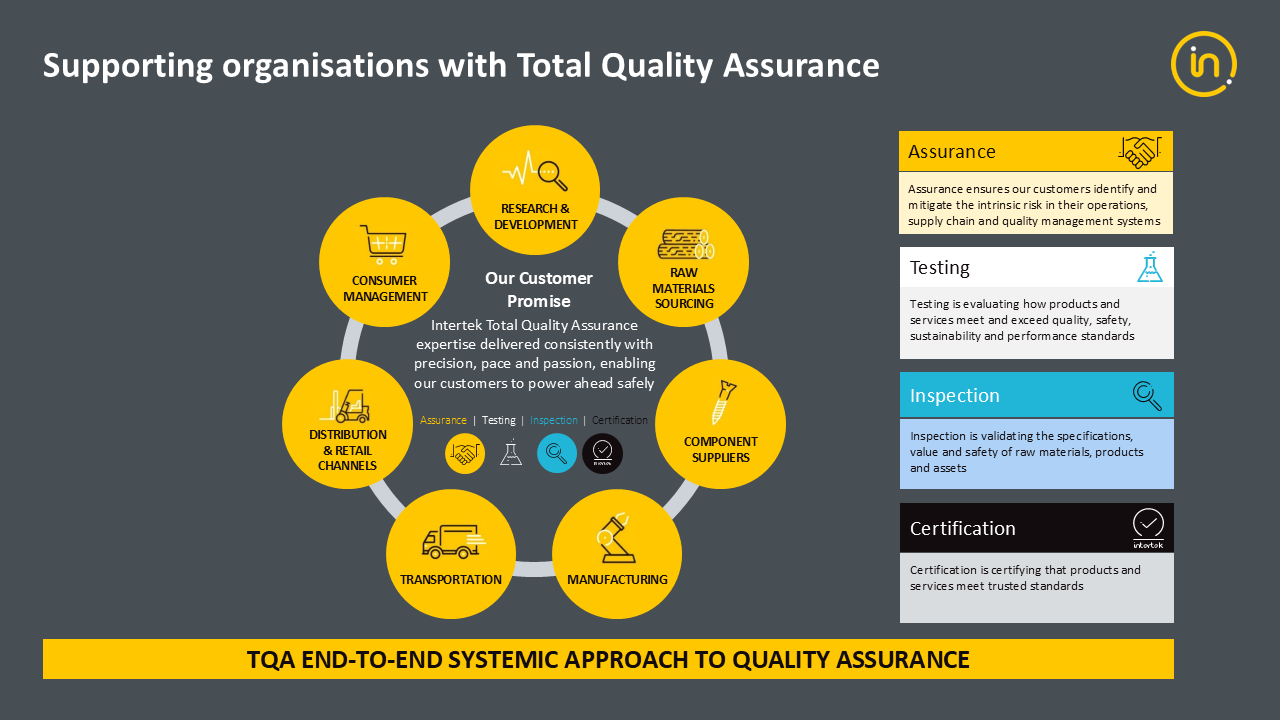

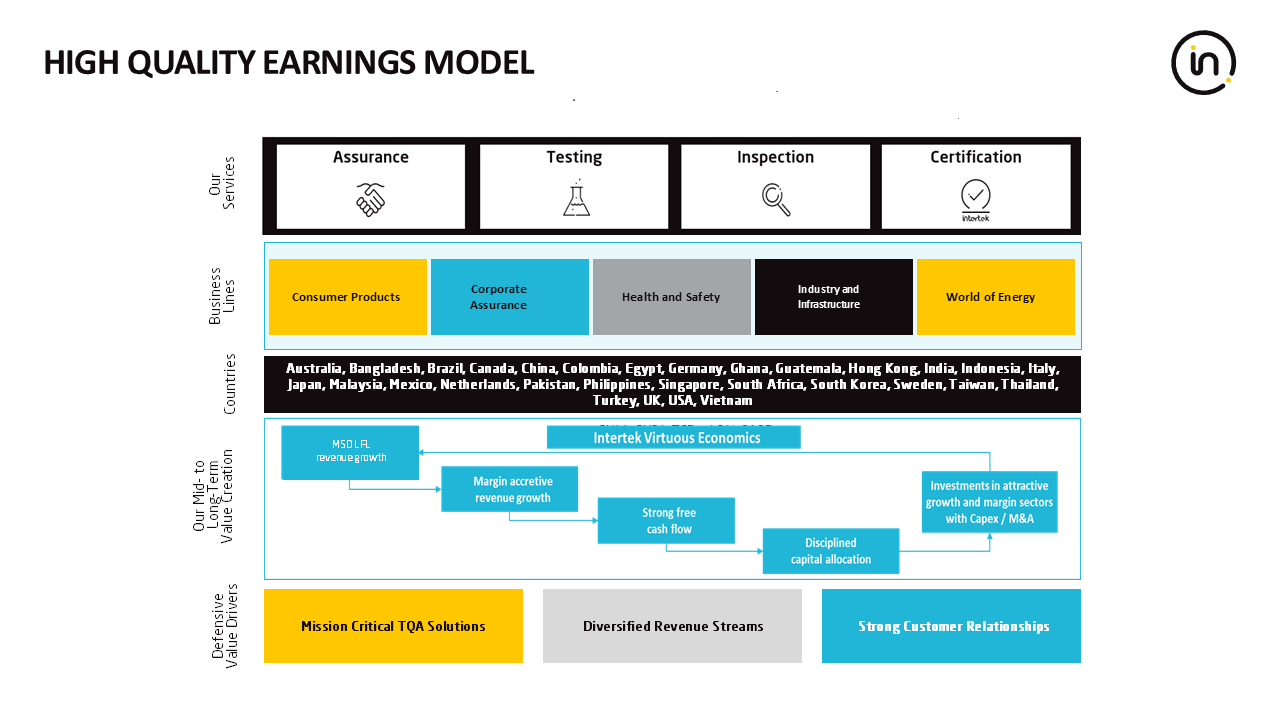

We operate in more than 100 countries in a variety of markets and industries, ranging from consumer goods to the energy sector, and we deliver a wide range of ATIC services.

Our Science‐based Customer Excellence is at the core of our competitive advantage and enables us to deliver mission critical services for our clients

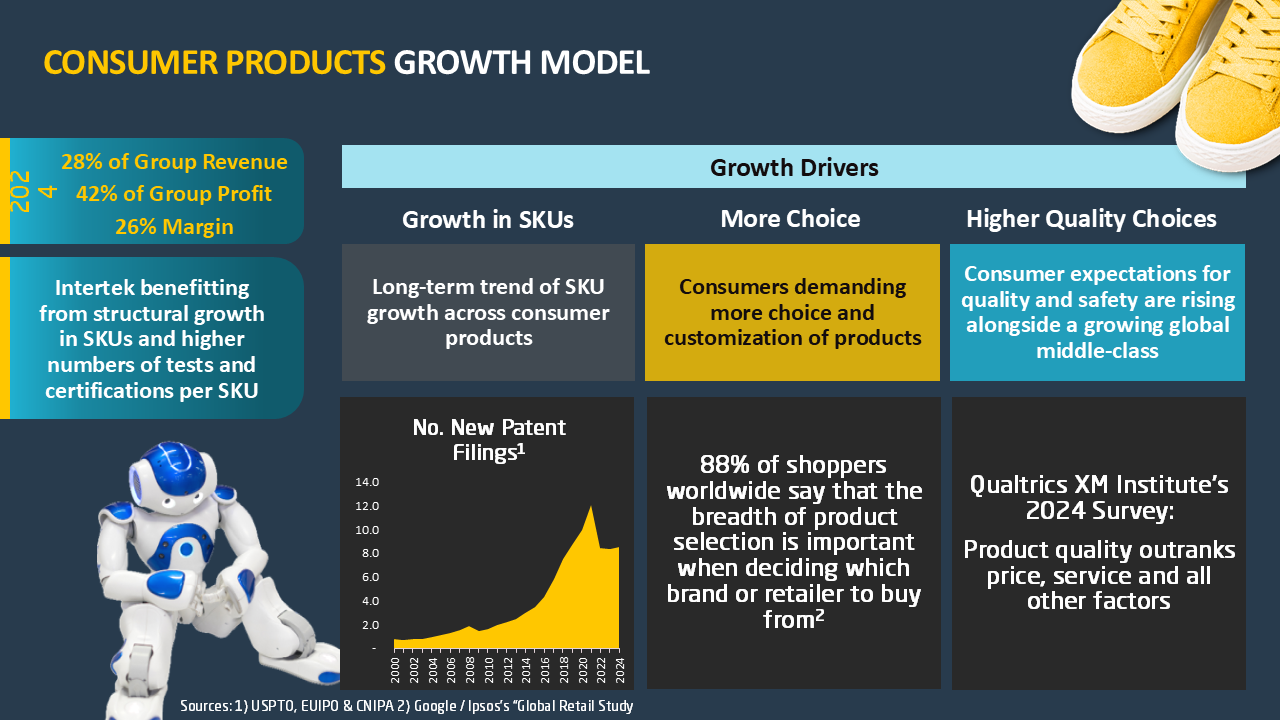

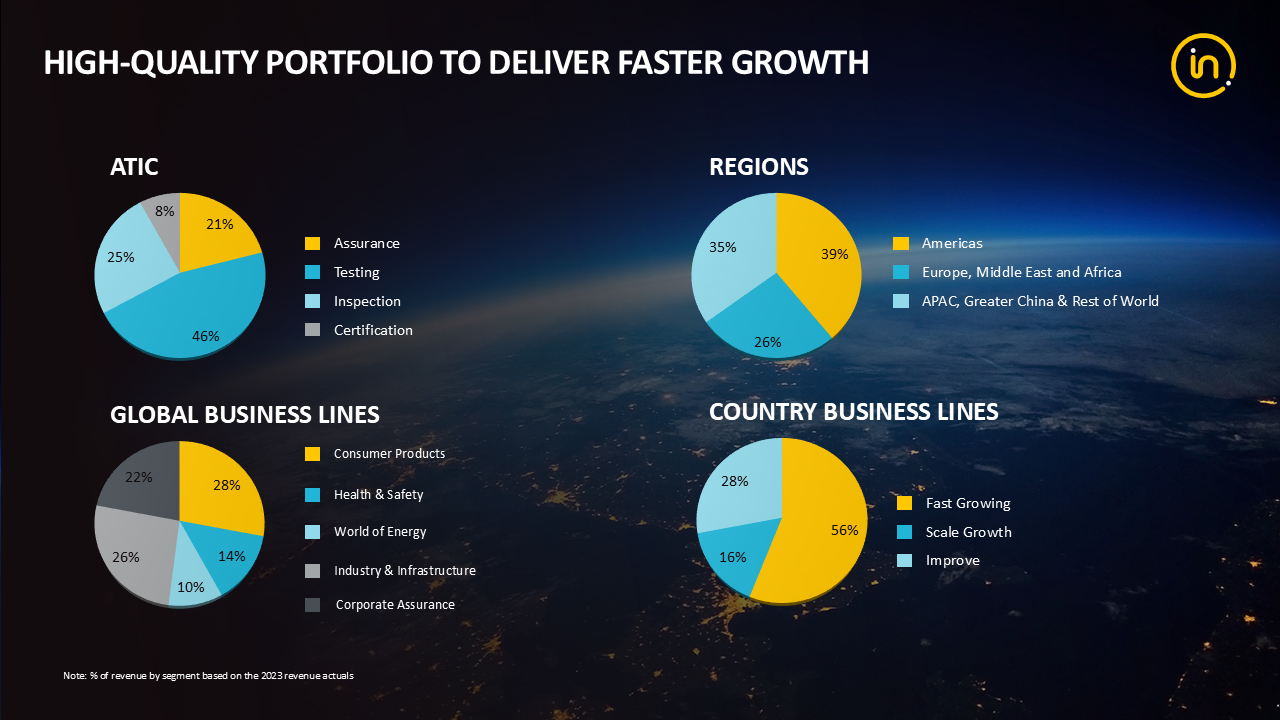

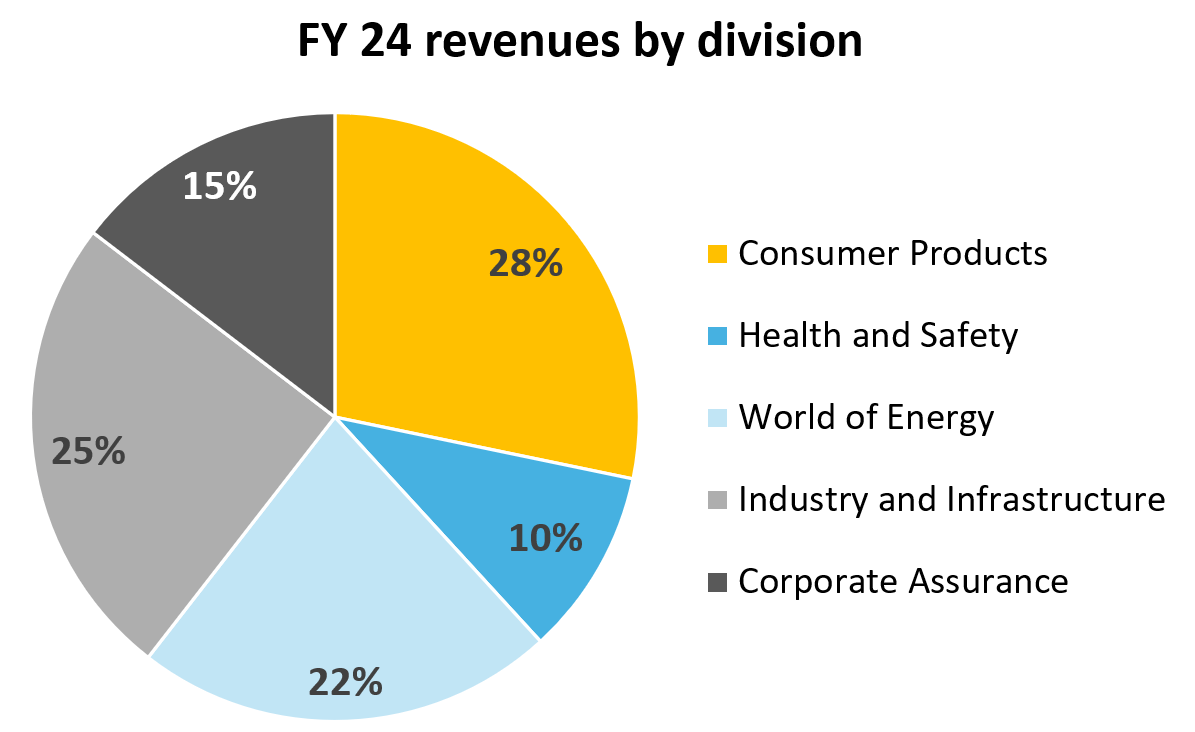

Consumer products (28%) is our largest division, followed by Industry & Infrastructure (25%) and World of Energy (22%). Corporate Assurance (15%) and Health & Safety (10%) and account for the remaining 25%.

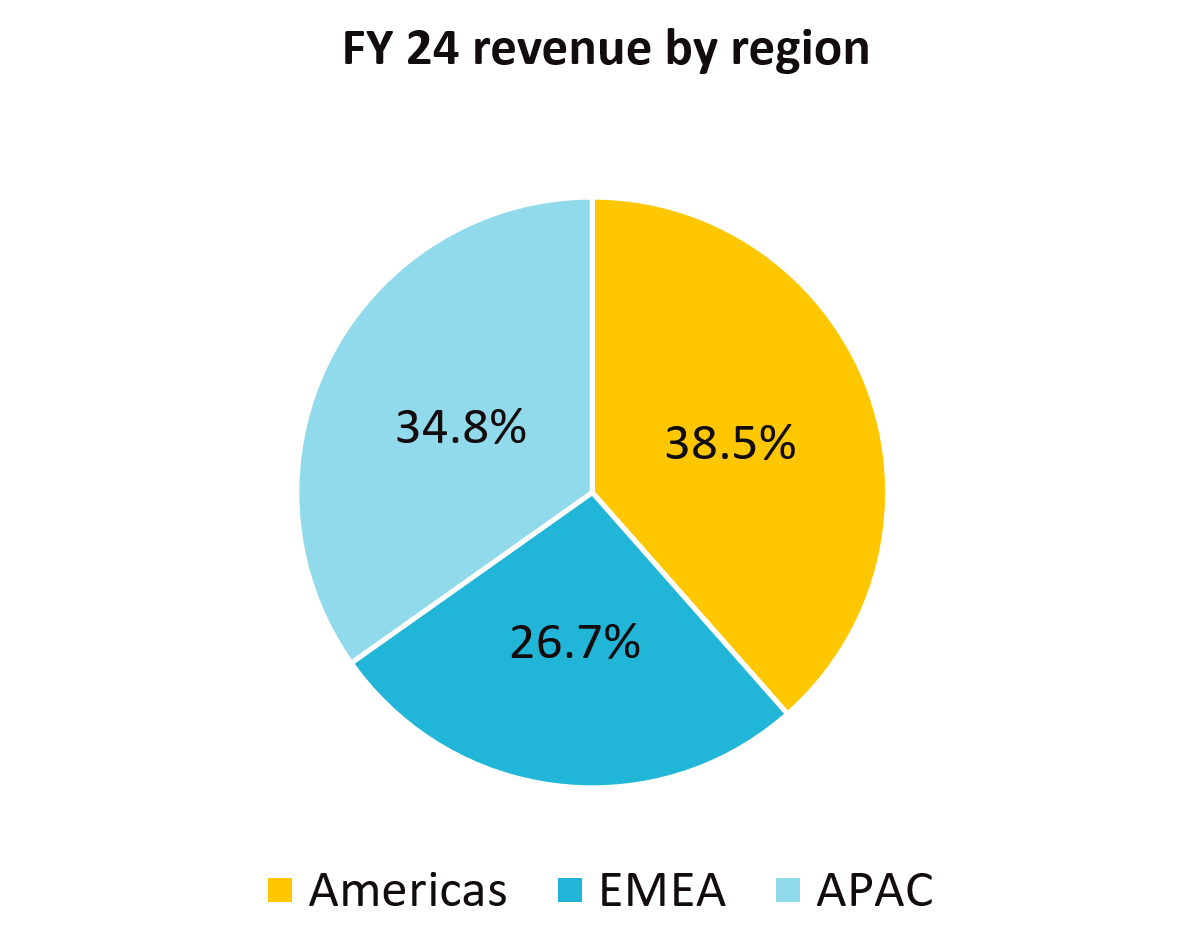

As a global company, we have operations in the Americas (38.5%), APAC (34.8%) and EMEA (26.7%).

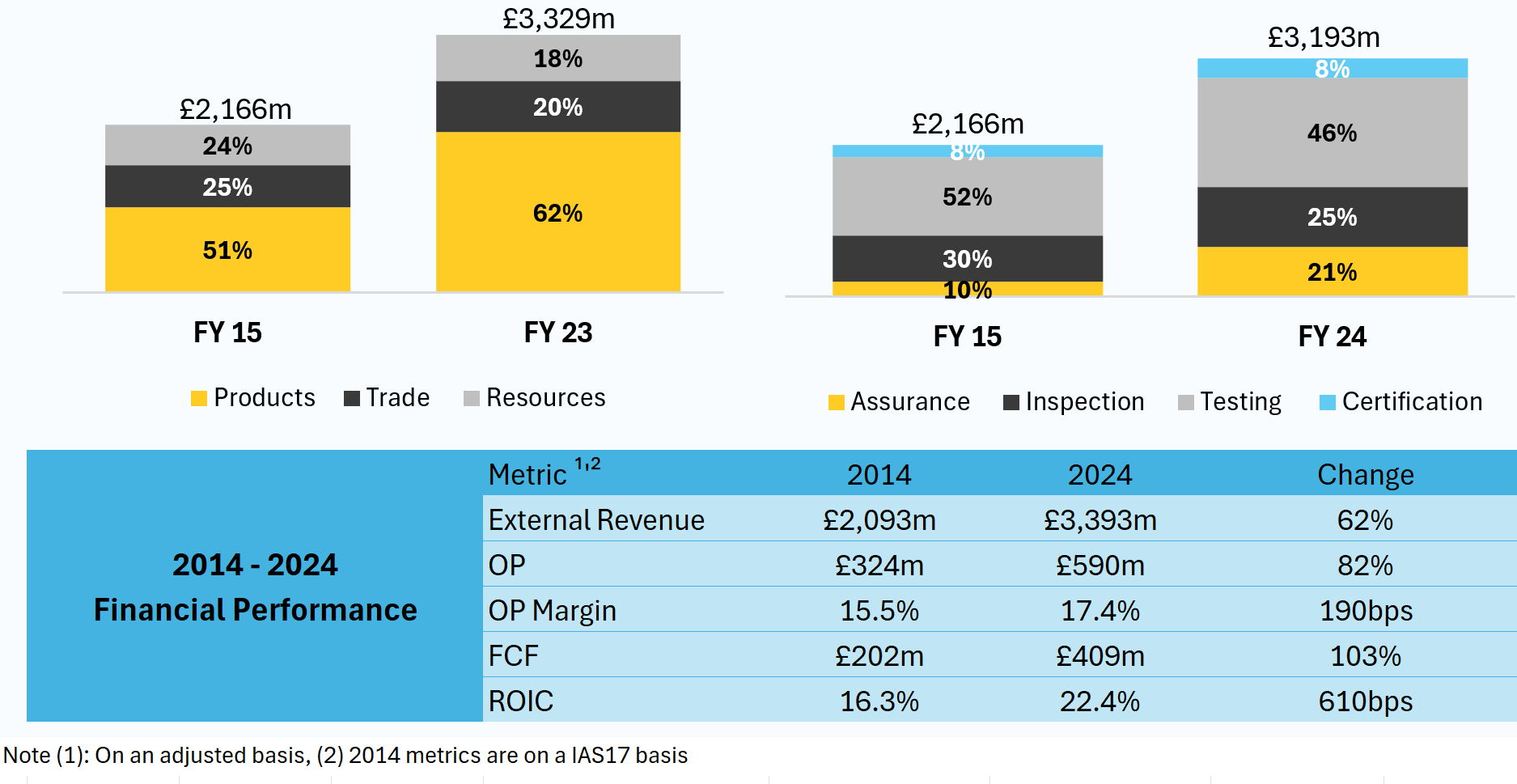

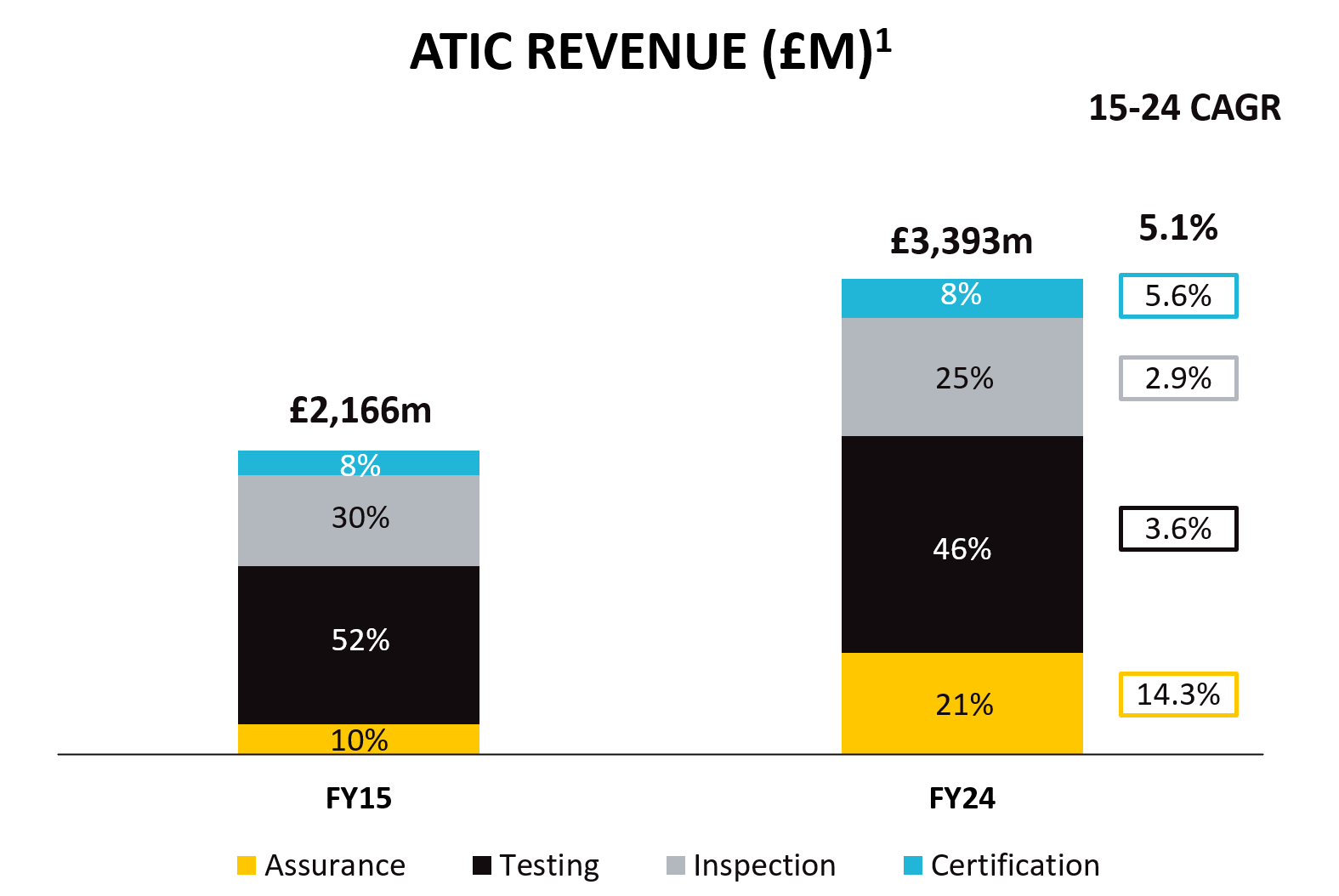

The split of our revenue continues to evolve with Assurance making up a greater percentage. Testing remains our largest service at 46% of revenue.

Note: (1) At actual rates

We work with more than 400,000 clients around the world and enjoy long-lasting relationships based on our superior customer service.

We provide independent quality assurance services that are mission critical for our clients. We have a strong technical expertise in all the sectors we operate in and when combined with our passionate and entrepreneurial culture, this enables us to support the growth agenda of our clients in an ever-changing and more complex operating environment.

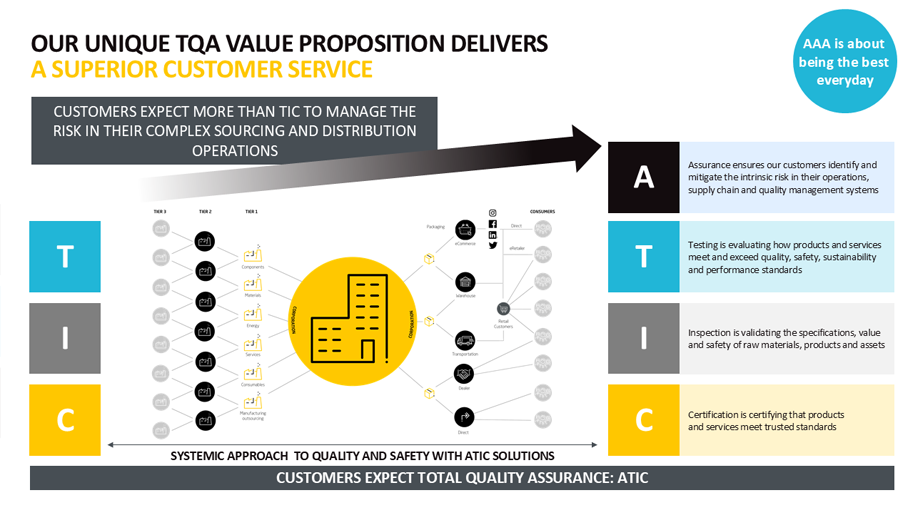

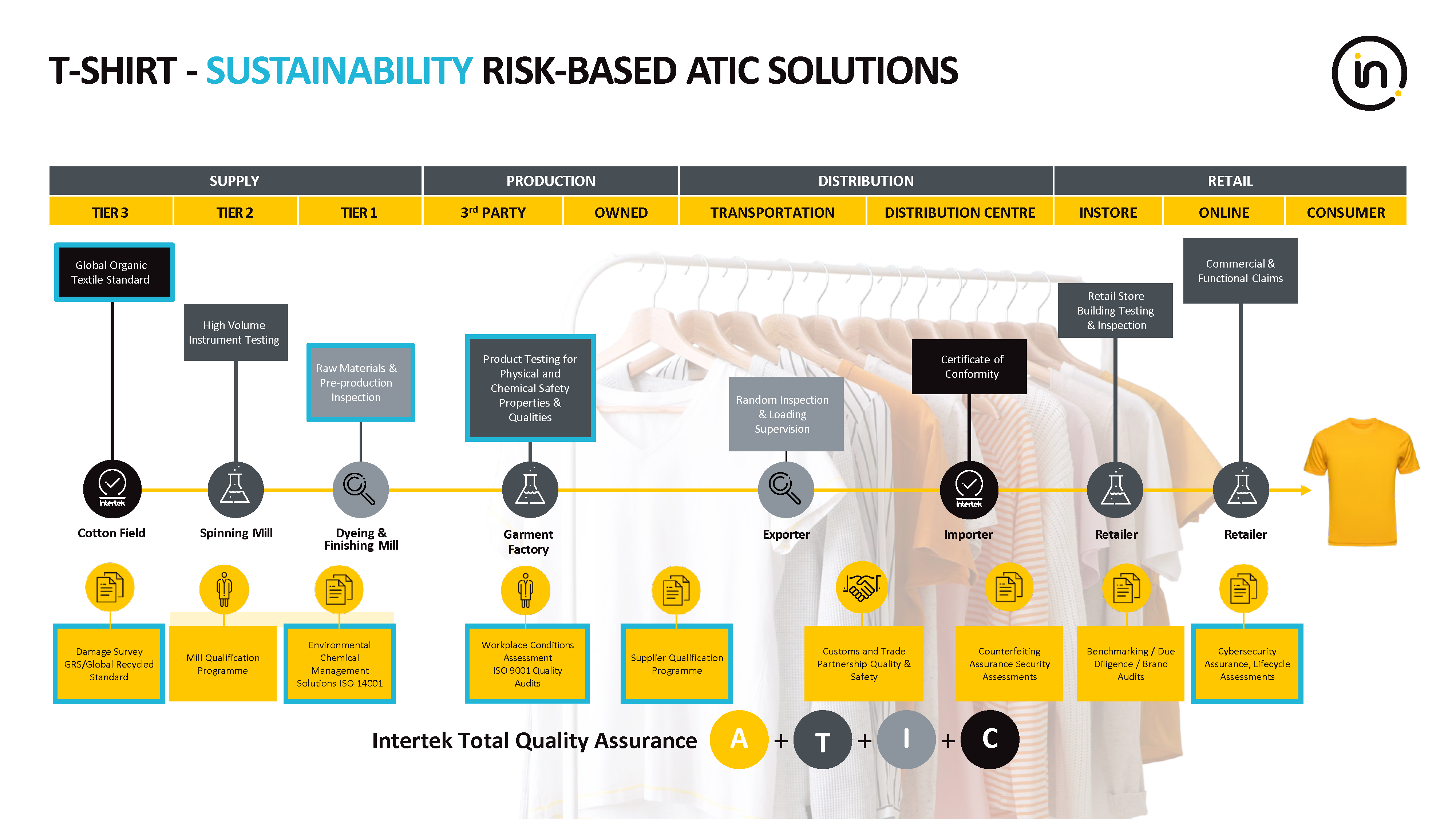

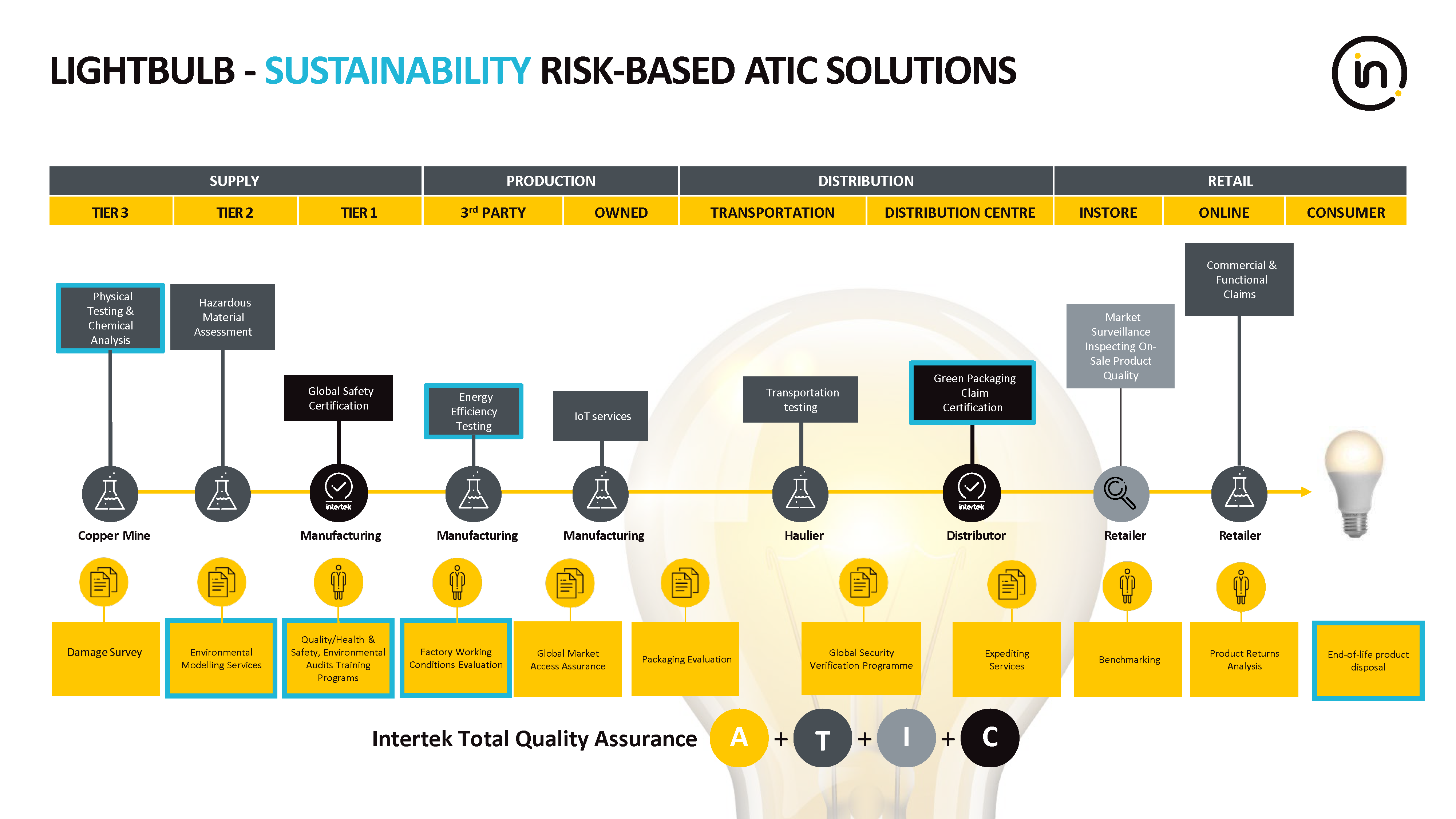

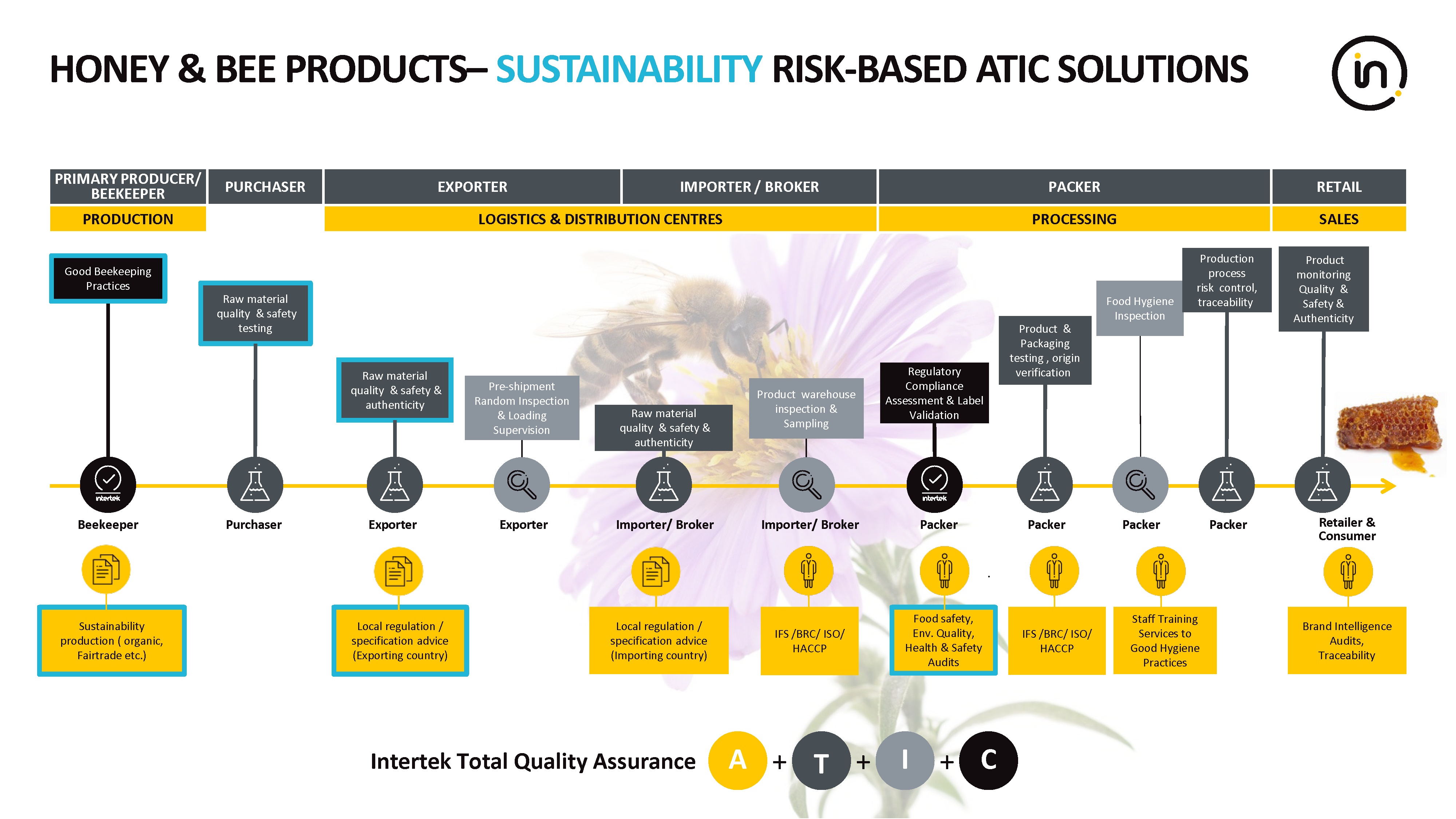

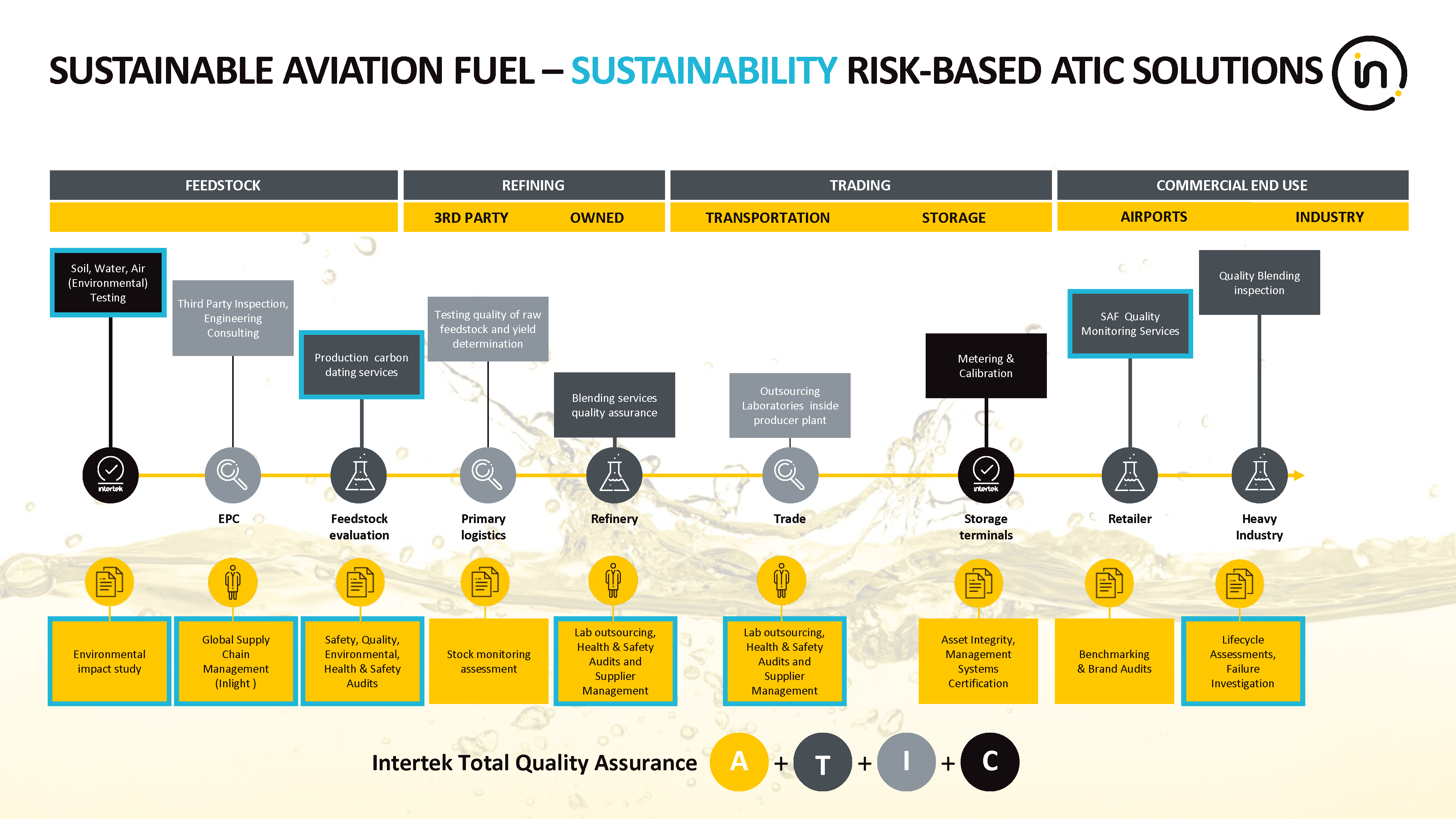

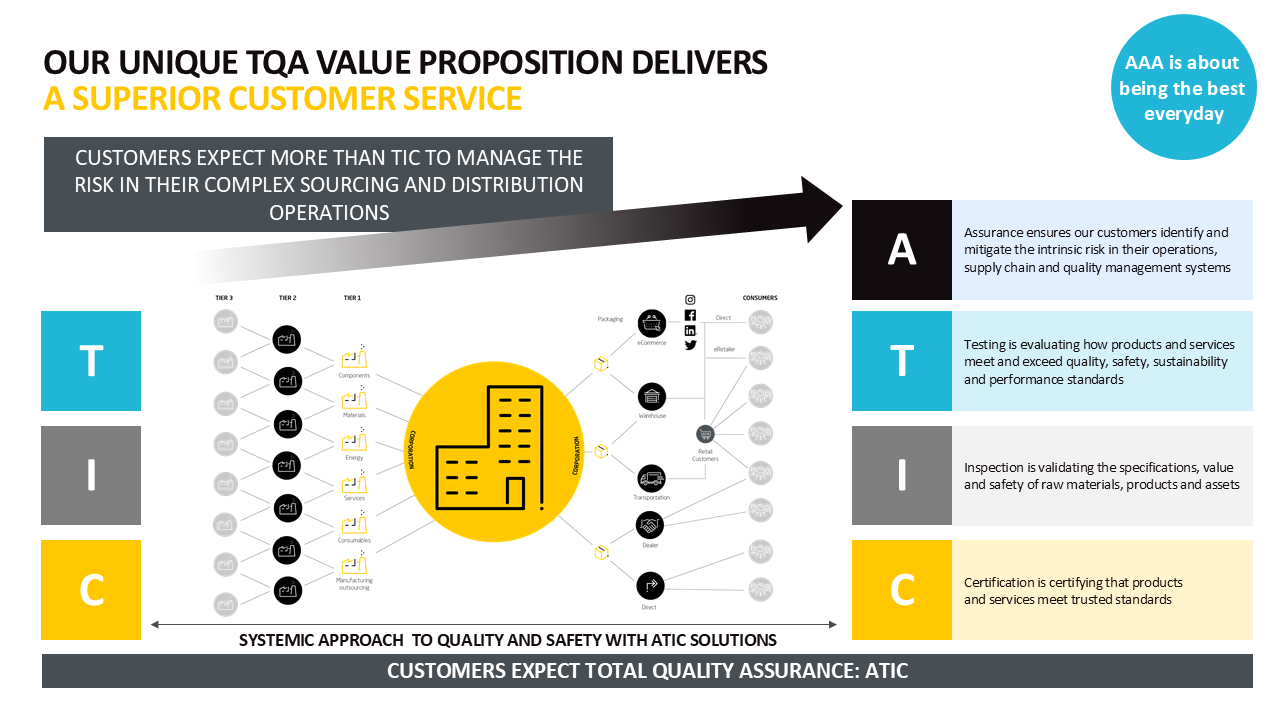

We provide ATIC solutions at every single stage of our clients’ operations. This is what we mean by Total Quality Assurance.

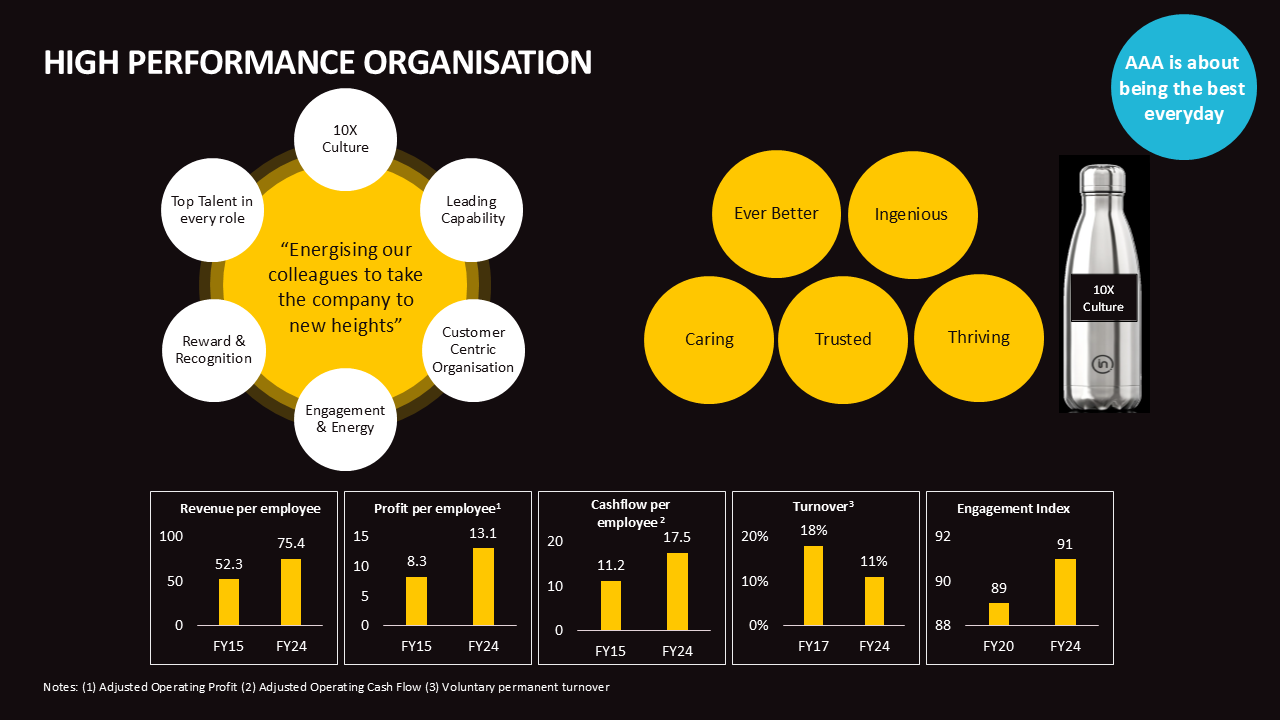

Intertek’s approach to being a high-performance organisation is through energising our colleagues to take the company to new heights. We put people at the heart of our growth strategy, our 10X culture is our DNA.

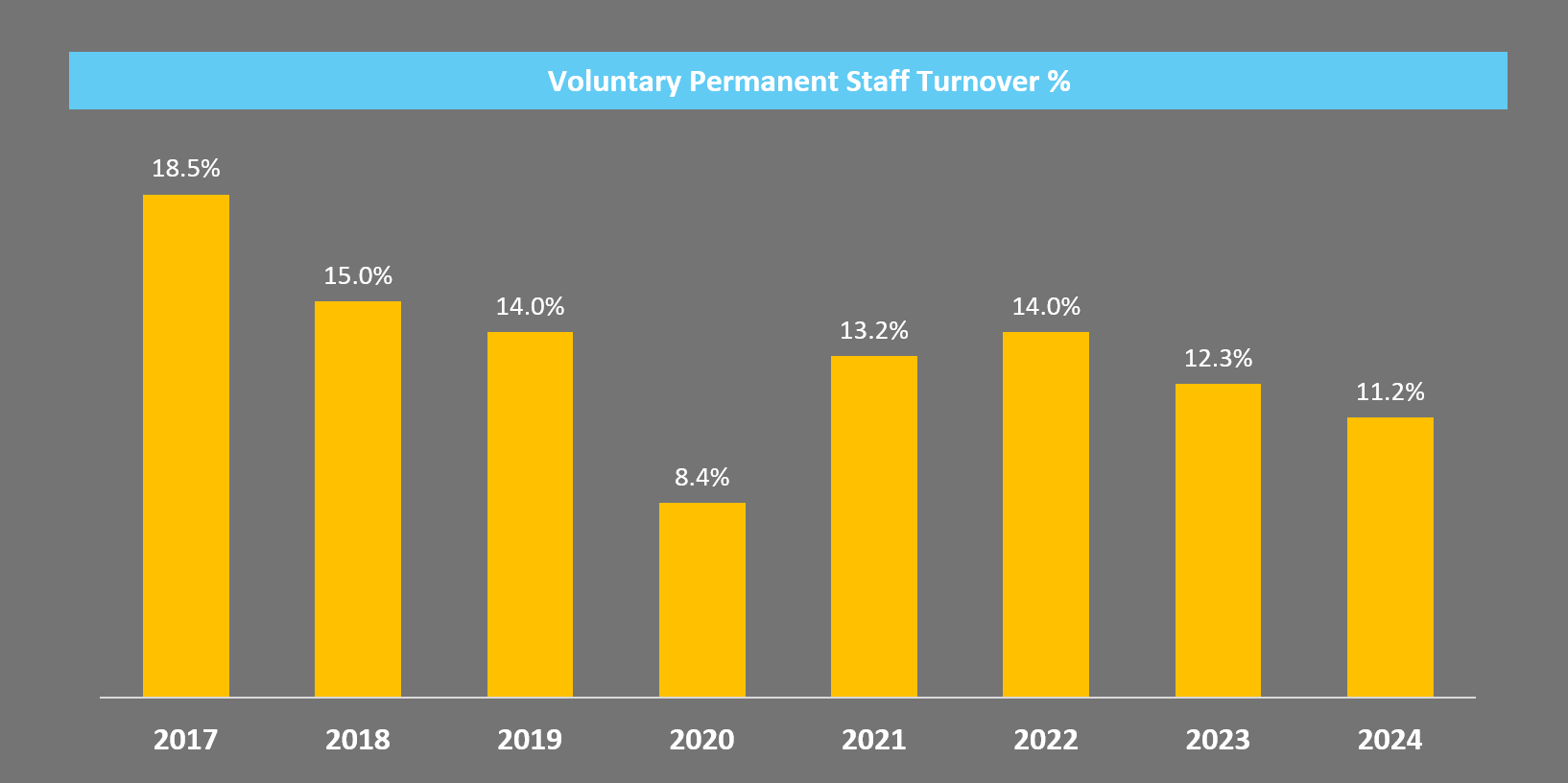

We have made significant progress on the metrics that define a high-performance organisation; revenue per employee, profit per employee, cash flow per employee, employee turnover, engagement.

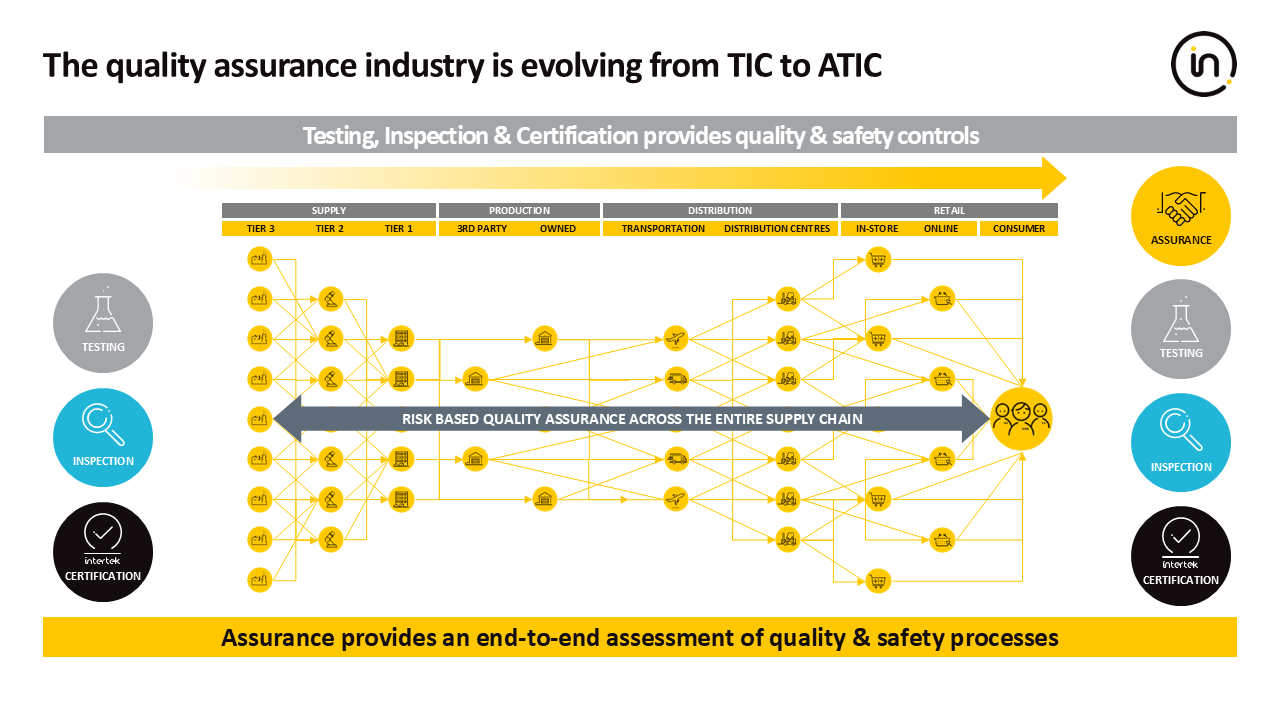

Assurance is the assessment of quality, safety and sustainability processes within company supply chains. With growing complexity in their nature, we provide an audit of company supply chains to identify and eliminate risks. This is done using real-time data which enables companies to detect issues instantly.

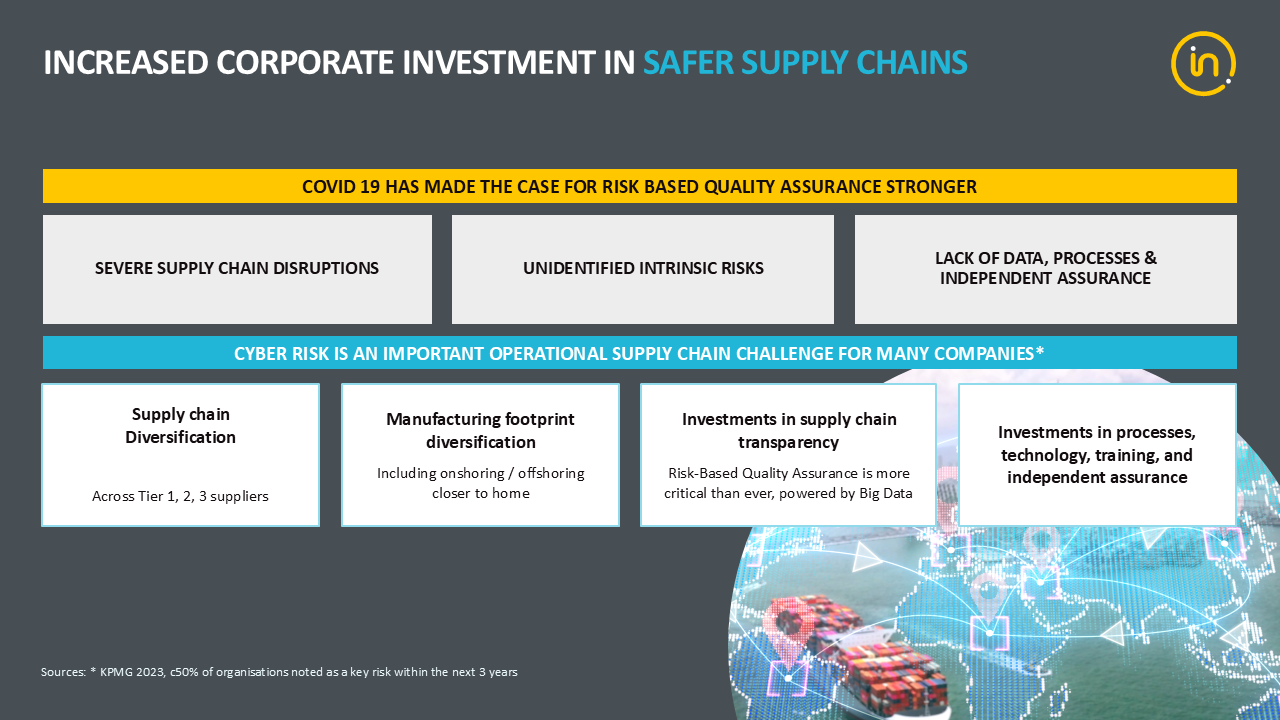

Covid-19 highlighted the fragility of global supply chains and the unidentified risks within them. As such, companies have been investing more in securing their supply chains, ensuring diversification. In addition, there has been increased investment in data protection, training and independent assurance.

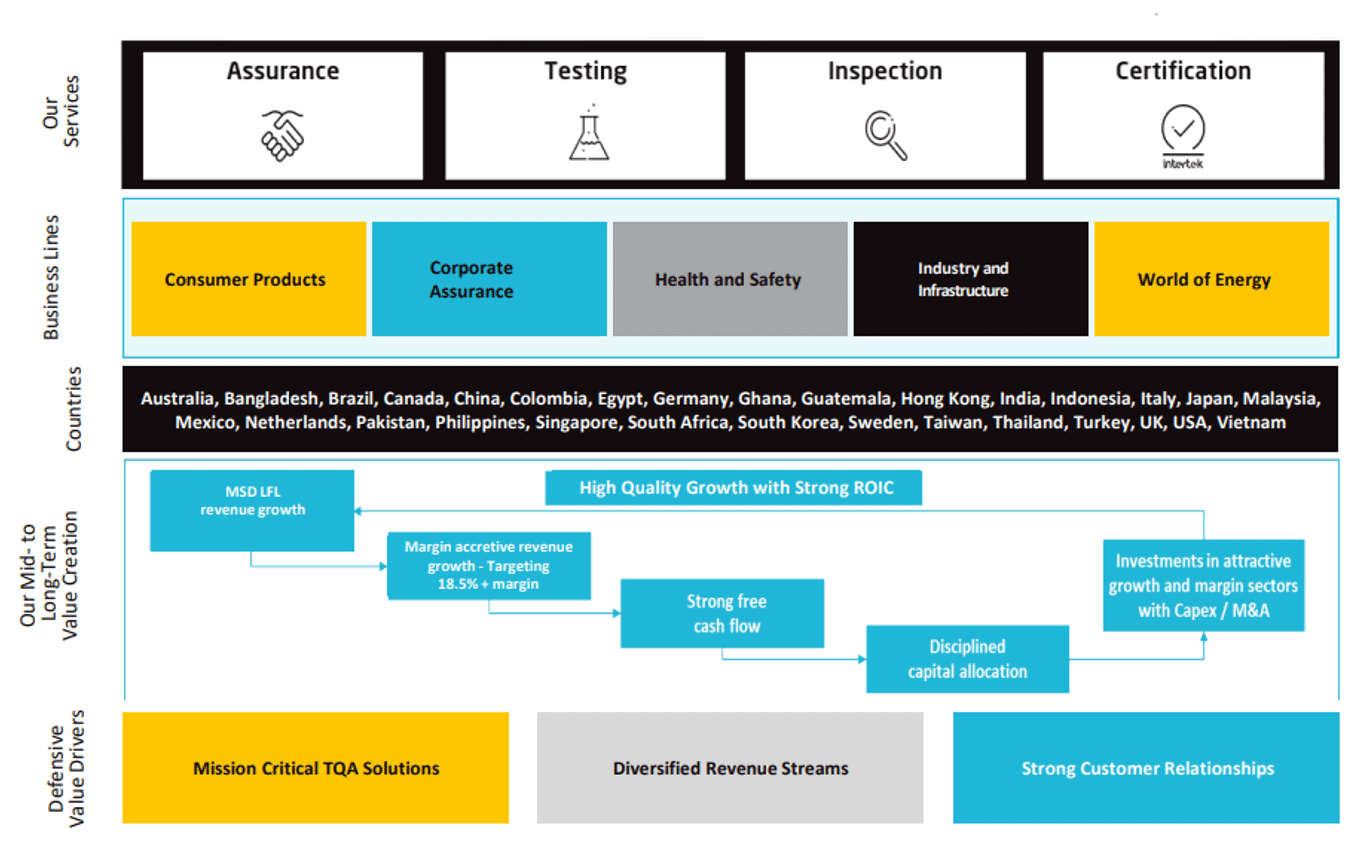

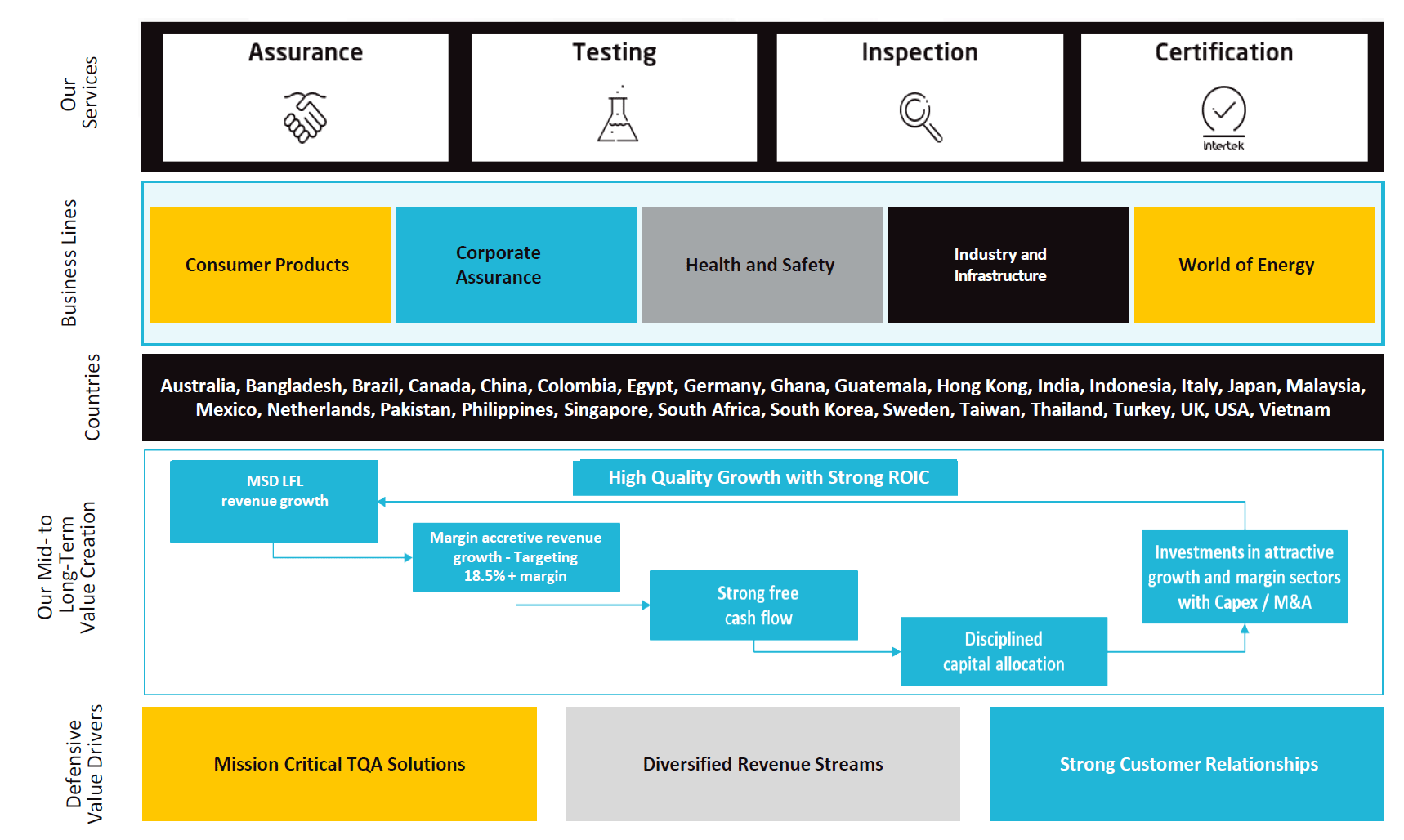

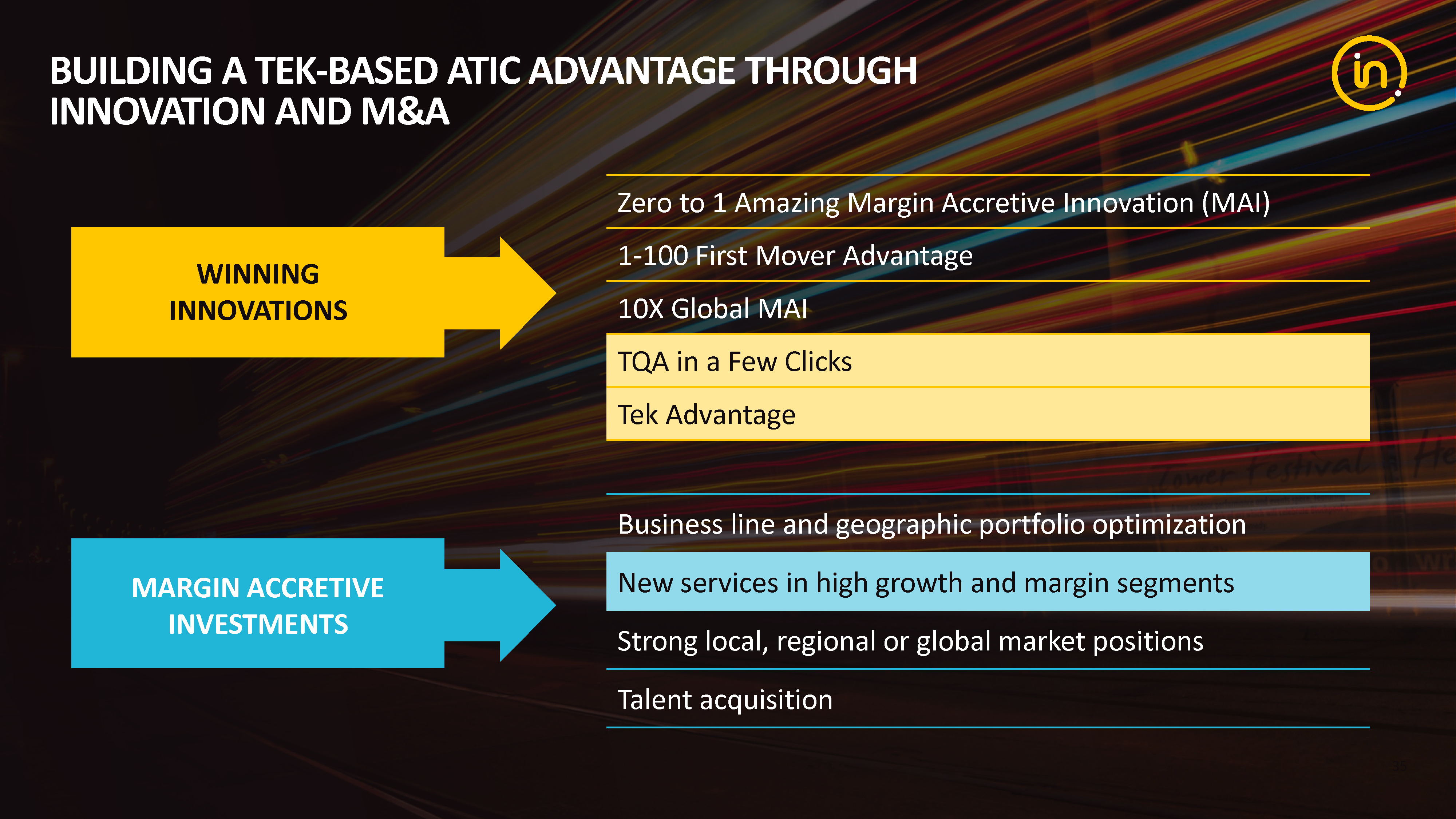

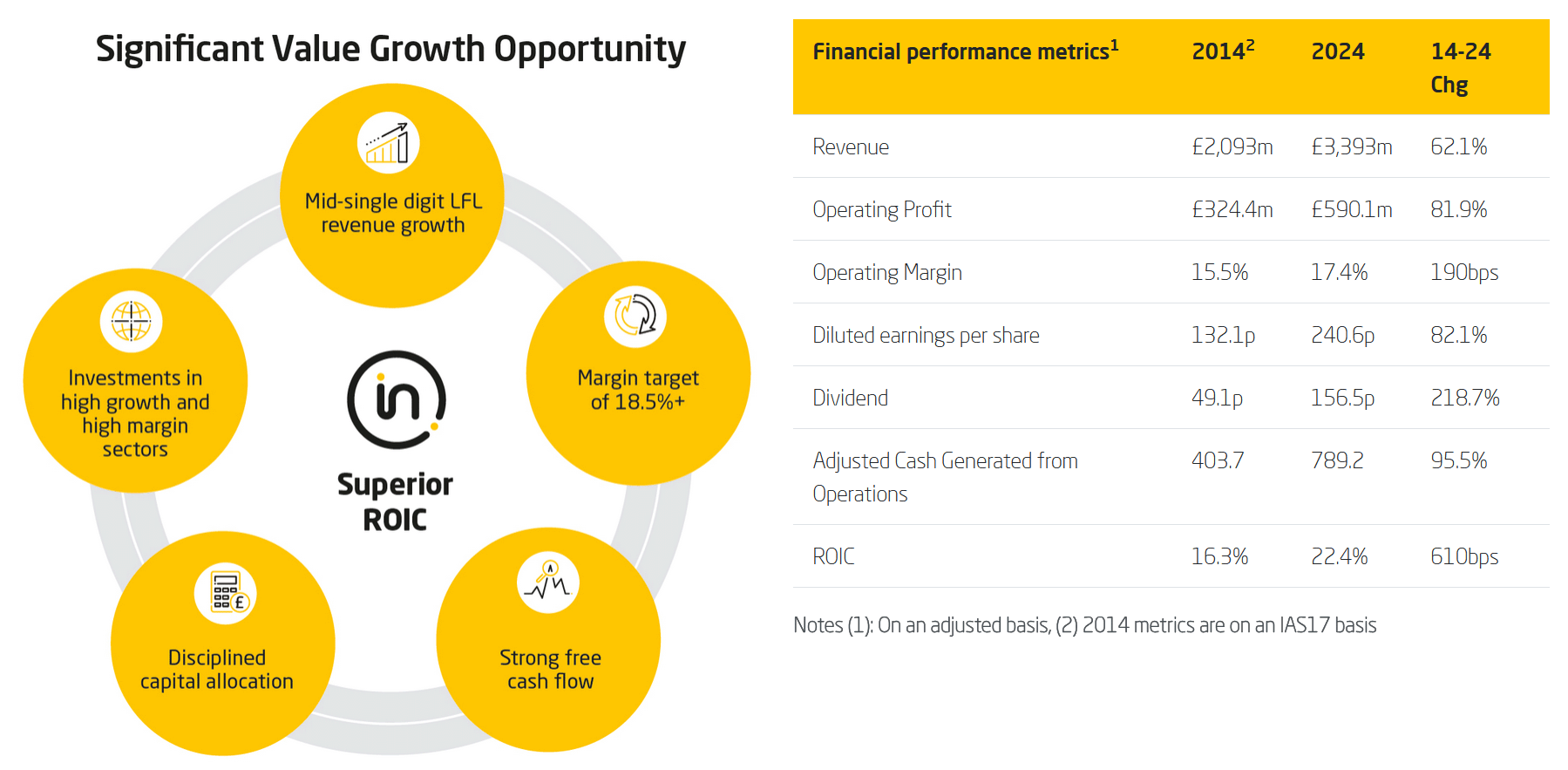

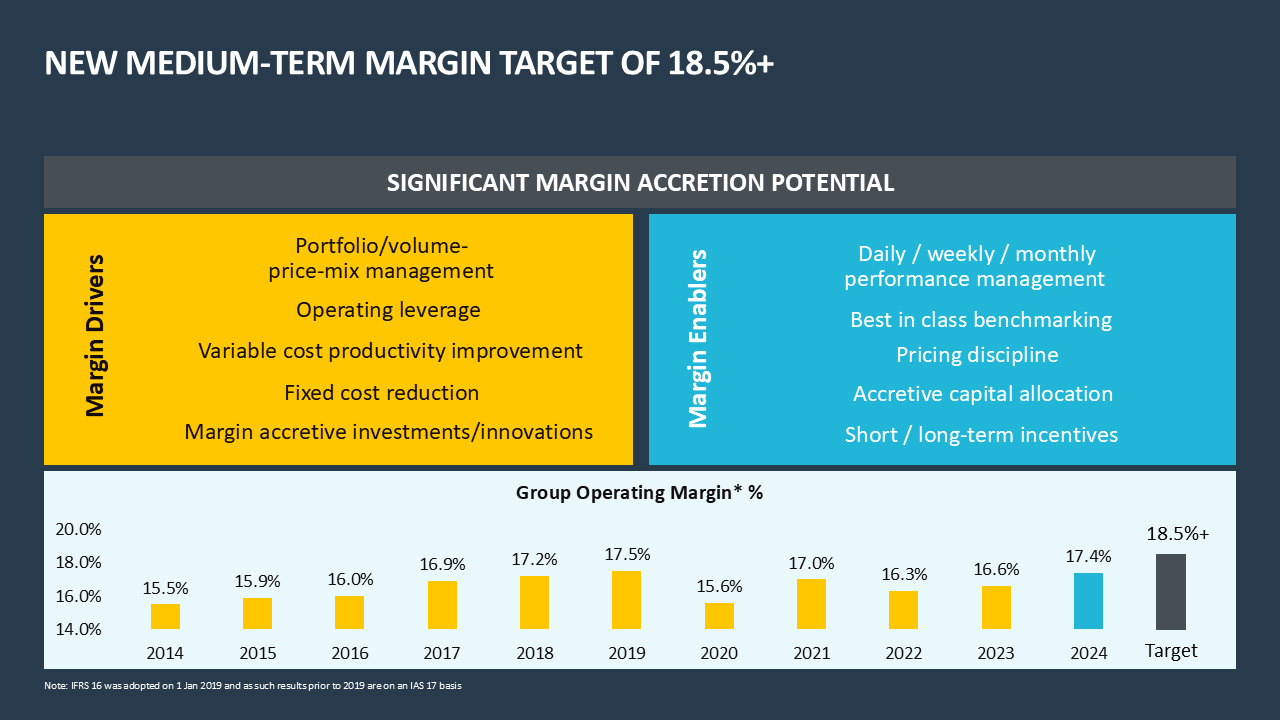

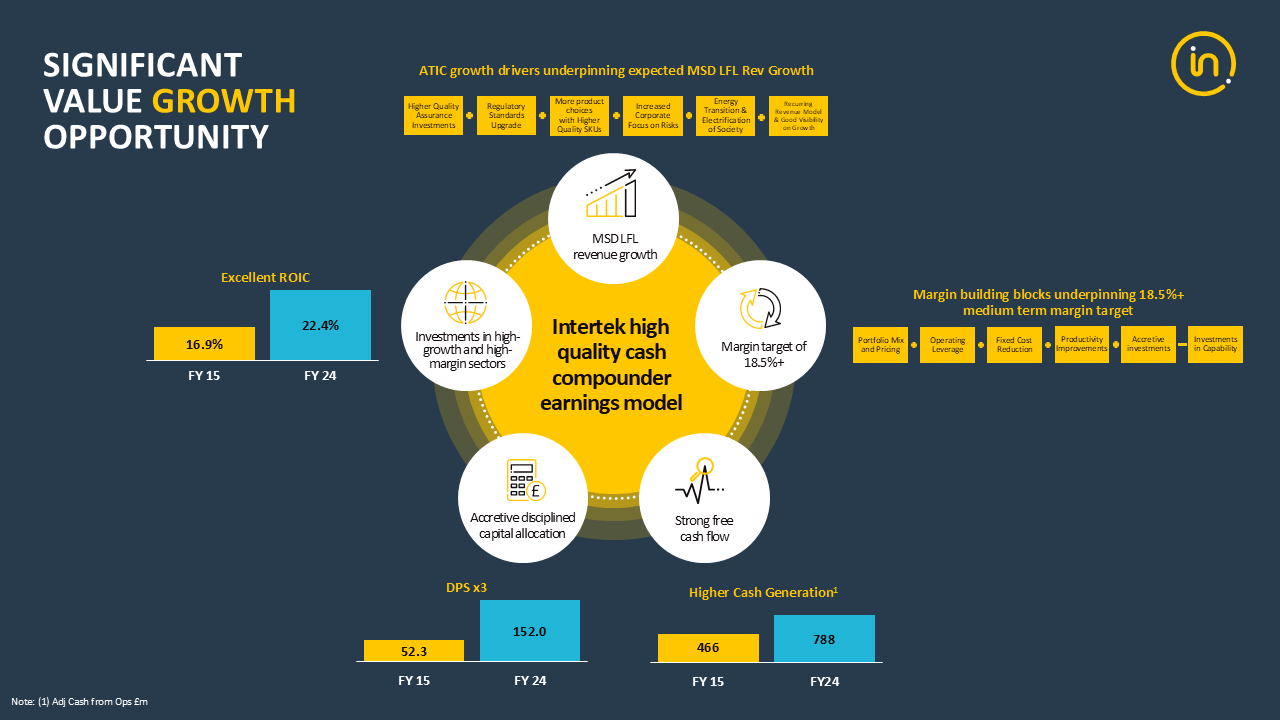

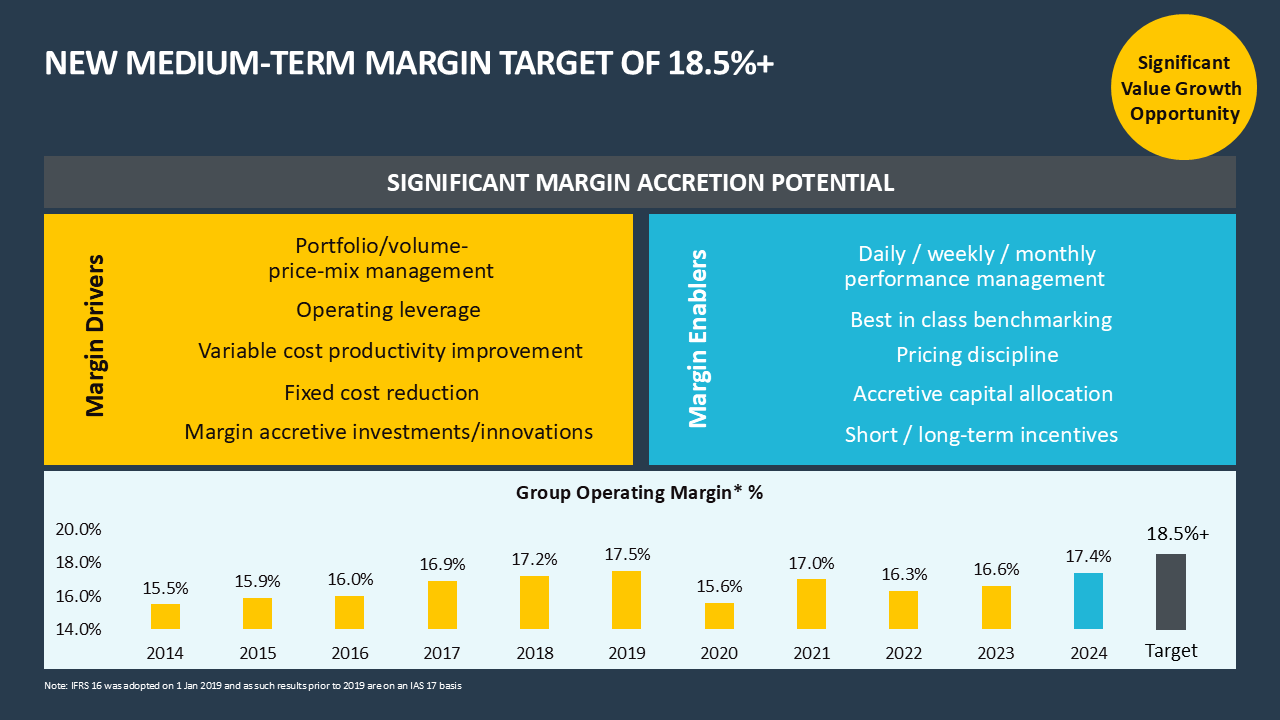

In 2023, as part of our Capital Markets event in London we launched our AAA growth strategy. The idea behind it was to deliver AAA value for all stakeholders and be the most trusted partner for Total Quality Assurance. Our aim was to deliver MSD LFL revenue growth at CCY, margin accretive revenue growth (18.5%+ margin target, announced at our FY24 results), strong FCF, and disciplined capital allocation in high growth and high margin sectors.

The strategy is on track and in FY-24 we delivered MSD LFL revenue growth, strong FCF and margin performance and have increased our dividend payout policy to c.65%.

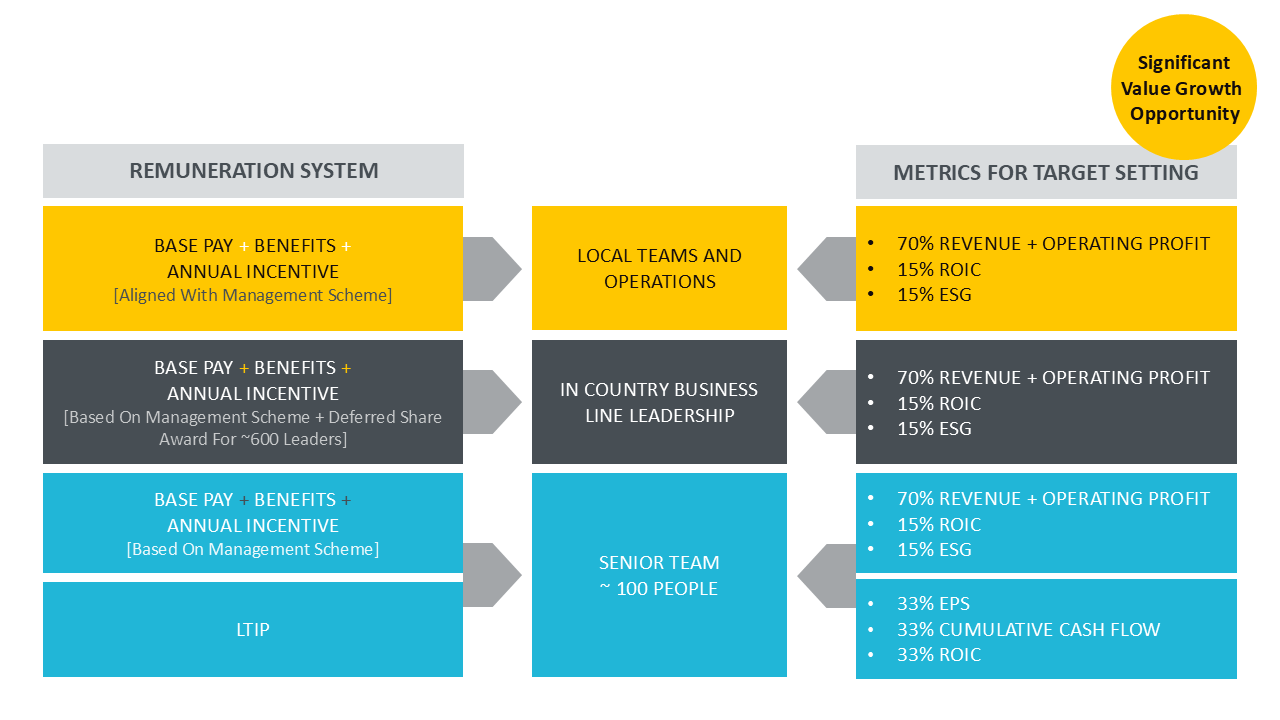

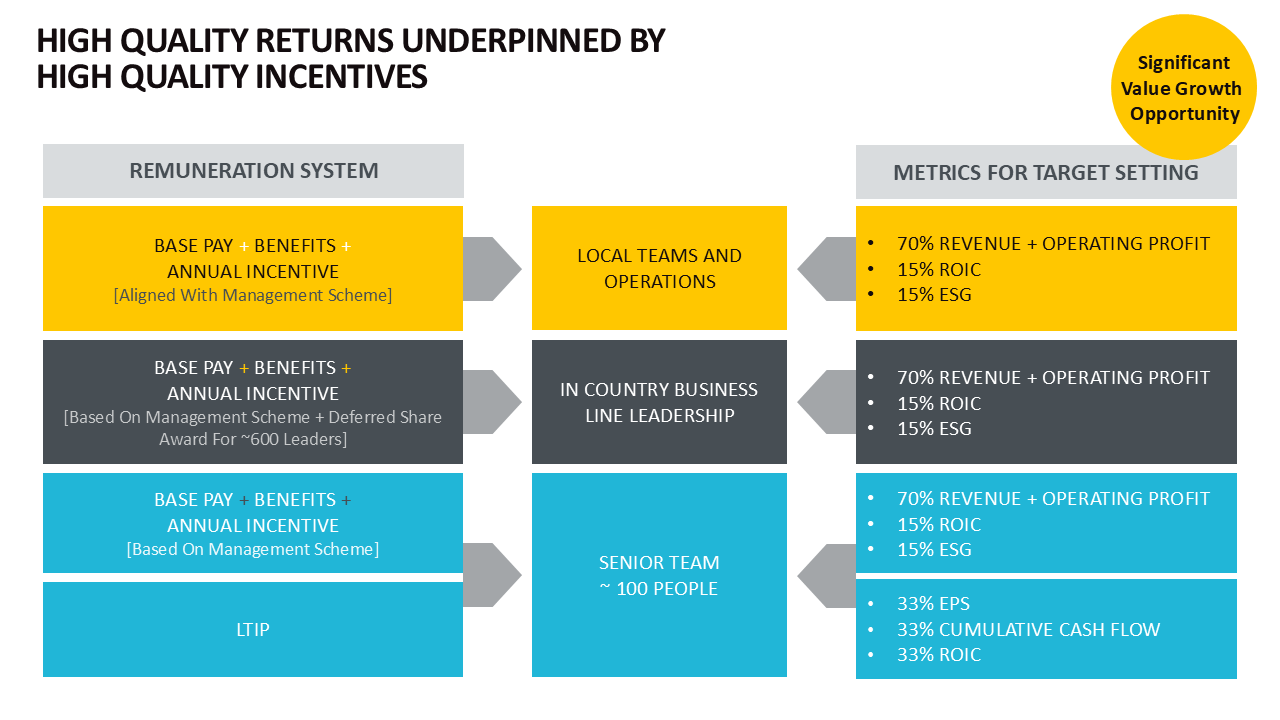

The reward structure is broken down that 70% of the short-term incentive is on a line-of-sight matrix of Revenue and Operating Profit while the balance is split between Group ROIC and Group ESG metrics. The long‐term incentive performance share program is based on a 3‐year performance cycle with a 2 year post vesting holding period. This is based equally on EPS, ROIC and FCF. We believe that having long-term incentives ensures the alignment with all stakeholders.

Since launching our people strategy in 2016, our voluntary employee turnover has come down from 18.5% in 2017 to 11.2% in 2024.

Divisions & Growth Opportunities

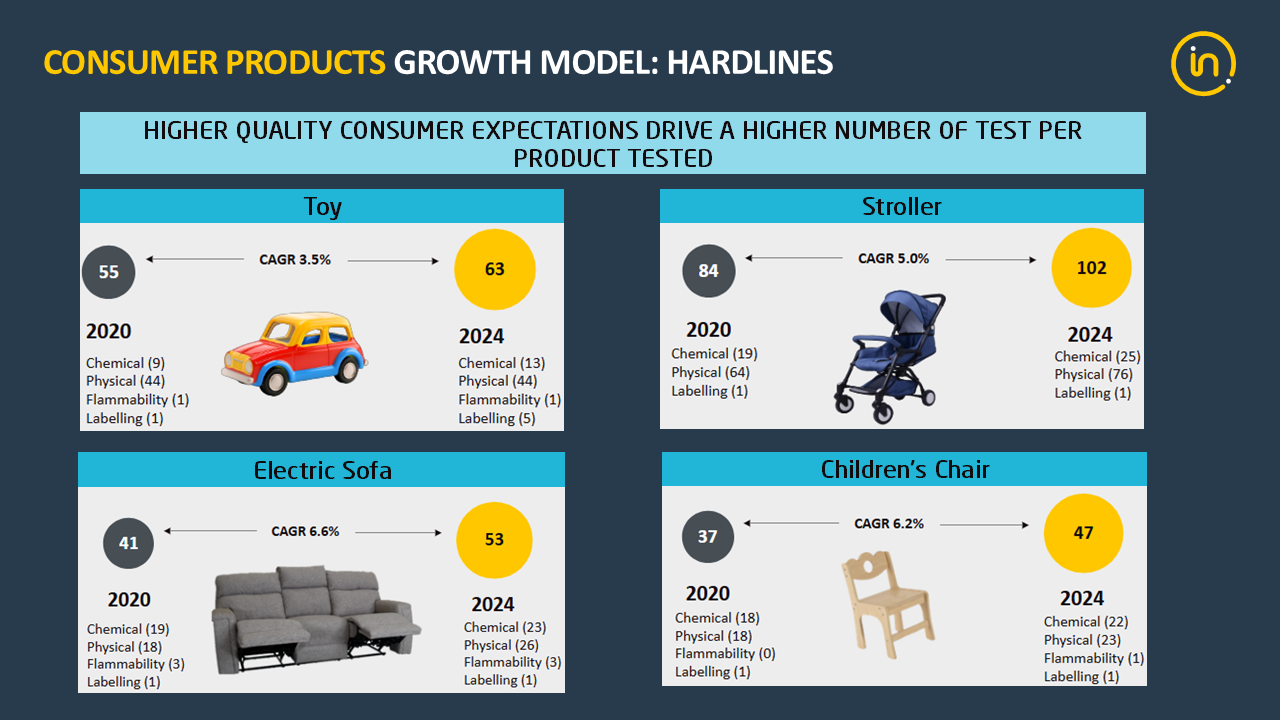

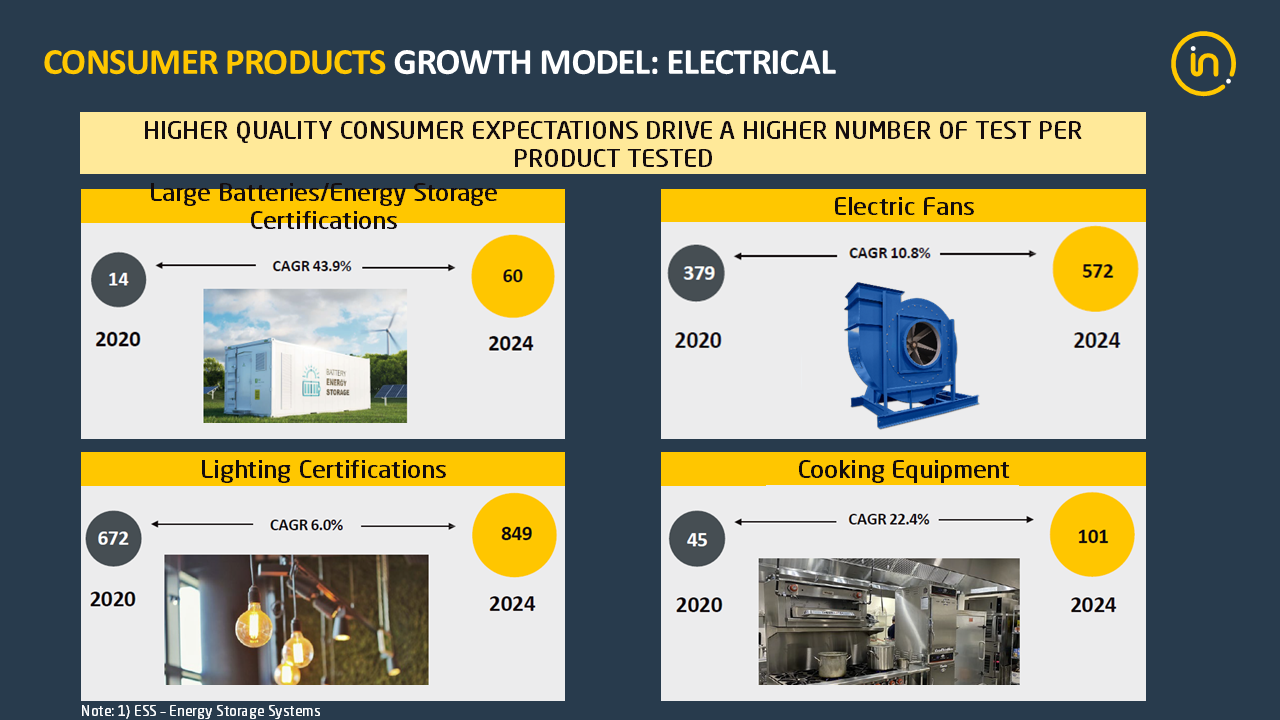

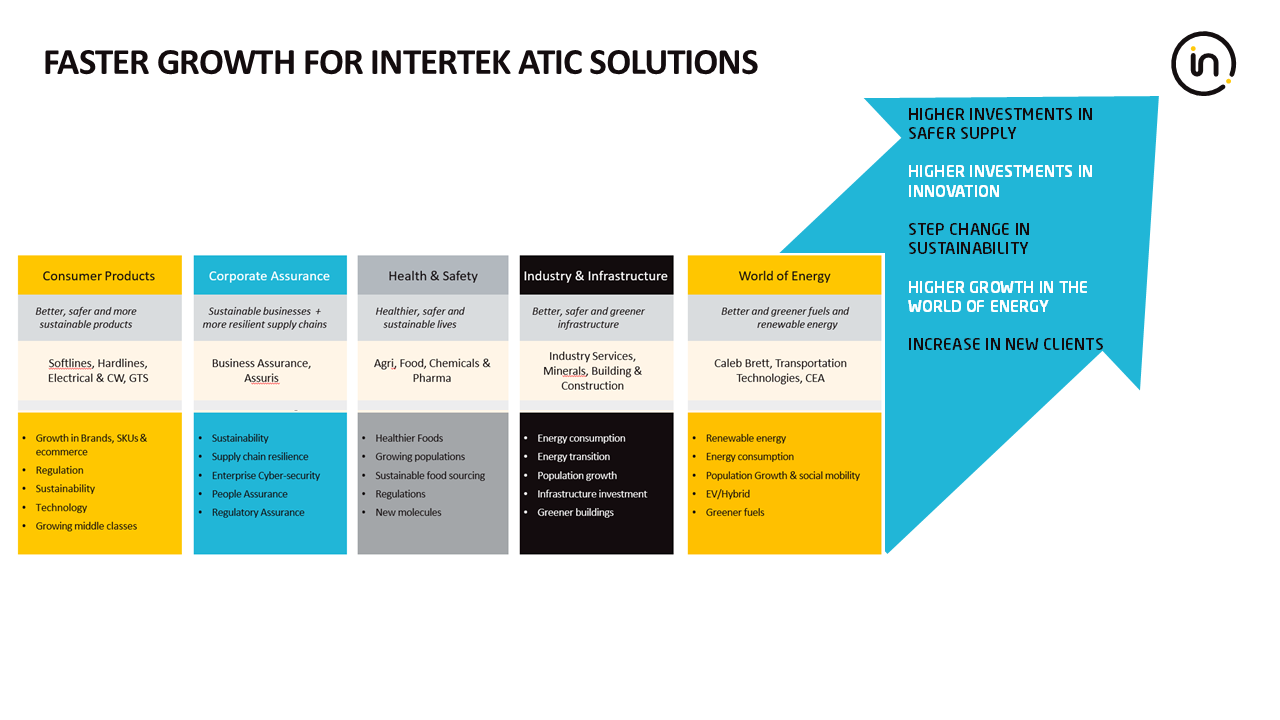

We expect to deliver Mid-Single-Digit Revenue growth on a like-for-like basis for the mid-to long-term. We are targeting HSD to DD growth in Corporate Assurance, MSD to HSD growth in Healthy and Safety and Industry and Infrastructure, and Low to MSD growth in Consumer Products and World of Energy.

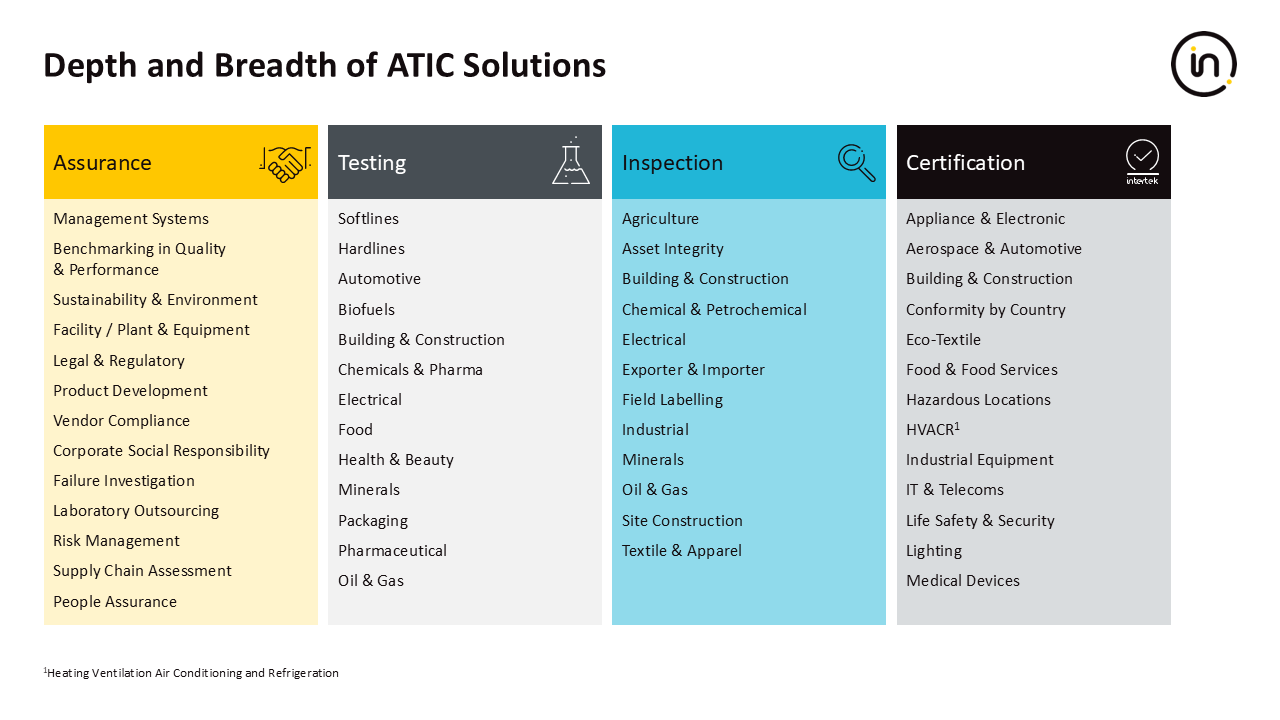

Our unique Assurance, Testing, Inspection and Certification (ATIC) offering means we are well-placed to take advantage of the huge growth opportunities in the global ATIC market.

Our industry has always benefitted from attractive growth drivers and now, more than ever, everyone wants to build an ever better, safer and more sustainable world. This means that corporations will invest more in quality, safety and sustainability, accelerating the demand for our industry-leading ATIC solutions.

Our customer research shows that the well-known attractive structural growth drivers in the Risk-based Quality Assurance industry will be augmented by:

- higher investments in safer and more resilient supply chains.

- continuous investments by corporations in innovation in new products and services.

- a step change in how companies manage sustainability.

- increased investments in traditional oil & gas and renewables.

- an increase in new clients, both in developed and emerging economies.

Our ATIC solutions ensure an end-to-end assessment of the risks within supply chains, ensuring superior customer service to clients. The whole ATIC offering assesses internal and third-party supply chain risks while also providing our Testing, Inspection and Certification services.

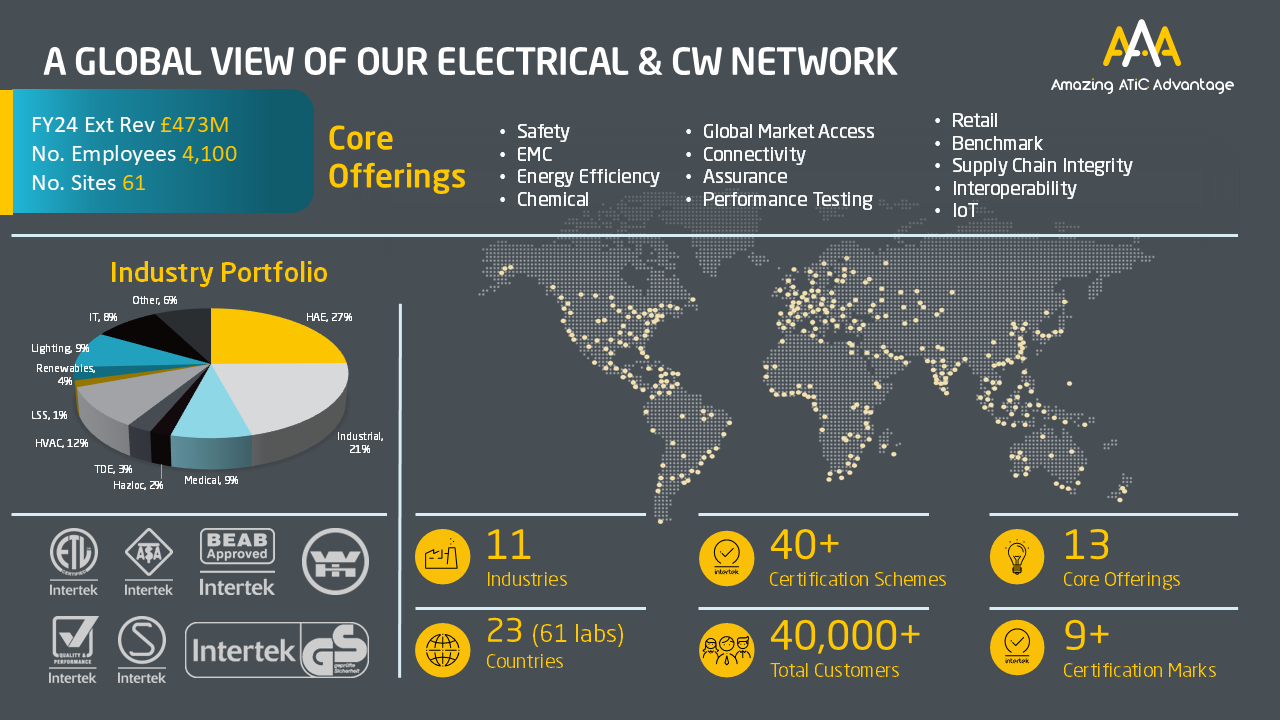

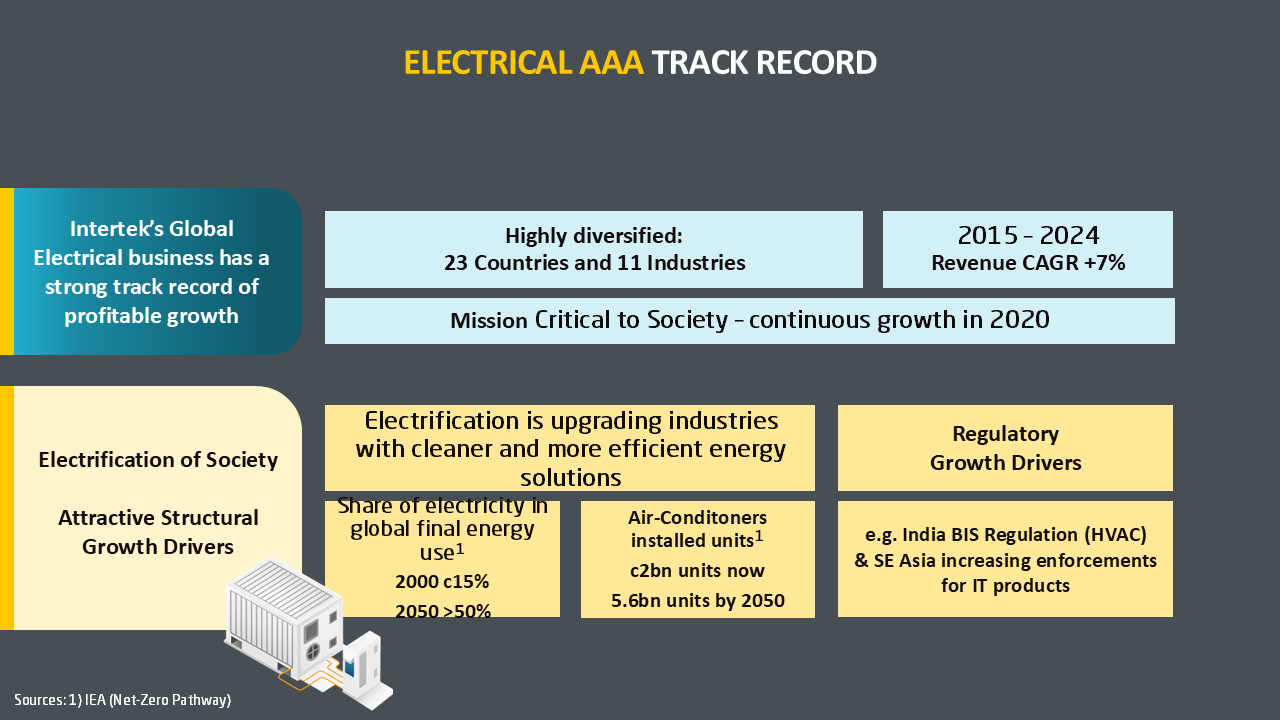

Our portfolio within the Electrical division expands beyond the Consumer business and spans across 11 industries in 23 countries. With 16 labs in the US, we maintain a podium position in this market.

Our offering ranges from ATIC services in Industrial to HVAC and Medical, where we ensure product safety and regulatory compliance throughout the entire product lifecycle.

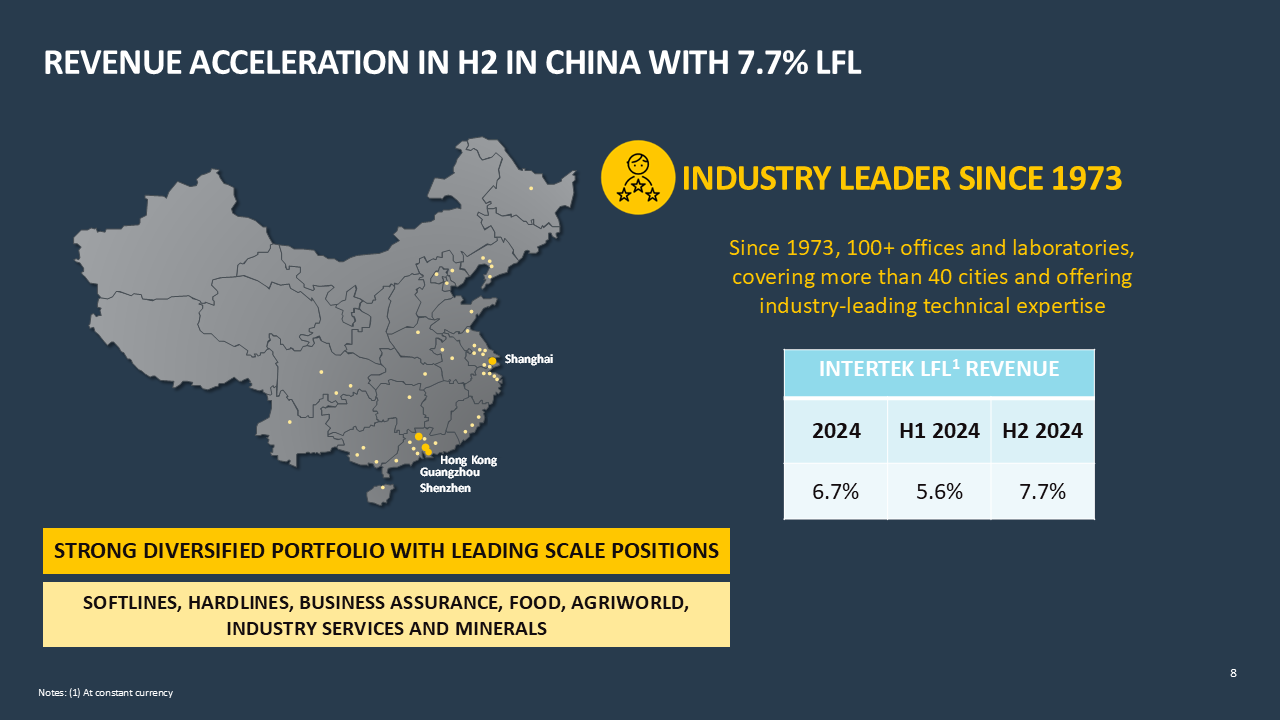

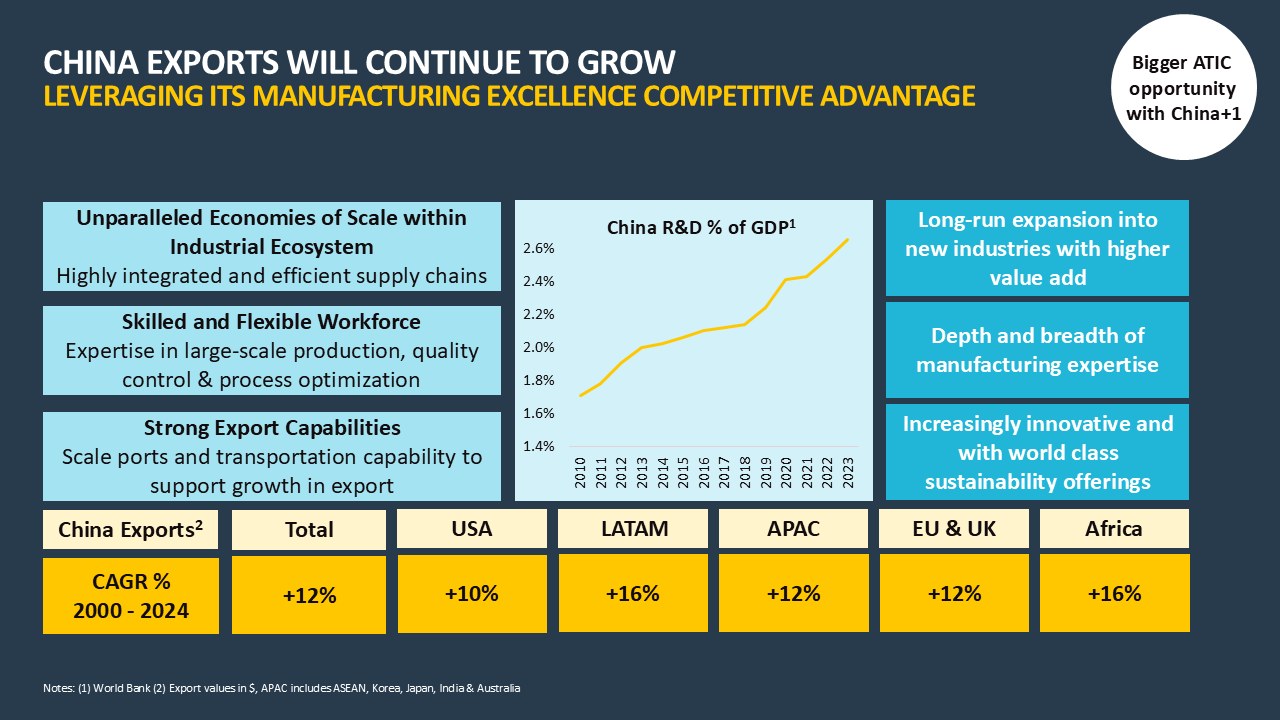

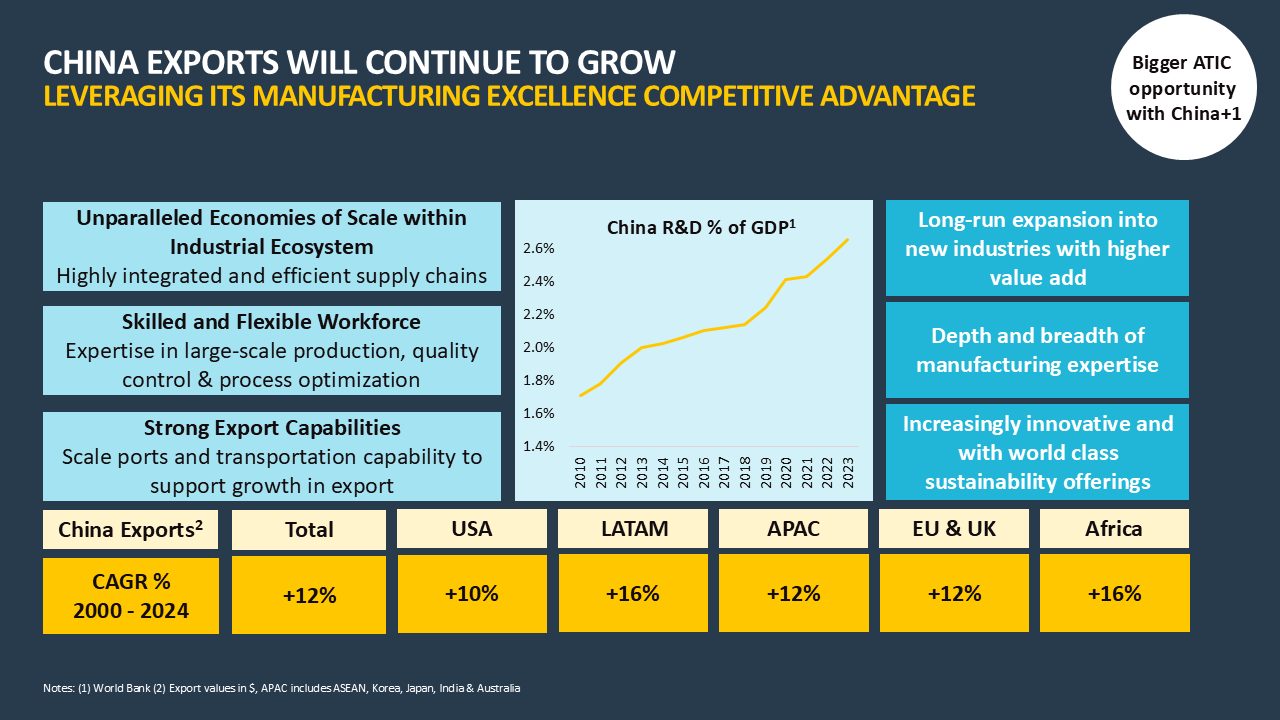

There remains ample opportunity in the Chinese export market ranging from automotive (ie. Electric Vehicles) to greater opportunity in the Consumer business and Sustainability metrics.

In addition to the export market, despite currently facing challenges, the domestic Chinese market has experienced significant growth over the last number of years. Growth opportunities in quality standards, ESG disclosures and supply chain assurance across many industries remain.

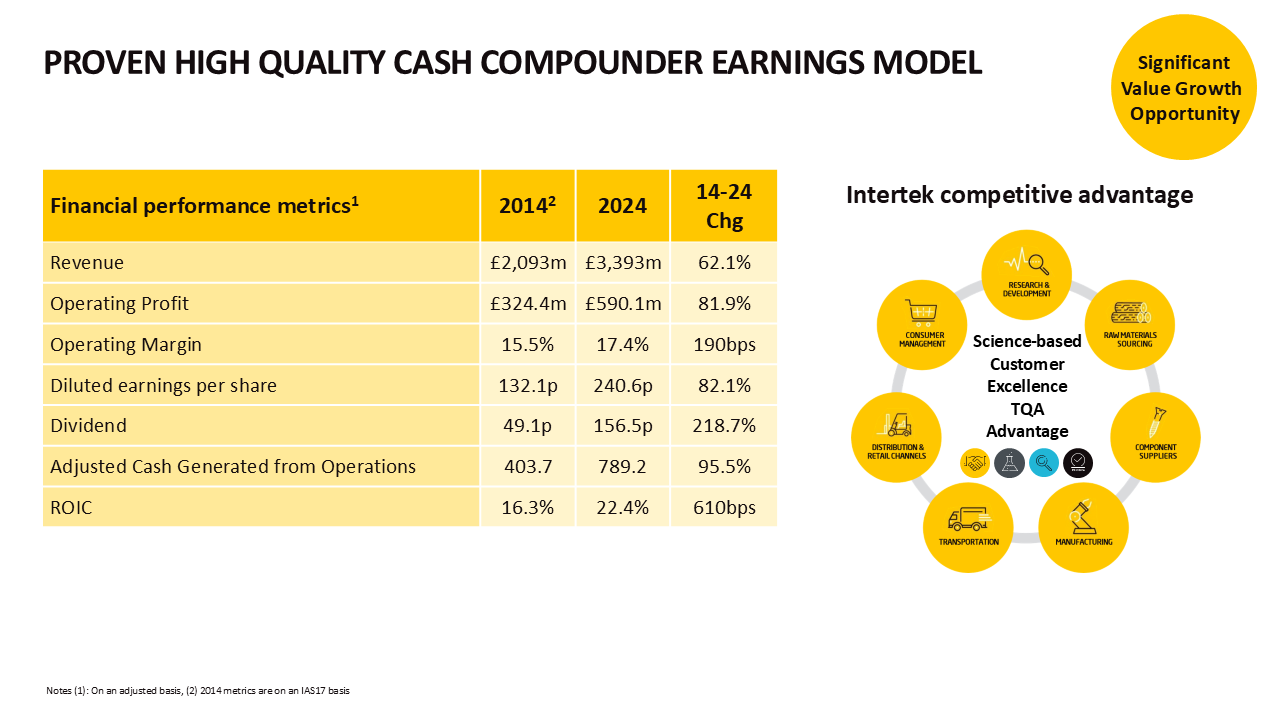

Cash Compounder Earnings Model

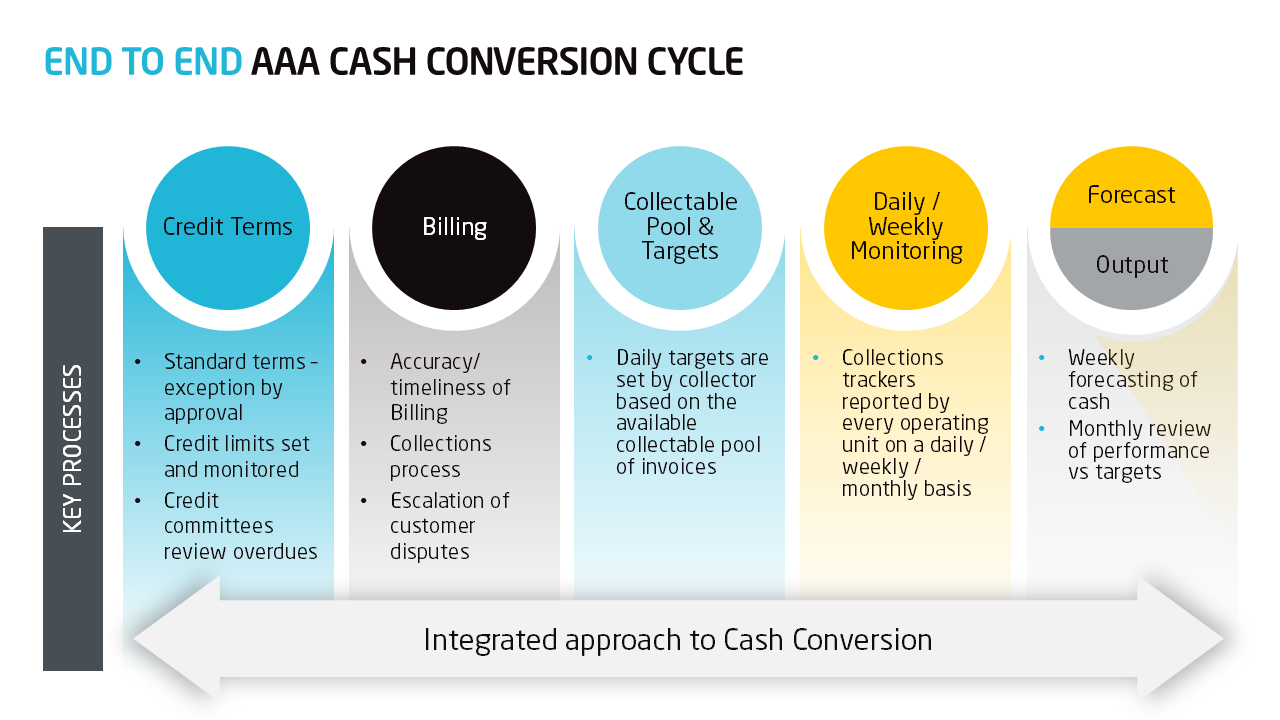

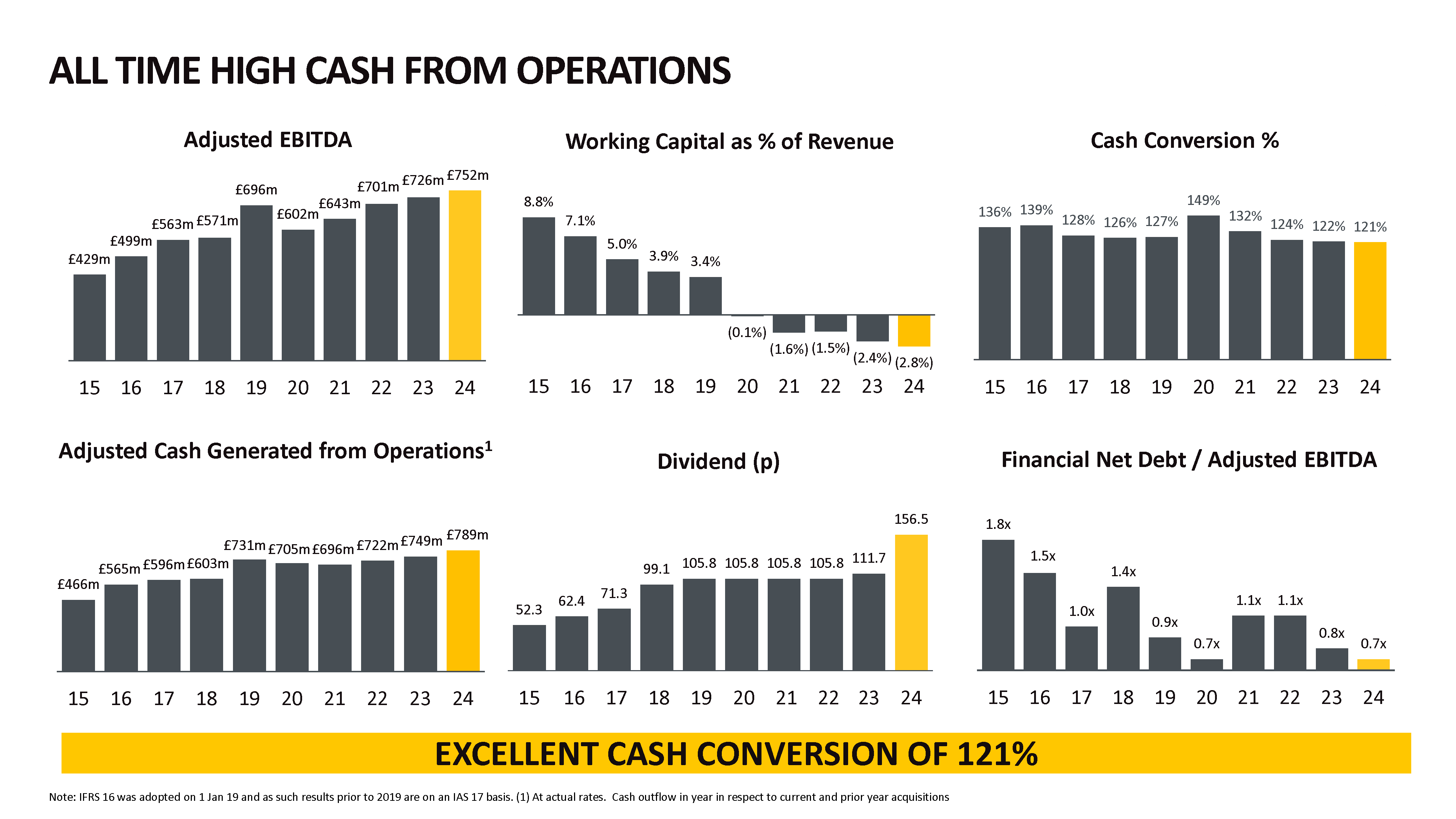

We operate a high-quality cash compounder earnings model, focusing on the compounding effect year after year of high-quality margin accretive revenue growth, strong free cash flow and superior returns. We aim to deliver significant value for every stakeholder.

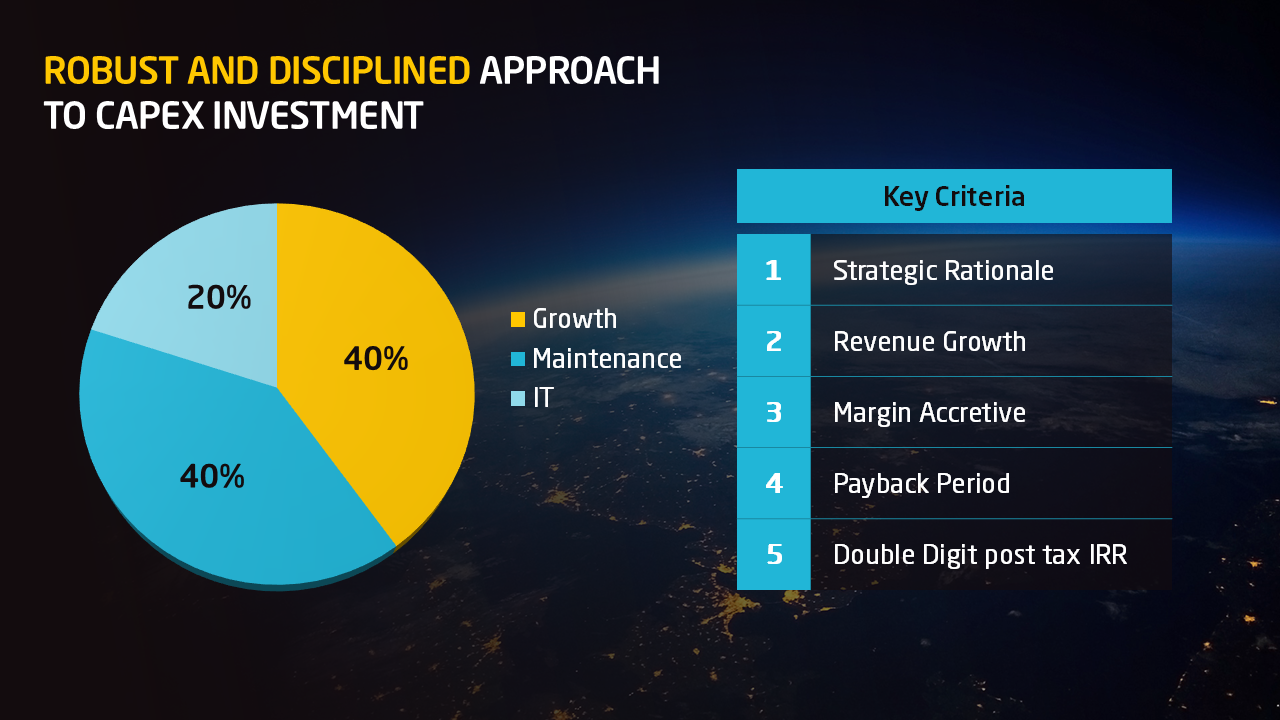

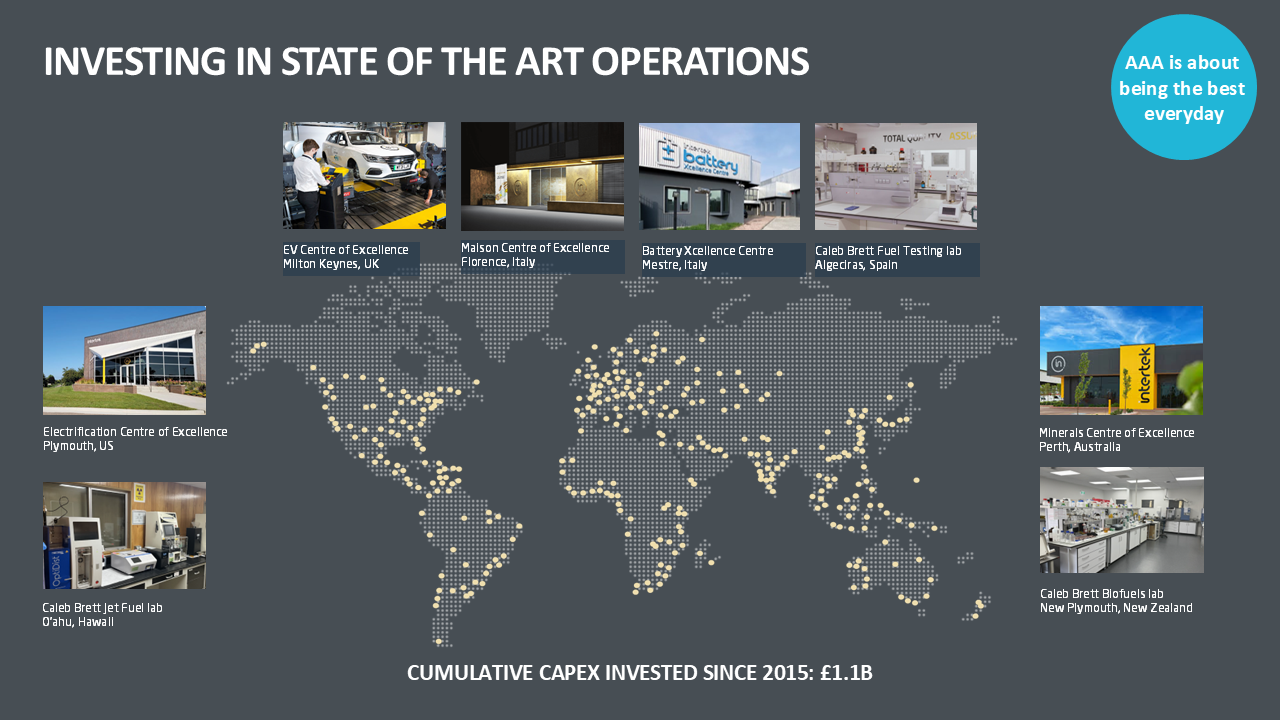

As part of our disciplined approach to capital allocation we view our CapEx investments through the lens of 5 key criteria. This includes our strategic rationale, potential revenue growth, the level of margin accretion, payback period and a double-digit post tax IRR.

We target a capex/sales ratio of up to 5%

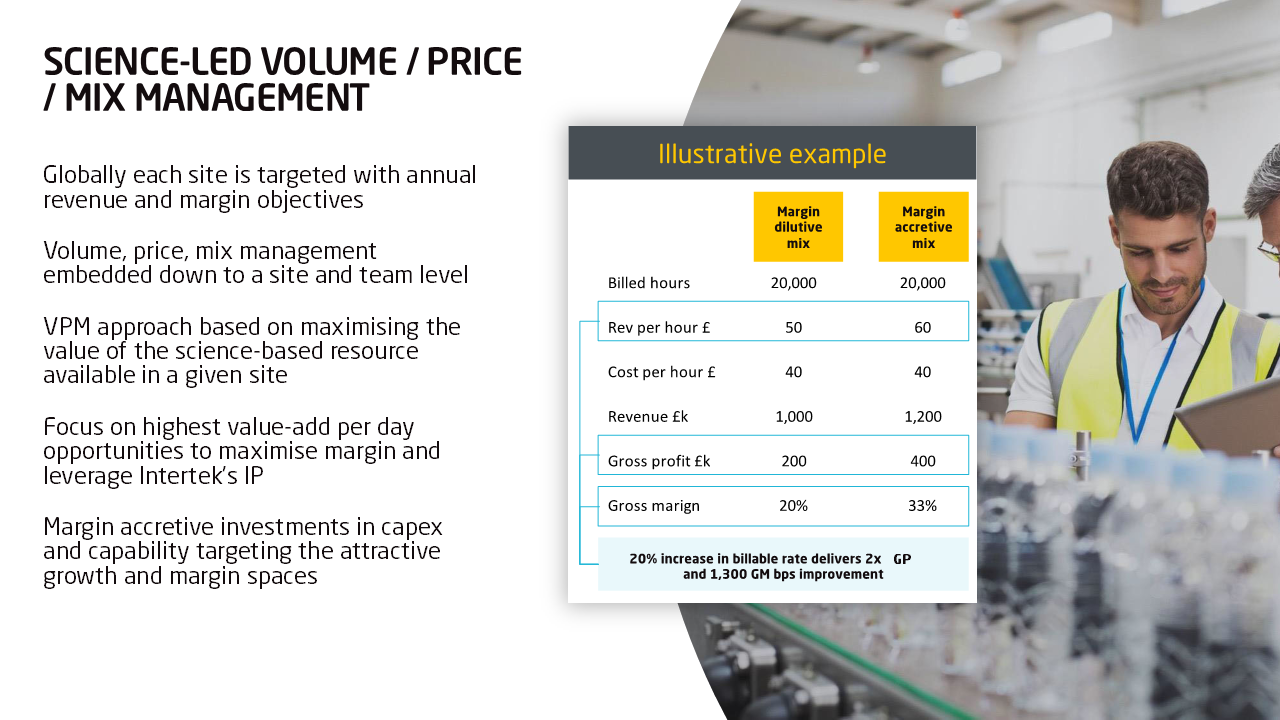

In order to maintain a focus on productivity across the organisation, pricing is embedded down to a site level with the aim to maximise efficiency. With regard to the pass-through of inflation, 50% of the increase is passed on, this further embeds our view on generating value for Intertek and its clients rather than the ease of higher prices.

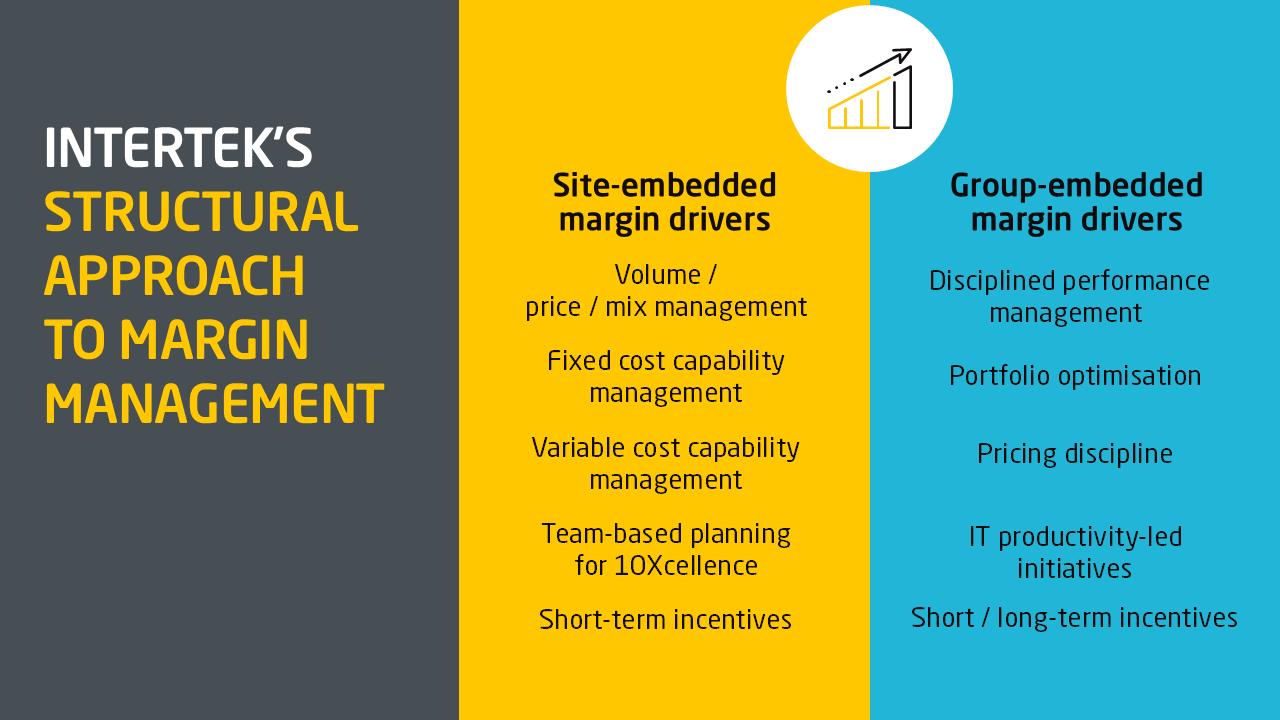

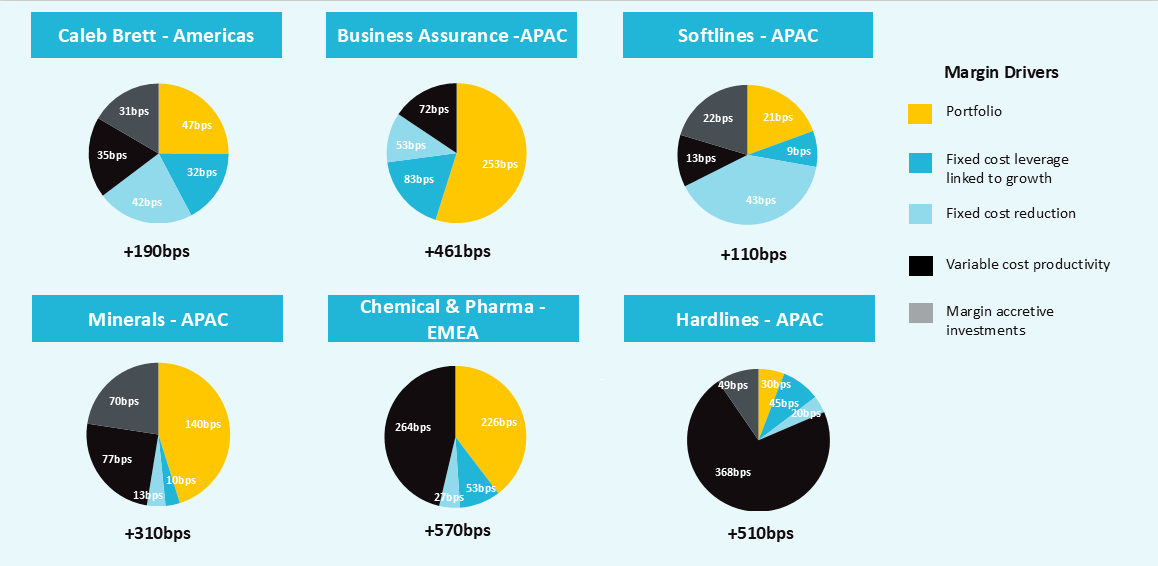

Margin Progression

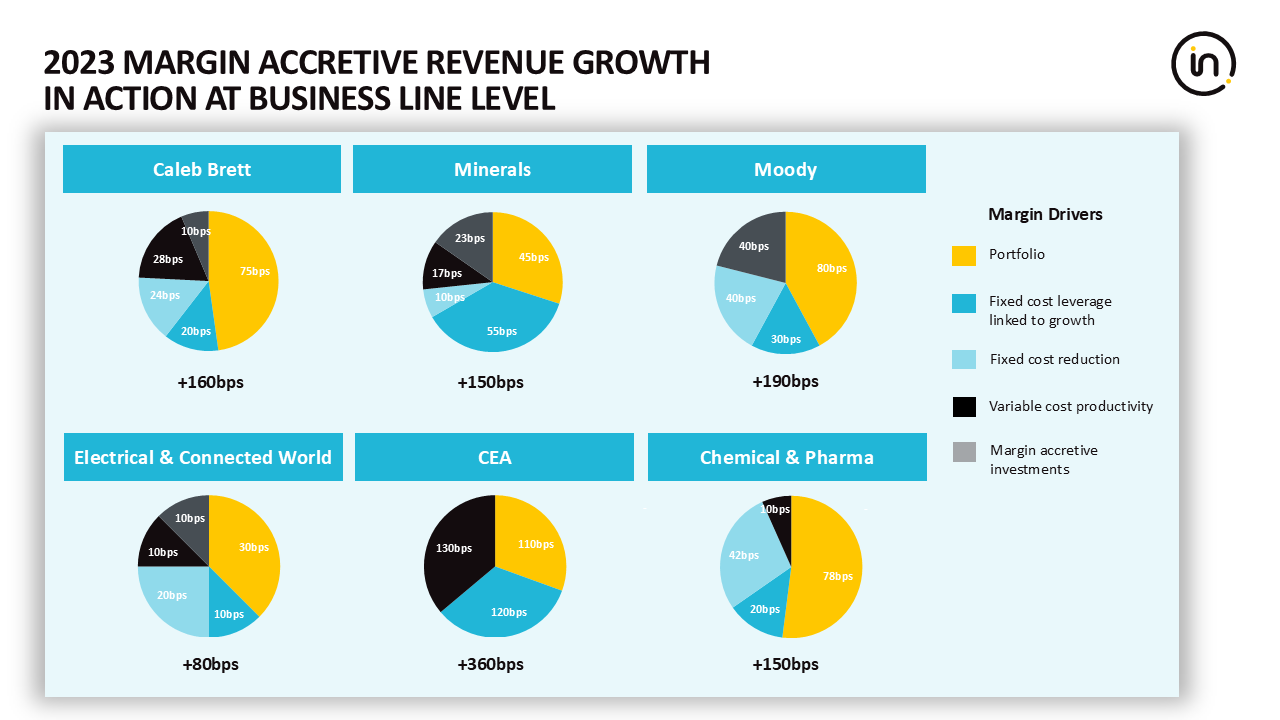

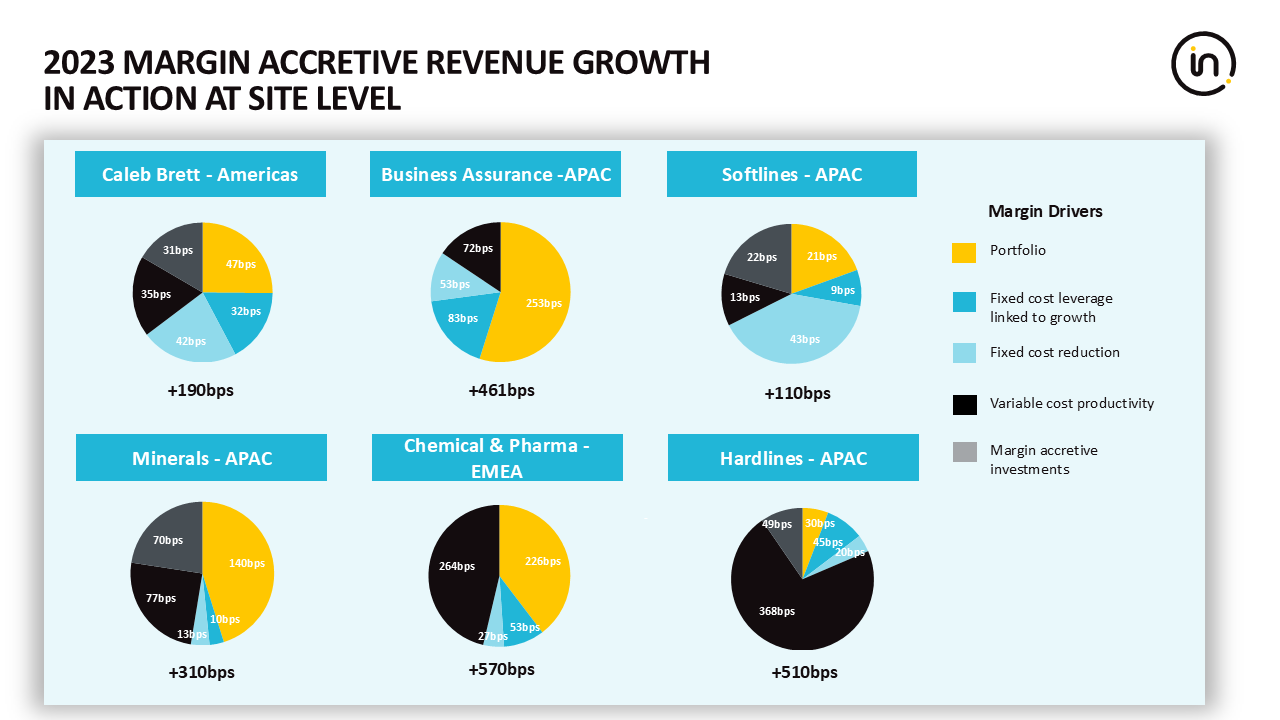

Structural margin improvement is driven from both a site and management level. This includes a rigorous focus on productivity metrics, cost and price discipline and portfolio management.

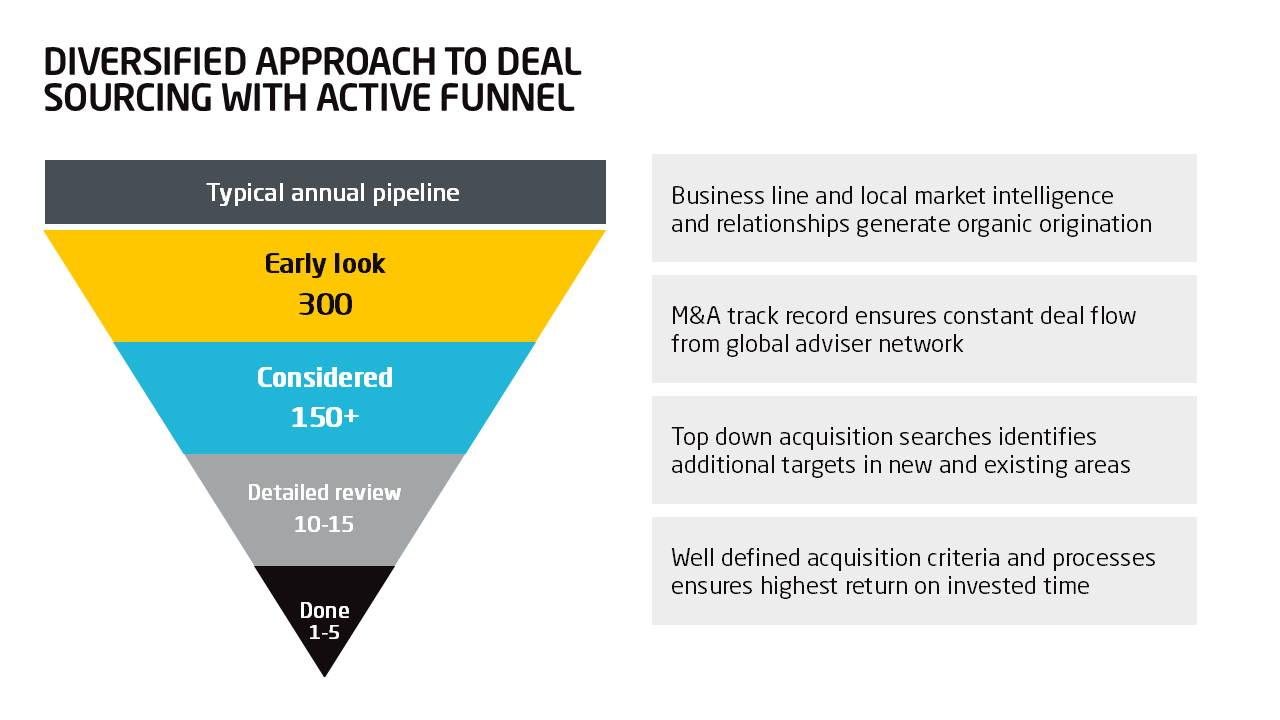

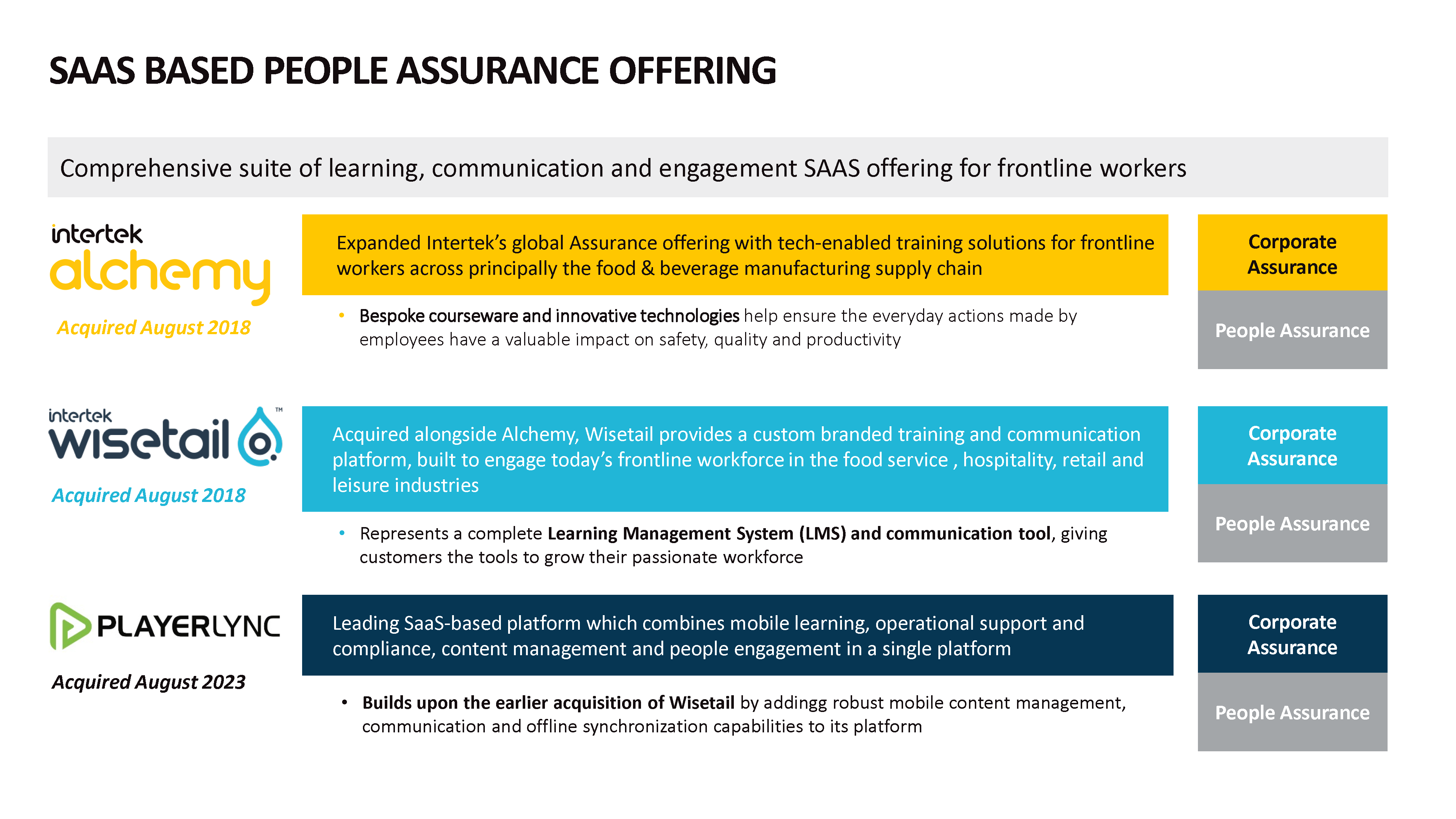

As outlined in our CMD in 2023, our focus is on investing in high growth margin accretive areas be that organically or through acquisition. Over the last decade, we have made high-growth, margin accretive acquisitions that augment the Intertek offering. Of note, since 2015, Assurance revenues have increased at a CAGR of 14%.

Examples of these investments include Alchemy, SAI Global, CEA, PlayerLync and our most recent acquisition TESIS, a leading provider of building products testing and assurance services, based in São Paulo, Brazil.

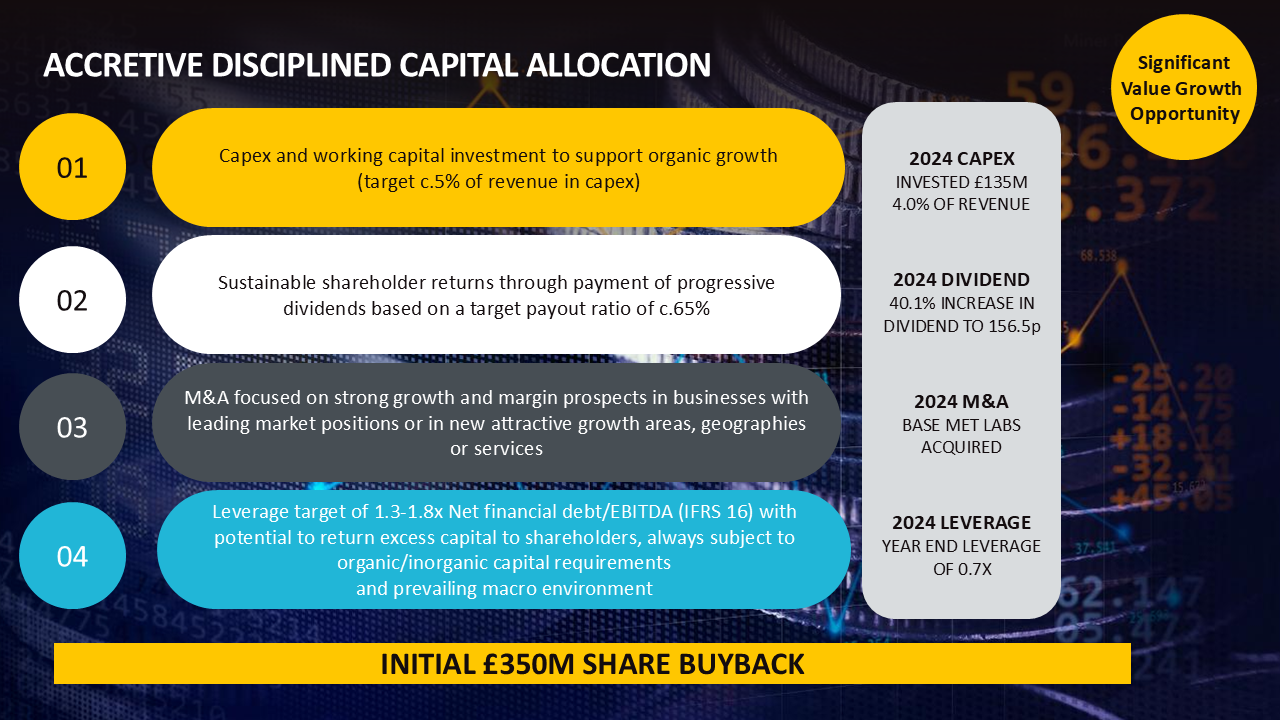

Capital Allocation

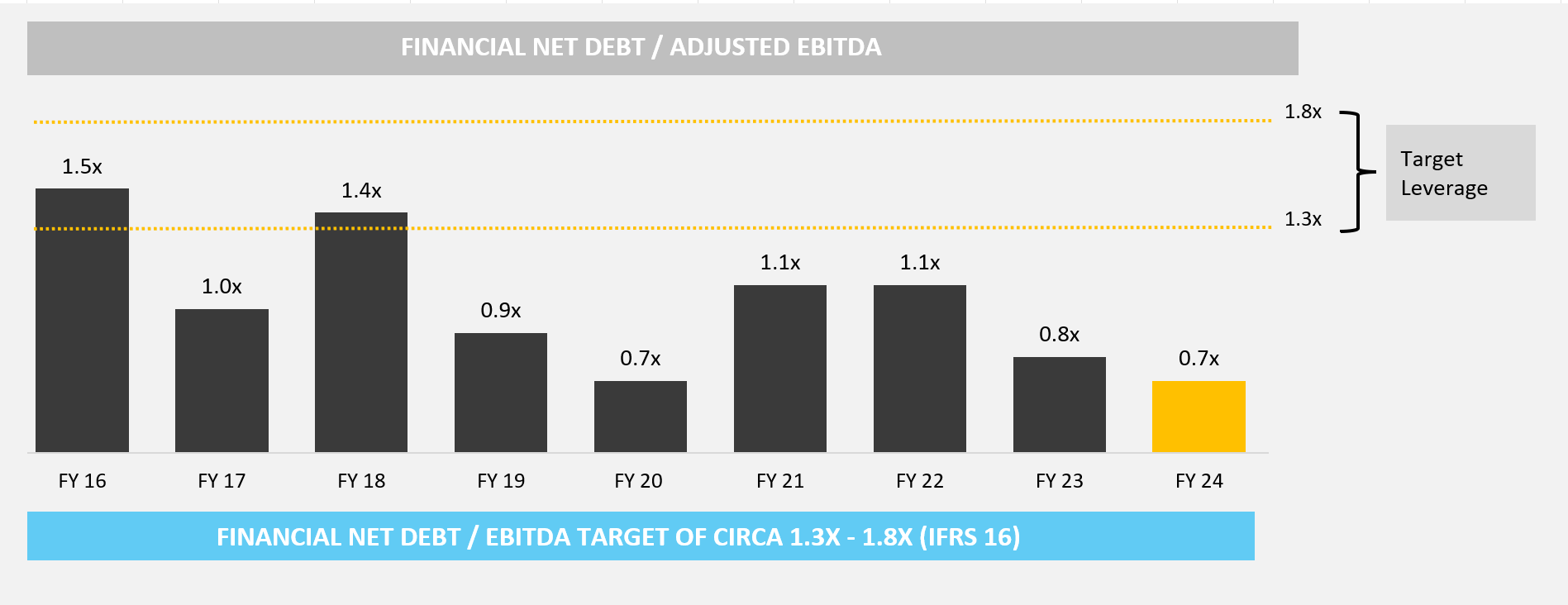

We take a disciplined approach to capital allocation. Our aim is to achieve margin accretive revenue growth and strong free cash flow. As such our CapEx investments are viewed through that lens.

Our investments have historically spanned across many regions and we constantly scan for new opportunities, be that organically or inorganically. We look for opportunities in high growth areas that will provide scale and augment the value Intertek currently offers.

Please note that the below slides are extracted from our HY 24 presentation and may not be fully up to date.

We maintain a continued focus on capital allocation. As such, given the strength of our earnings models, our performance track record, our confidence in future growth opportunities and the current level of leverage, at the time of our FY24 results, we announced today an initial £350 million share buyback program to be completed during the current financial year.

Currently, we are on track to complete the buyback programme in the stated timeframe. The progress of can be viewed in the most recent RNS here.

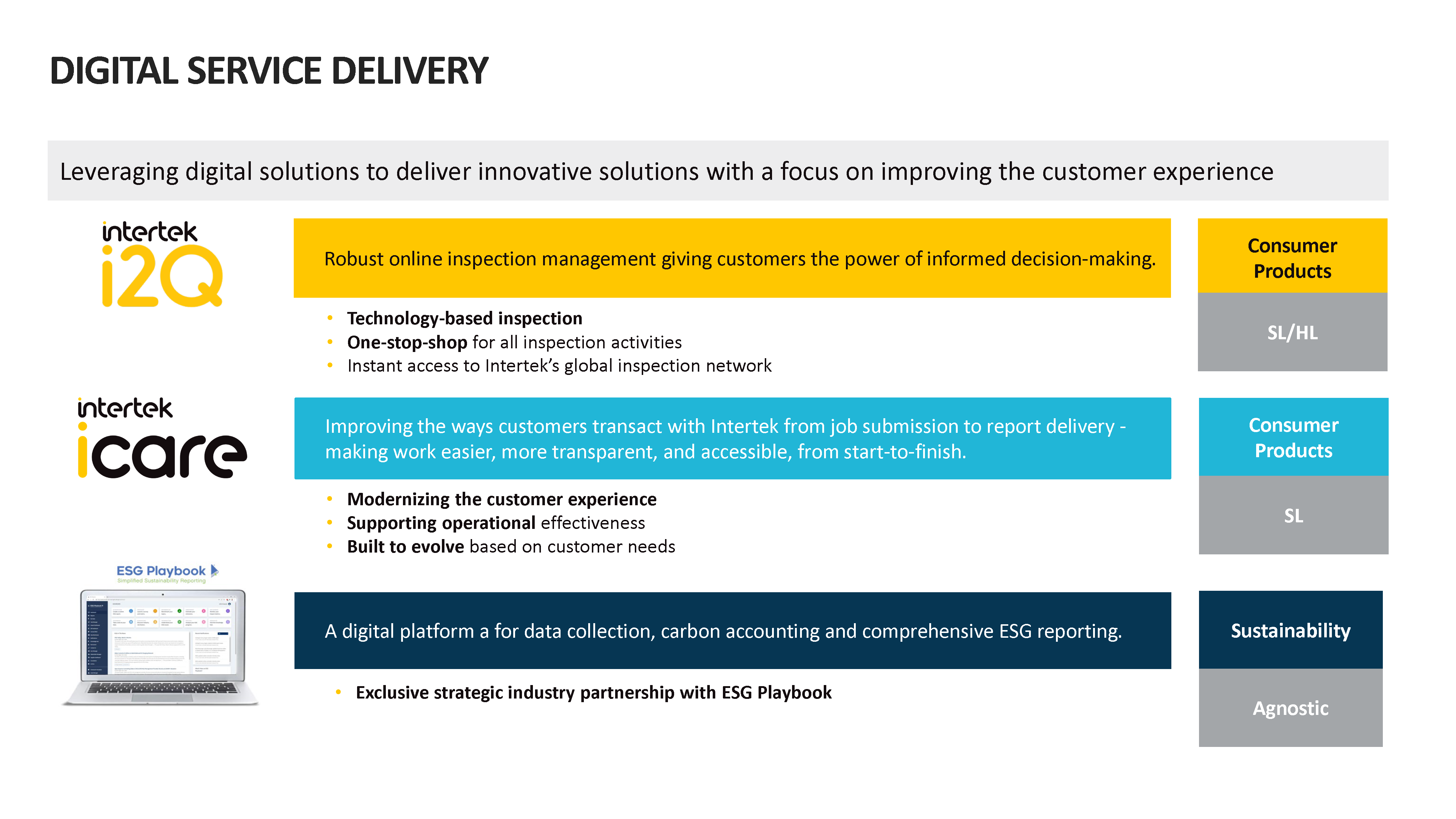

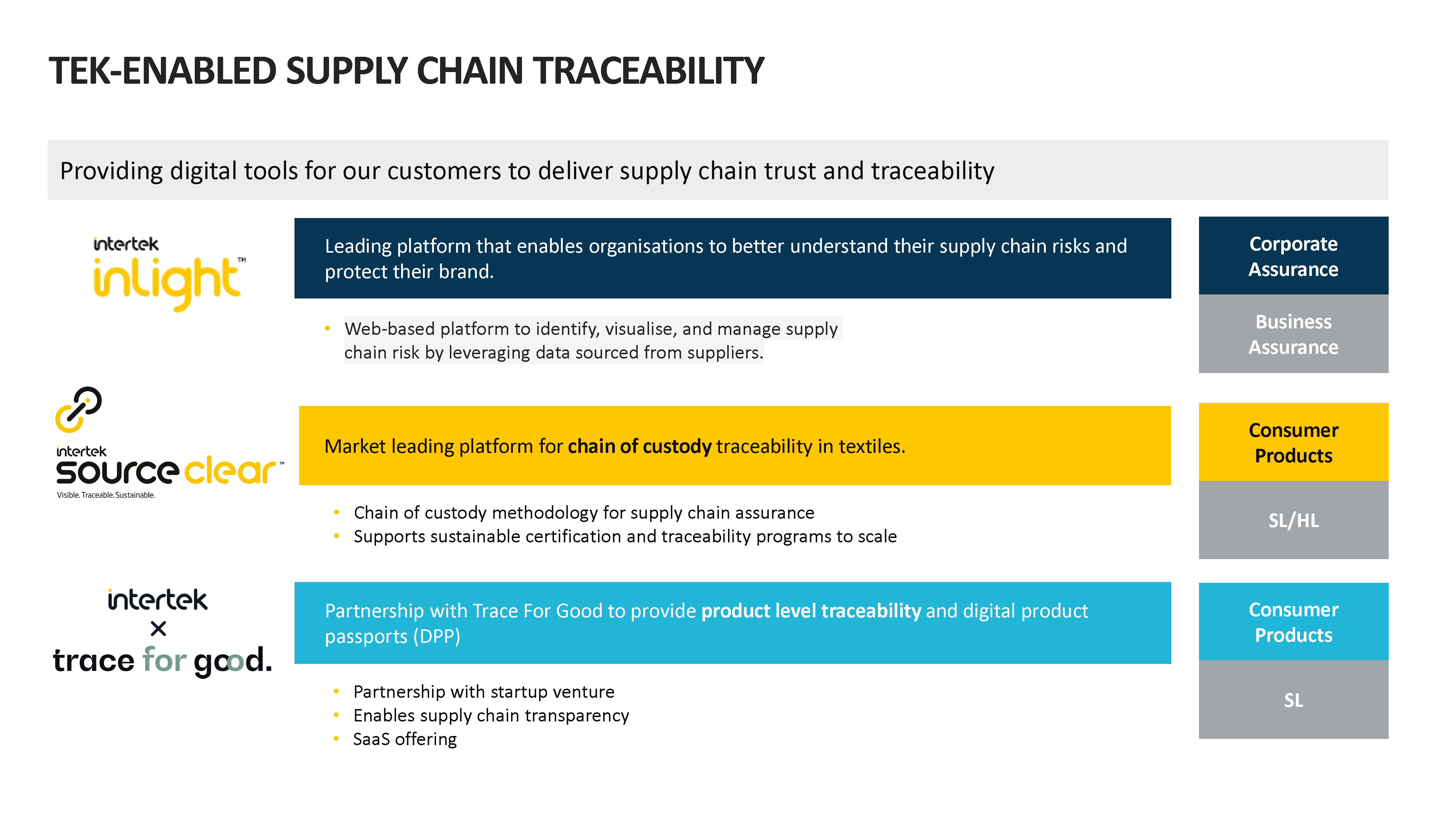

Innovations & Digitisation Opportunities

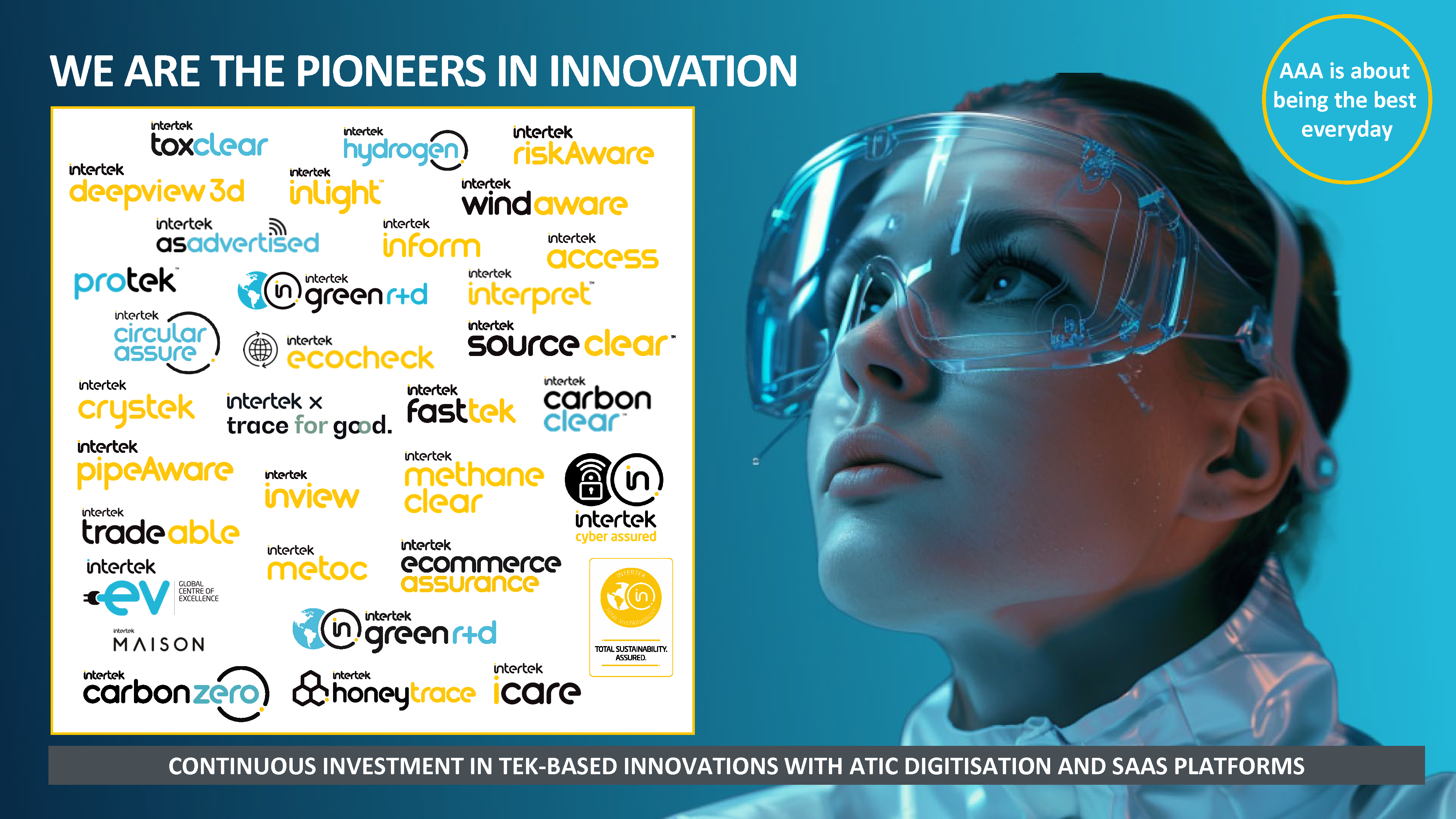

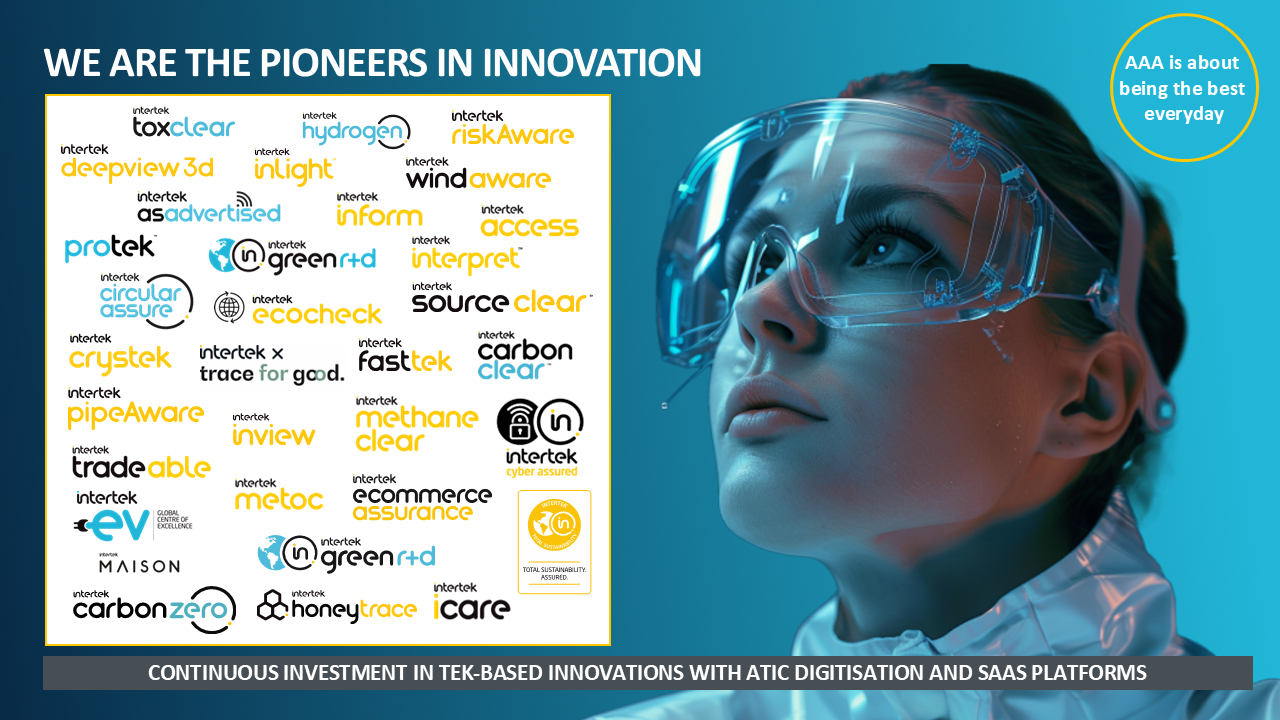

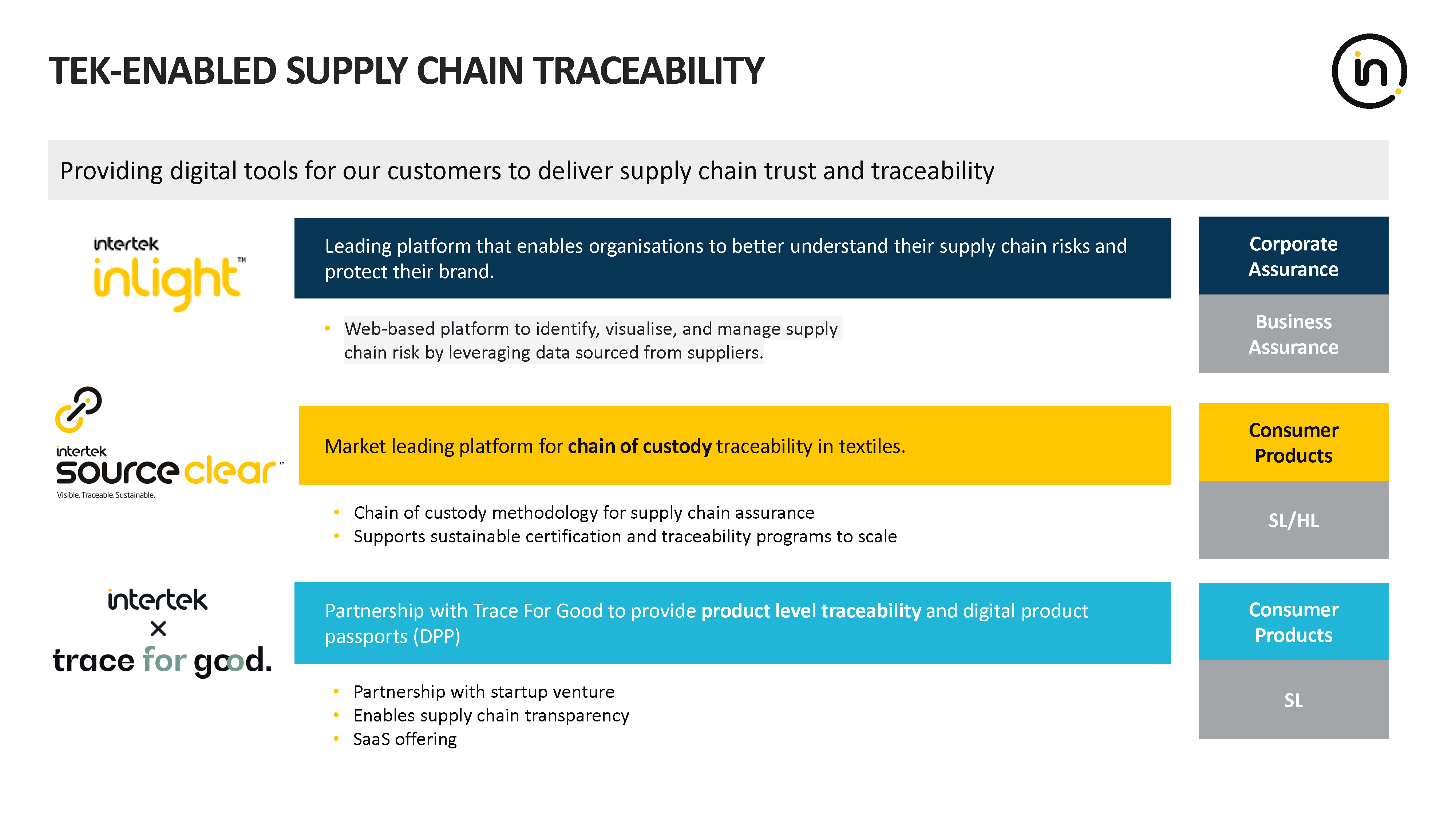

Intertek has created a number of successful breakthrough innovations over the years. The most recent example of this is AI², a comprehensive, risk-based AI assurance programme built around industry-leading solutions and addressing governance, transparency, security, and safety. Another example is Intertek ToxClear, a digital sustainable chemical management platform that helps firms with the traceability of chemicals throughout their supply chains.

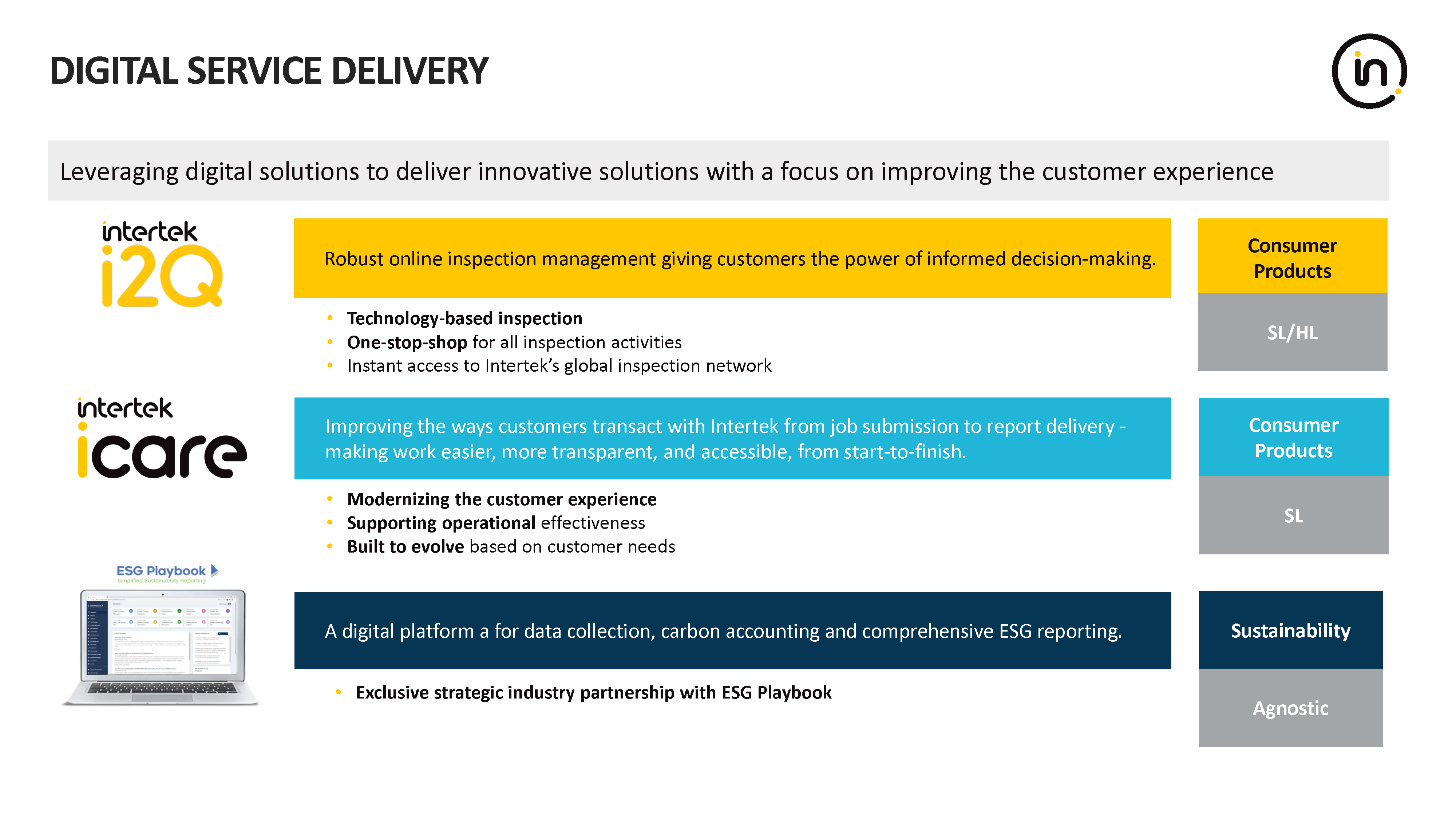

While the ATIC industry in its nature is quite labour intensive, Intertek has been leveraging digital solutions for some time to improve the service provided to customers. In addition to many technology-based solutions including the aforementioned innovations (SupplyTek and AI²), technology-based inspection is a tool provided by Intertek which customers can use to make informed decisions. This can be accessed in real-time via the platform

Our SaaS solutions play a critical role in enhancing our ATIC services by enabling the use of real-time data, enabling clients to make faster and more informed decisions. This results in greater transparency across the system and improves risk management.

A key example is our ToxClear platform, a SaaS solution that helps clients identify and monitor harmful chemicals within their supply chains. By providing full visibility into chemical usage, ToxClear enables our clients to pinpoint areas for improvement and take steps towards detoxifying their supply chain.

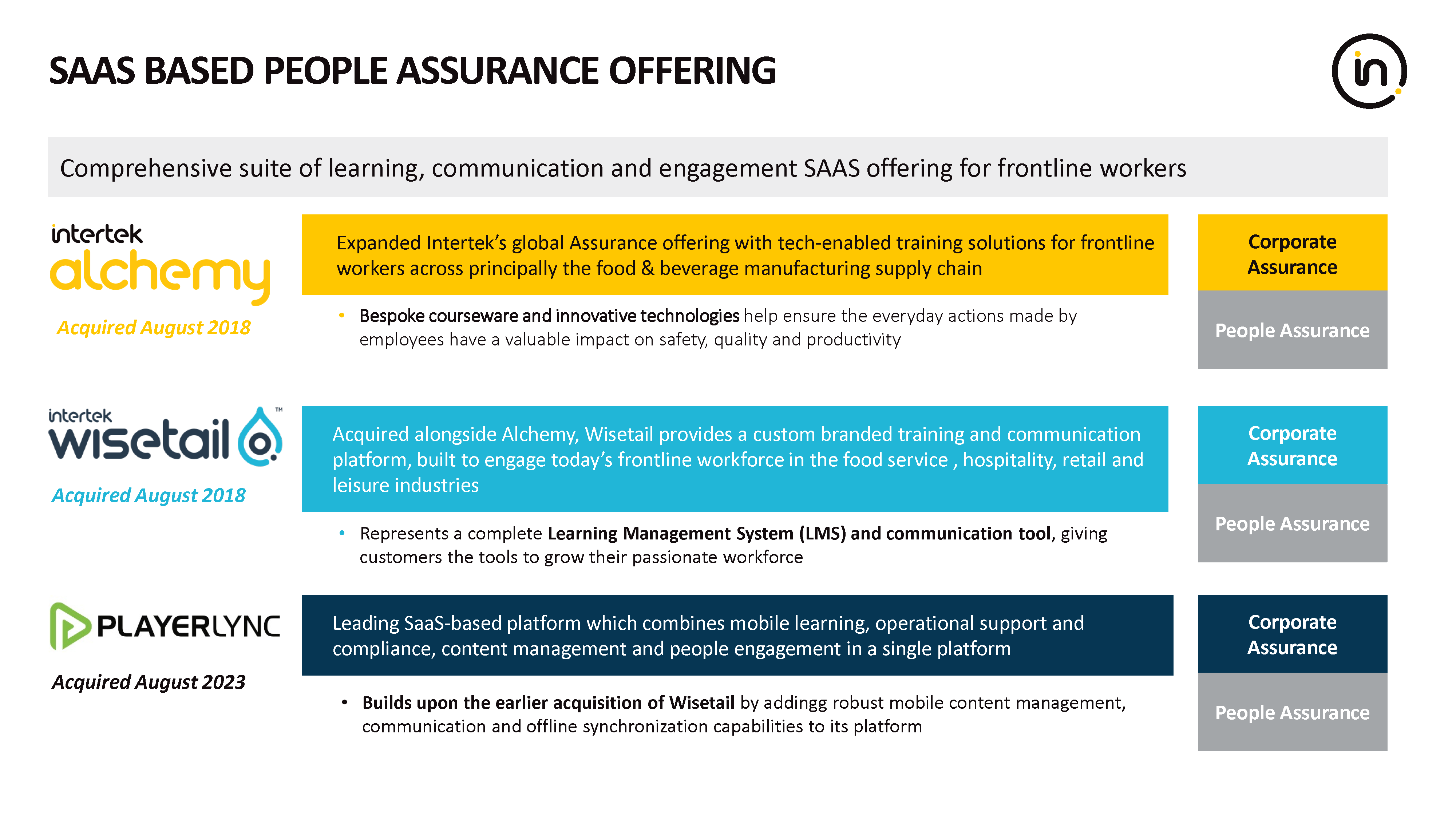

Another example of one of our SaaS solutions is Alchemy. Acquired in 2018, the SaaS solution address the critical skill gaps among frontline employees, particularly in the food industry. It is a learning platform that provides training to employees through identifying skill gaps and closing them, in addition to compliance.

Particularly critical in today’s world of uncertainty surrounding global trade and tariffs, SupplyTek is the world’s first end-to-end global market access solution turning supply chain uncertainty into a competitive advantage for its clients. It does this through three areas; Consulting, Training and Assurance. This enables companies to map their supply chain and assess risk. It also offers strategic advice on moving suppliers and market access regulations. Through the use of SupplyTek, companies can be assured that their people have the right capabilities.

SupplyTek

We view AI & Digitisation as an opportunity for our business when used correctly. Intertek has long pioneered the use of data to make informed decisions and improve efficiency throughout our operations. In addition, it can help provide faster feedback time to our clients, enabling them to access real-time data on issues within their supply chain.

With more than 130 years of quality and safety expertise across a wide range of industries, the launch of Intertek AI² expands Intertek’s industry-leading offering of ATIC solutions, providing a comprehensive, risk-based AI assurance programme built around industry-leading solutions and addressing governance, transparency, security, and safety. Services include:

- Governed AI services establish risk and quality management frameworks, AI governance structures, regulatory compliance strategies, and oversight mechanisms ensuring accountability and adherence to evolving requirements including EU AI Act obligations and ISO42001.

- Transparent AIservices develop technical documentation meeting regulatory standards, implement appropriate explainability levels for different applications, and creates communication strategies making AI behaviour understandable to diverse stakeholders.

- Secure AIservices deliver cybersecurity tailored to AI systems, red teaming exercises identifying vulnerabilities and failure modes, threat monitoring and incident response planning, and security architecture guidance addressing unique AI vulnerabilities.

- Safe AIservices provide comprehensive testing and validation using AI-specific methodologies, data quality assessment and improvement, independent performance verification, and bias detection and mitigation across diverse populations and use cases

Intertek AI² - AI Assured: Smarter, Safer, Trusted

AAA Strategy

Our AAA strategy is very clear: to be the best in the industry everyday for our customers, employees, communities and shareholders.

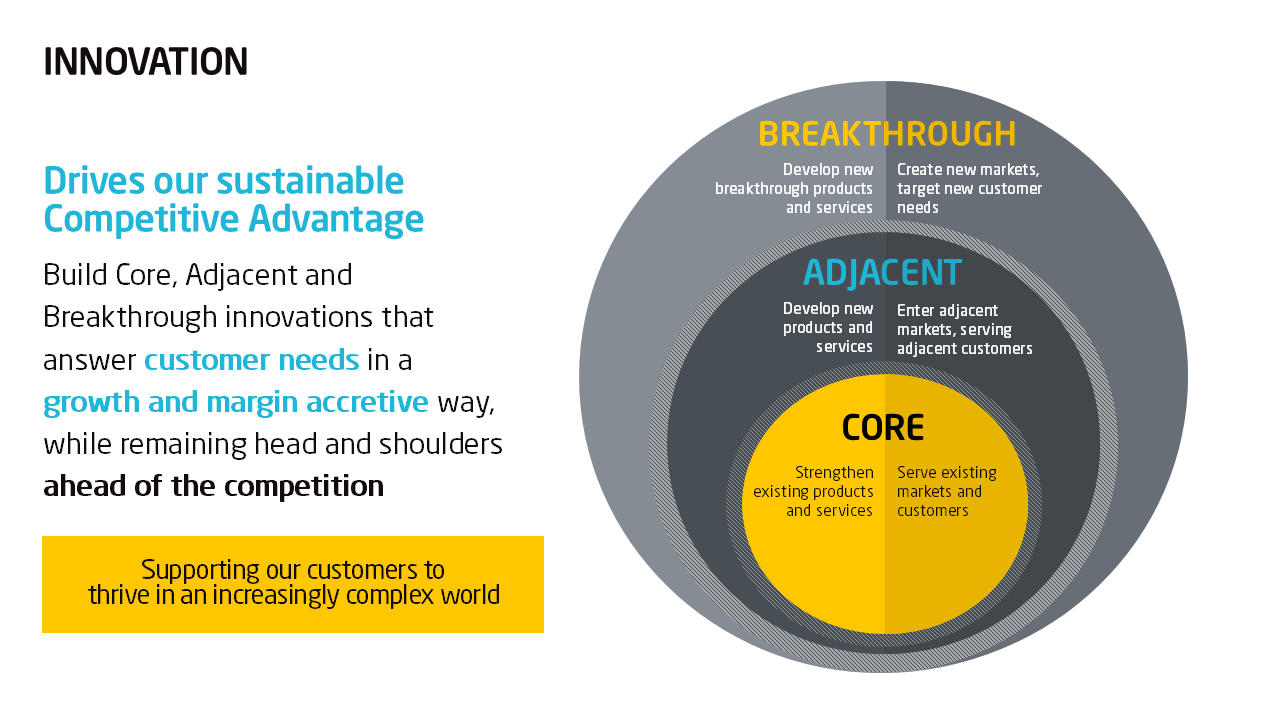

Our goal is to be the most trusted partner for our clients and to do so capitalise on our unique, science-based, ATIC value proposition. We are constantly investing our state-of-the-art operations, pioneering innovations which are largely technology-based and rigorously monitor our customer service performance.

- Faster growth expected for our ATIC solutions as companies focus more on mitigating risks in their supply chains.

- Margin accretion potential to be achieved through portfolio mix, operating leverage, cost reduction, increased productivity and margin accretive investments.

- Our earnings model is a quality, cash compounding earnings, with a proven track-record. Between 2014 and 2024 we have grown our revenue by 62% and increased operating profit by 82%. In addition, our EPS has grown by over two-thirds in this period while cash from operations has increased by £385m.

In 2023, as part of our Capital Markets event in London we launched our AAA growth strategy. The idea behind it is to deliver AAA value for all stakeholders and be the most trusted partner for Total Quality Assurance. Our aim is to deliver MSD LFL revenue growth at CCY, margin accretive revenue growth (18.5%+ margin target, announced at our FY24 results), strong FCF, and disciplined capital allocation in high growth and high margin sectors.

The strategy is on track and in FY-24 we delivered MSD LFL revenue growth, strong FCF and margin performance and have increased our dividend payout policy to c.65%.

We operate in more than 100 countries in a variety of markets and industries, ranging from consumer goods to the energy sector, and we deliver a wide range of ATIC services.

Our Science‐based Customer Excellence is at the core of our competitive advantage and enables us to deliver mission critical services for our clients.

Energising our colleagues is at the heart of our high-performance organisation. Our 10x Culture is the cement to our continuous improvement approach and we have made significant progress on the metrics that define a high-performance organisation; revenue per employee, profit per employee, cash flow per employee, employee turnover, engagement.

- The depth and breadth of our ATIC solutions positions us well to seize the increased corporate needs for Risk-based Quality Assurance.

- We see exciting growth opportunities for each of our Divisions.

- Our revenues are well diversified by geography, and we enjoy strong positions in the USA (30% of our revenues) and in Asia-Pacific (39% of our revenues) which benefit from structural investment growth opportunities.

- Our portfolio mix is skewed to growth with 56% of our revenues exposed to the fast-growing segments, while 16% of our mix is Scale growth and 28% offers room for improvement.

Please note that the below slides are extracted from our FY 23 presentation and may not be fully up to date.

We maintain a continued focus on capital allocation. As such, given the strength of our earnings models, our performance track record, our confidence in future growth opportunities and the current level of leverage, at the time of our FY24 results, we announced today an initial £350 million share buyback program to be completed during the current financial year.

Currently, we are on track to complete the buyback programme in the stated timeframe. The progress of can be viewed in the most recent RNS here.

Assurance is the assessment of quality, safety and sustainability processes within company supply chains. With growing complexity in their nature, we provide an audit of company supply chains to identify and eliminate risks. This is done using real-time data which enables companies to detect issues instantly.

Our ATIC solutions ensure an end-to-end assessment of the risks within supply chains, ensuring superior customer service to clients. The whole ATIC offering assesses internal and third-party supply chain risks while also providing our Testing, Inspection and Certification services.

We are operating in a higher organic growth market with very attractive ATIC growth opportunities. Factors such as regulation, innovation, technology and emerging risks across supply chains have prompted companies to focus their investments on Risk-based Quality Assurance over the last couple of decades.

Covid-19 highlighted the fragility of global supply chains and the unidentified risks within them. As such, companies have been investing more in securing their supply chains, ensuring diversification. In addition, there has been increased investment in data protection, training and independent assurance.

Supply chains never stand still, and as such our investments have never been focused on one area or region. Our global footprint and capital-light business model means we are very agile, giving us the ability to move fast if we need to build additional ATIC capability for our clients in existing or new markets.

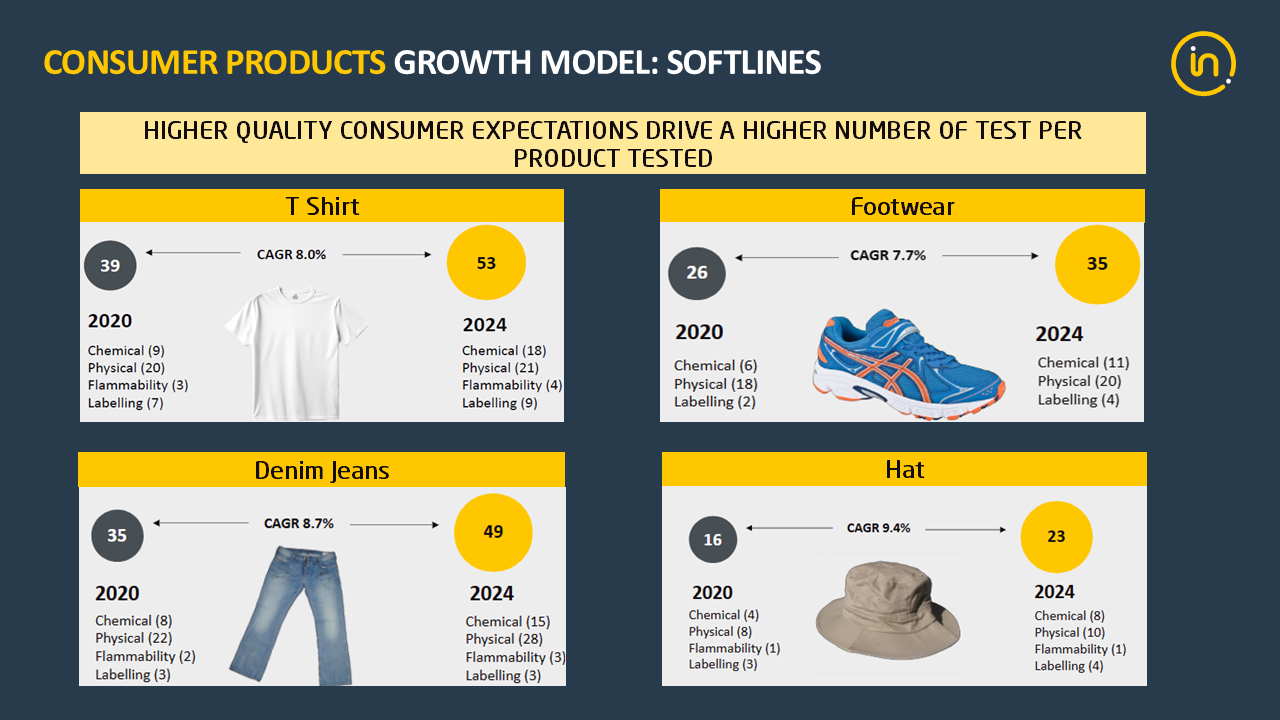

Our priority is to drive growth first the number of SKUs in the global market that need to be tested and certified, and second the number of factories and tier 1/2/3 suppliers that we need to audit and inspect.

China+1 is making the ATIC market larger for Intertek, with an increase in the number of products to test and plants to audit

Our investments have historically spanned across many regions and we constantly scan for new opportunities, be that organically or inorganically. We look for opportunities in high growth areas that will provide scale and augment the value Intertek currently offers.

Please note that the below slides are extracted from our HY 24 presentation and may not be fully up to date.

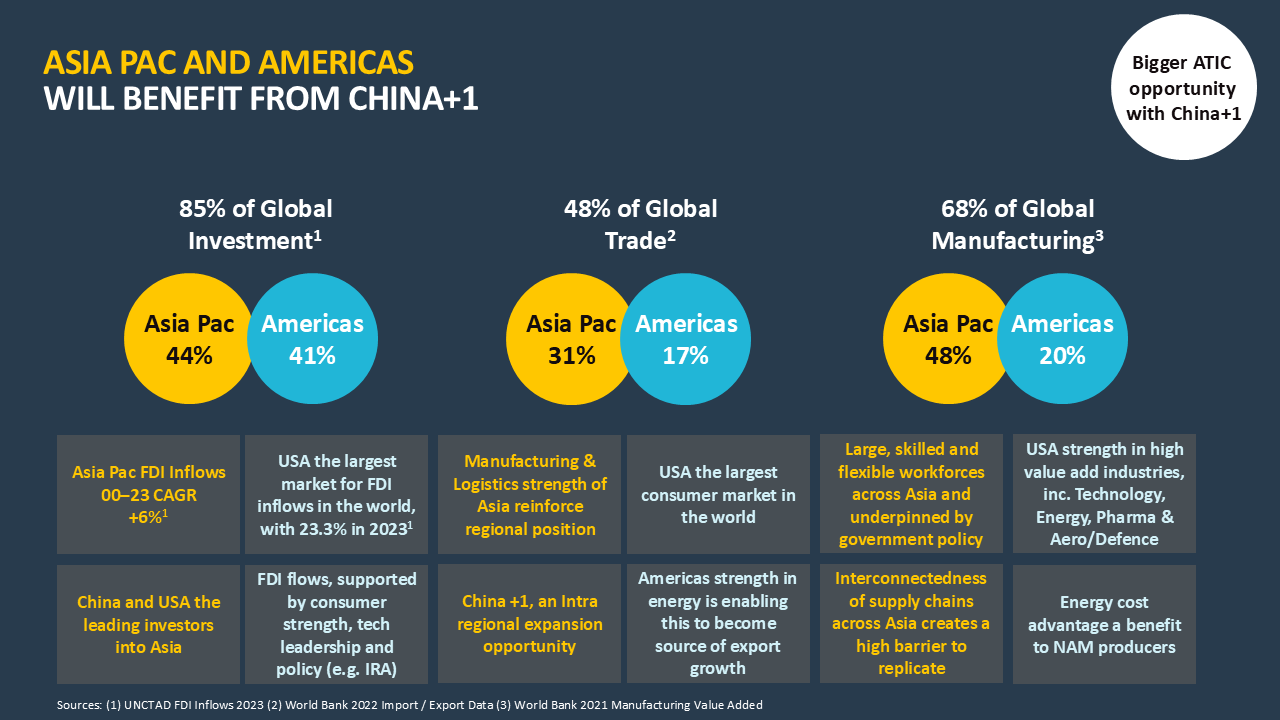

Both APAC and the Americas will benefit from China+1 as these are the two vibrant economic regions in terms of investments in additional supply chain capability. The two regions represent 68% of global manufacturing and 85% of the global investments that are currently made.

We have invested both organically and inorganically over the past few years and are well positioned to benefit with these two regions representing 73% of Intertek revenues

Intertek has created a number of successful breakthrough innovations over the years. The most recent example of this is AI², a comprehensive, risk-based AI assurance programme built around industry-leading solutions and addressing governance, transparency, security, and safety. Another example is Intertek ToxClear, a digital sustainable chemical management platform that helps firms with the traceability of chemicals throughout their supply chains.

Our SaaS solutions play a critical role in enhancing our ATIC services by enabling the use of real-time data, enabling clients to make faster and more informed decisions. This results in greater transparency across the system and improves risk management.

A key example is our ToxClear platform, a SaaS solution that helps clients identify and monitor harmful chemicals within their supply chains. By providing full visibility into chemical usage, ToxClear enables our clients to pinpoint areas for improvement and take steps towards detoxifying their supply chain.

Another example of one of our SaaS solutions is Alchemy. Acquired in 2018, the SaaS solution address the critical skill gaps among frontline employees, particularly in the food industry. It is a learning platform that provides training to employees through identifying skill gaps and closing them, in addition to compliance.

While the ATIC industry in its nature is quite labour intensive, Intertek has been leveraging digital solutions for some time to improve the service provided to customers. In addition to many technology-based solutions including the innovations AI² and ToxClear, technology-based inspection is a tool provided by Intertek which customers can use to make informed decisions. This can be accessed in real-time via the platform.

We view AI & Digitisation as an opportunity for our business when used correctly. Intertek has long pioneered the use of data to make informed decisions and improve efficiency throughout our operations. In addition, it can help provide faster feedback time to our clients, enabling them to access real-time data on issues within their supply chain.

Sustainability

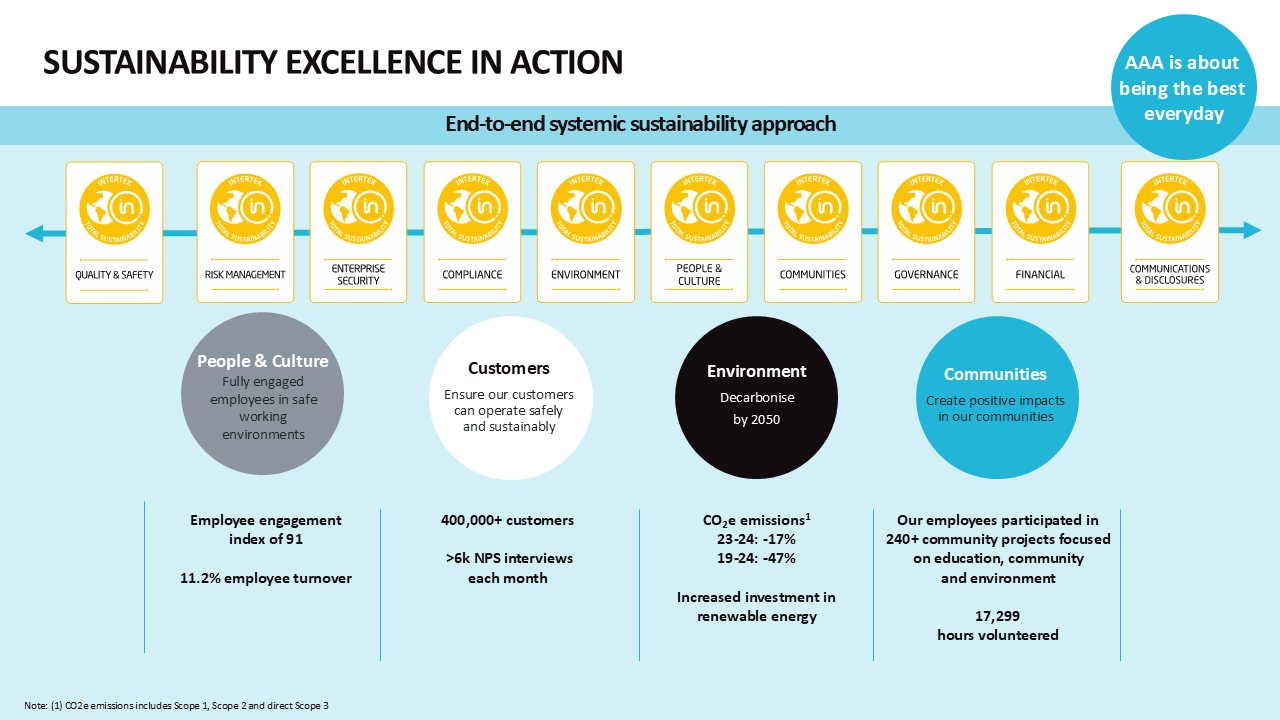

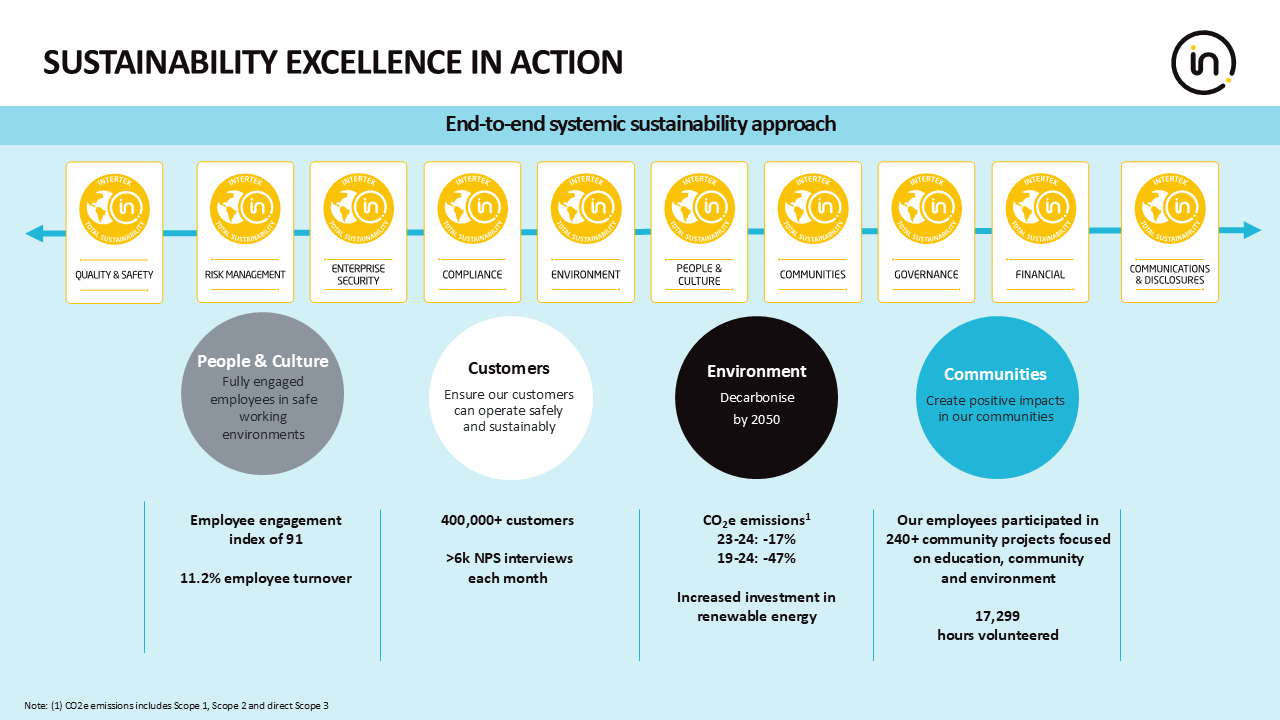

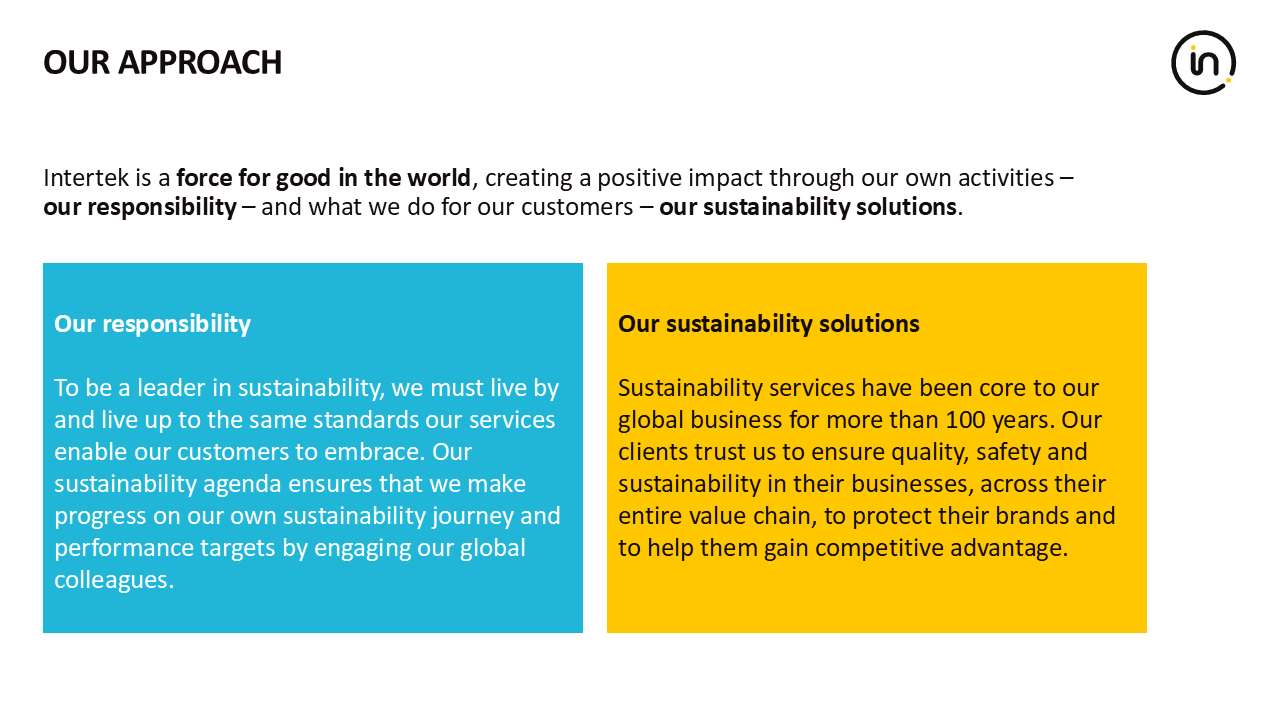

Sustainability is the movement of our time and central to everything we do at Intertek, anchored in our purpose, our vision, our values and our strategy. For us, sustainability excellence means much more than achieving net zero.

Intertek is in a unique position that helps our clients achieve their sustainability goals while making progress on our own goals, for example achieving our Net Zero target. We continue to make progress on customer satisfaction, diversity & inclusion, health and safety, compliance and engagement.

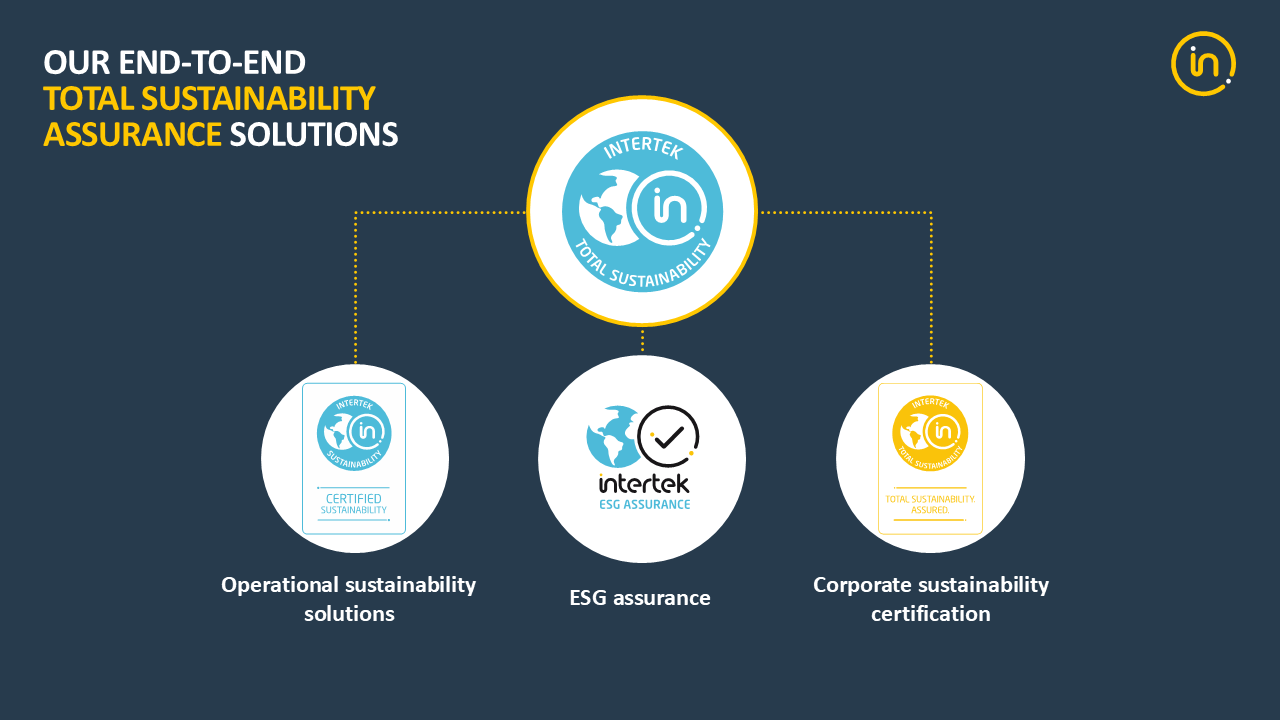

For our clients, our tailored TSA services support organisations across various industries in managing, achieving and validating their sustainability initiatives.

Positive Impact

Sustainability services have been core to our global business for more than 100 years. Our clients trust us to ensure quality, safety and sustainability in their businesses, across their entire value chain, to protect their brands and to help them gain competitive advantage. We do this across all of our 5 business lines.

For example, our Consumer Products focuses on the ATIC solutions we offer to our clients to develop and sell better, safer, and more sustainable products to their own clients. We help our clients meet safety, regulatory and brand standards, and develop new products, materials and technologies, as well as the import of goods in their markets, based on acceptable quality and safety standards.

For more information on how we make a positive impact across all of our business lines, please see our Strategic Report (Operating Review).

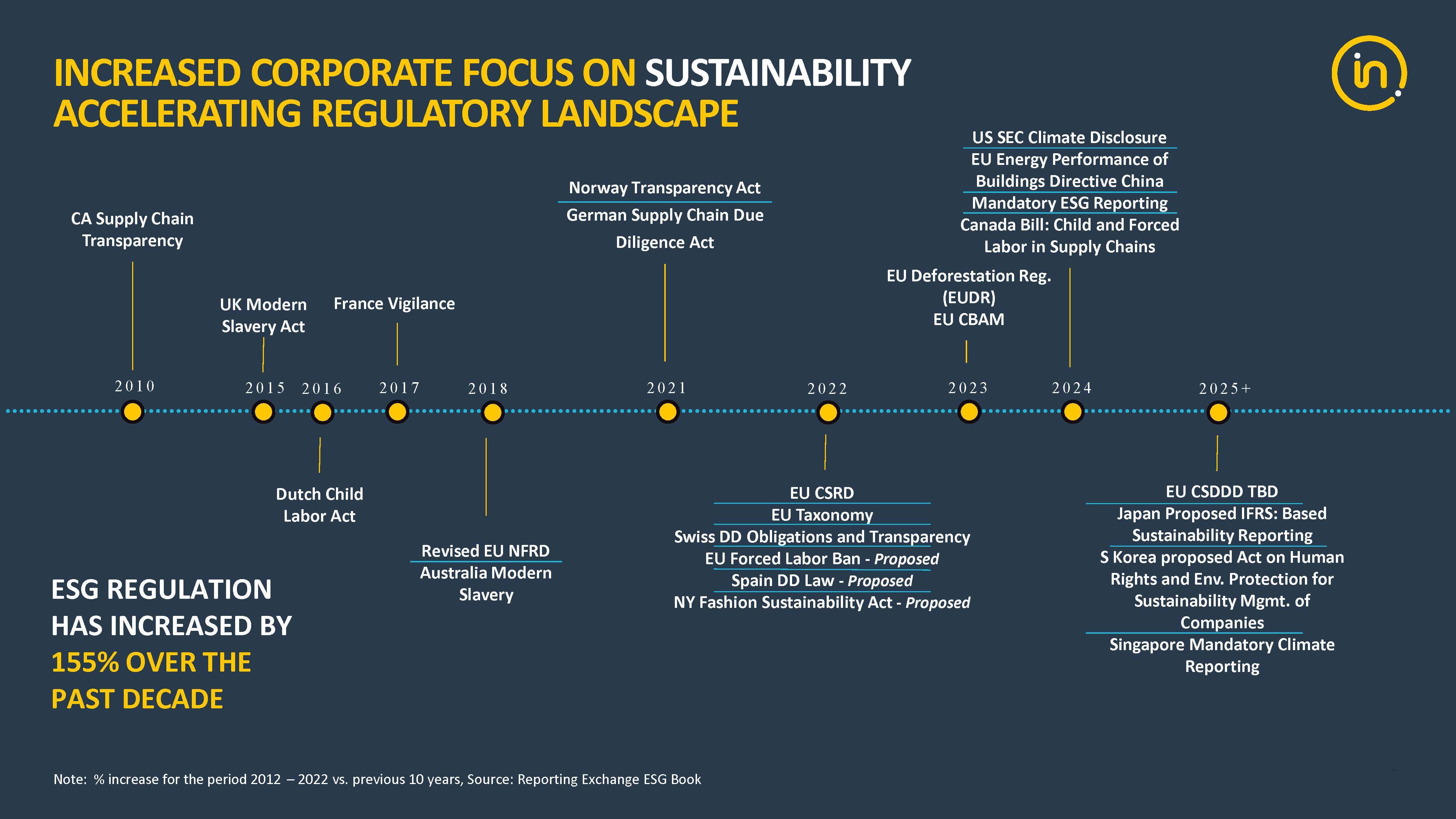

With the greater focus by corporations on sustainability throughout their entire value chain, our sustainability services have become increasingly important for risk mitigation and corporate sustainability certification.

We offer Industry leading operational solutions, focusing on risks within the value chain. These include: R&D development, tier 1/2/3 supplier sustainability performance, energy-waste-water-chemical-air quality-safety management, carbon footprint assessment for scope 1/2/3 and Eco-scoring of their products.

We also advise how companies can complement these with the right sustainability policies underpinned by precise corporate processes which we can audit with our Corporate Sustainability Certification programme.

The reputational risks for companies are significant, and we have seen recently world class companies being fined by regulators for having made unsubstantiated claims about their products. That’s why we help our clients with our ESG assurance solutions which offers an independent audit of their non-financial disclosures.

A growth driver for our business is the increased investment by corporations in sustainability as global regulations evolve from opt-in to mandatory.

The increasingly rigorous regulatory environment has highlighted the importance of product safety for consumers, and we are the partner of choice for many global brands to test and certify products.

There has been a greater level of awareness from companies, aided by regulation, on the processes within the value chain and the associated risks. Our social audits ensure greater levels of governance across the value chain, ultimately leading a better and safer world.

An example of this is our audit of Clipper logistics. Brand reputation is critically important to the company and as such we were asked to conduct an audit of its labour practices. As a result of working with Intertek, Clipper is able to say to its colleagues internally that it is proud of its ethical standards, that people are working for an organisation that is ethically minded, and that the fair treatment of everyone who works for Clipper Logistics is at the forefront of the HR strategy.

To maintain our proactive approach to an increased regulatory environment, in 2024 we conducted a preliminary Double Materiality Assessment, to help us meet upcoming regulations

Our Sustainability Journey

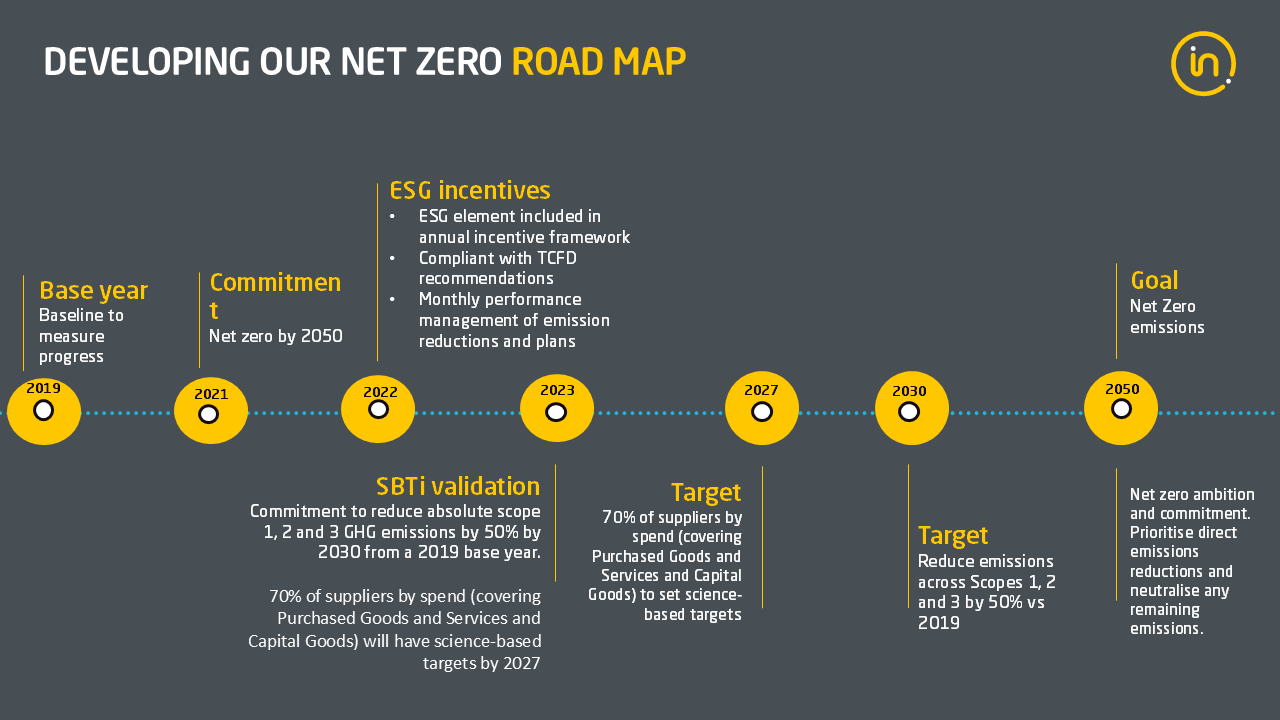

At Intertek we recognise the urgent need to address climate change and are committed to aligning our operations with a low-carbon economy. Our Climate Transition Plan is a critical component of our long-term strategy to reduce GHG emissions, enhance resilience to climate-related risks, and ensure that we contribute positively to global sustainability goals.

We are committed to reaching net zero emissions by 2050, with an interim target to reduce absolute scope 1, scope 2 and scope 3 (business travel and employee commuting) GHG emissions by 50% before 2030.

In 2024 we made further progress towards our net zero goal and have continued monthly performance management of emission reductions and action plans. In addition, by optimising energy use in our offices and laboratories and transitioning to cleaner energy sources, we reduced our operational market-based emissions by 16.7% against 2023 and 47.2% against our base year 2019.

Improving gender balance is critical for us. We continue to focus on gender diversity by attracting, developing and retaining more talented women across the business. Within our global workforce, 35% of our TQA Experts are women.

We ensure that men and women are paid equally for doing equivalent roles and we are committed to a number of measures to ensure we provide an energising workplace, free of any gender bias, where employees can flourish based on their talent and effort.

In 2024, we increased the percentage of women in senior management to 26.3% and our aim for 2025 is to increase this to 30%.

See the link below to find out about the progression of women in senior management at Intertek within out Diversity, equity and inclusion section .

2024 was our eight consecutive year as a constituent of the FTSE4Good. We retained our 'AAA' rating in the MSCI ESG Ratings assessment, as well as our 'Prime' rating under ISS ESG requirements. In addition, our ESG rating of 15.9 from Sustainalytics and our 'B' score as part of CDP’s Climate Change Programme highlight our commitment to sustainability.

Our ESG credentials are laid out in our 2024 Sustainability Report.

Having worked and built relationships to understand the diverse needs of each of our local communities, our countries and business lines define their own agendas to create a positive and lasting impact. These agendas are tied to the Group’s priorities and aligned to the UN Sustainable Development Goals. Our Beyond Net Zero Steering Committee oversees community investments at a global level.

Examples of initiatives in action are evident in our Sustainability Report.

In 2024, our voluntary permanent employee turnover improved to a five-year low rate of 11.2% in 2024 (2023: 12.3%).

We recognise the importance of employee engagement in driving sustainable performance for all stakeholders, and we measure employee engagement against our Intertek ATIC Engagement Index. In 2024, we achieved a new high score of 91 (2023: 87).

See the link below to find out more about our voluntary employee turnover and engagement at Intertek within our Employees section.

Total Recordable Incident Rate (TRIR) includes medical treatments incidents, lost time incidents and fatalities per 200,000 hours worked. We measure incidents as part of the effectiveness of our safety culture.

Our TRIR target is less than 0.5 per 200,000 hours worked which we achieved in 2024.

Intertek’s TRIR progress is available in our Sustainability Report and in via the link below within the Health & safety section.

We place significant importance on customer satisfaction and feedback here at Intertek. We believe that the most effective way of doing this is engaging with our customers through interviews.

Since 2015, we have used the Net Promoter Score (‘NPS’) process to listen to our customers, enabling us to improve our customer service over the years consistently. In 2024, we conducted on average 6,036 NPS interviews per month.

More information on Intertek’s customer focus can be found via the link below within the Customer satisfaction section.

We conduct compliance training throughout the entire organisation, be that online or face to face when available. As of 2024 we have a 100% completion rate, highlighting our commitment to the highest standards of integrity and professional ethics.

See the link below to find out more about our Compliance training at Intertek within our Compliance section

11. What is the growth outlook by division?